Clouded Judgement 9.30.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

MS CIO Survey

There’s a lot of attention on what happens to spending / budgets over the coming 18 months with the broader economy weakening. This week we got a peak into the enterprise buyer mindset with the quarterly CIO survey from MS. Budget growth for 2022 was revised down a full 1% from the prior quarters survey (from 4% to 3% ), demonstrating near term budget pressure. The expected budget growth for 2023 currently sits at 2.8%. While this still shows an expectation for “growth,” the 10 year average for annual budget growth (in the MS Surveys) is 4.1%. So clearly the early expectations for growth in 2023 are coming in low. Within the broader IT budgets, software did have the highest growth expectations for 2023 at 3.1%. The overall takeaway seemed to be as uncertainty persists, companies plan to spend less. At the same time, the expectations are still for budget growth, and we’ll see how that trends. In older MS CIO surveys, budget expectations went negative only in 2009 and 2020. The graph below shows budget growth expectations over time. The purple dot at 2.8% at the far right is the initial expectation for 2023 budget growth. As you can see in the visual while the expectation for 2023 is lower than whta we’ve seen historically, it’s not that much lower. My read is that there’s still some optimism built into the budget expectations that a deeper hard landing won’t happen, and if the economy continues to worsen we could see a bigger decline in budget expectations (and thus forward estimates).

The chart can be confusing, but here’s how to read it, using the red line towards the far right as an example. This shows what ‘21 budget growth expectations were at the point in time on the X axis. So the first dot on the red line implies that in Q3 ‘20 budget growth expectation for the full year 2021 was ~1.5%. In Q4 ‘20 the 2021 budget growth expectation was 3%

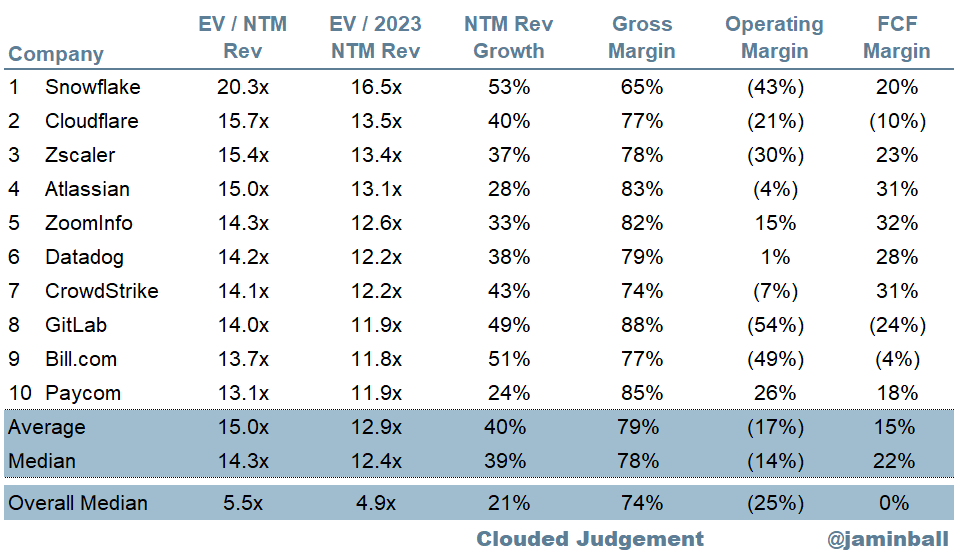

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

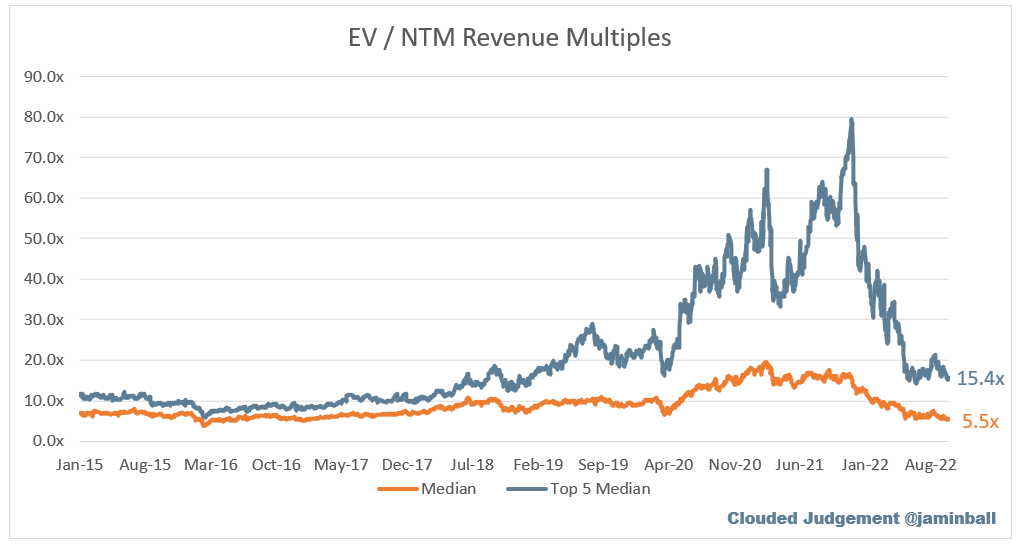

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.5x

Top 5 Median: 15.4x

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 11.1x

Mid Growth Median: 5.6x

Low Growth Median: 3.0x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

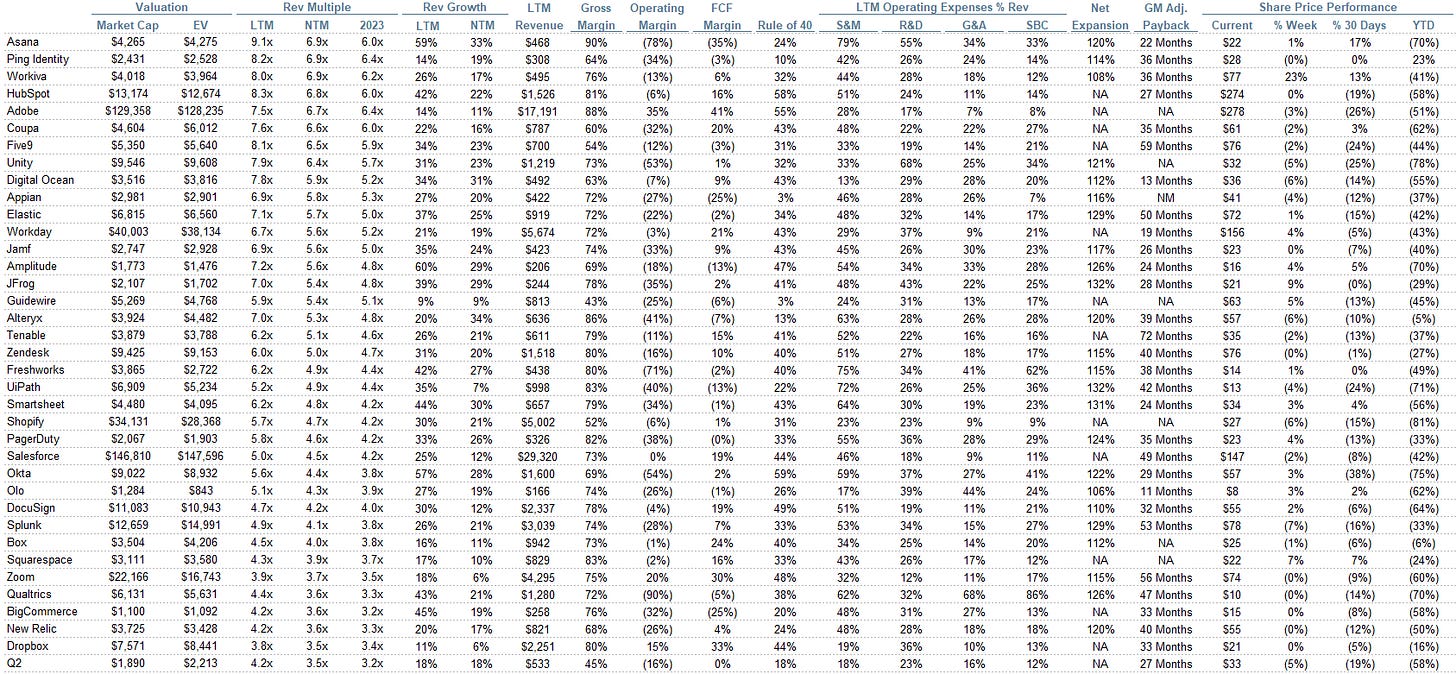

Operating Metrics

Median NTM growth rate: 21%

Median LTM growth rate: 30%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 0%

Median Net Retention: 120%

Median CAC Payback: 33 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.