Clouded Judgement 9.4.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any significant news. Follow along to stay up to date!

Highlight of the Week - More Earnings!

Zoom, once again, with a Quarter for the record books

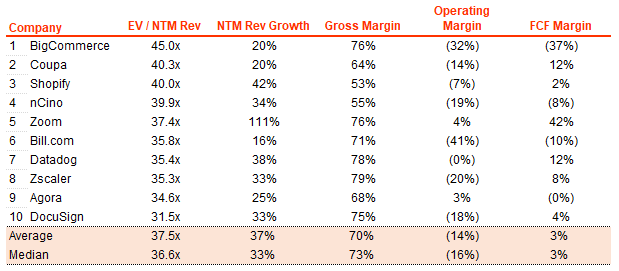

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

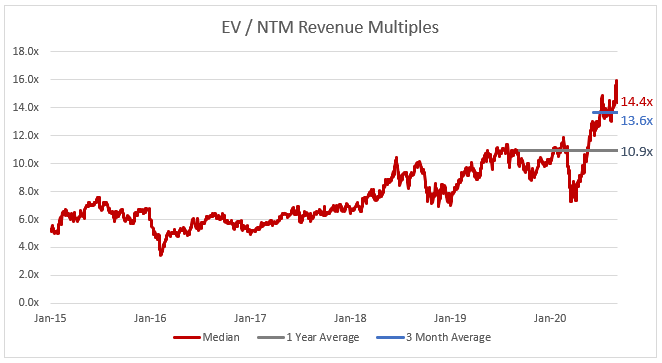

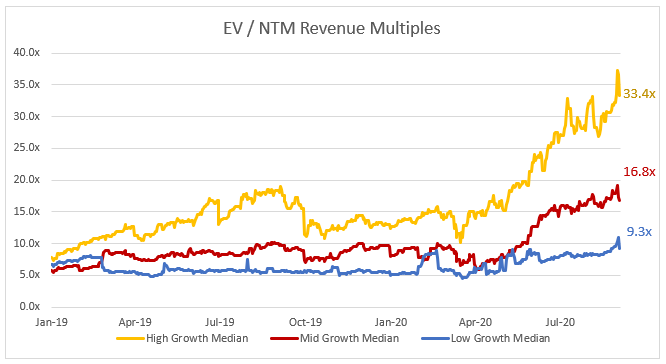

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 14.4x

Top 5 Median: 40.0x

3 Month Trailing Average: 13.6x

1 Year Trailing Average: 10.9x

We’ve seen so much volatility recently that it’s hard to see the up / down swings of the last couple weeks. The chart below looks back at how multiple have trended over the last year:

Bucketed by Growth:

High Growth Median: 21.0x

Mid Growth Median: 13.8x

Low Growth Median: 7.1x

Operating Metrics

Median NTM growth rate: 19%

Median LTM growth rate: 31%

Median Gross Margin: 73%

Median Operating Margin (16%)

Median FCF Margin: 4%

Median Net Retention: 116%

Median CAC Payback: 31 months

Comps Output

One thing to call out - not all companies who reported this week have received updated consensus estimates from research analysts yet (Zoom has)

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures