GitLab: Benchmarking the S-1 Data

Today GitLab their initial S-1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

GitLab Overview

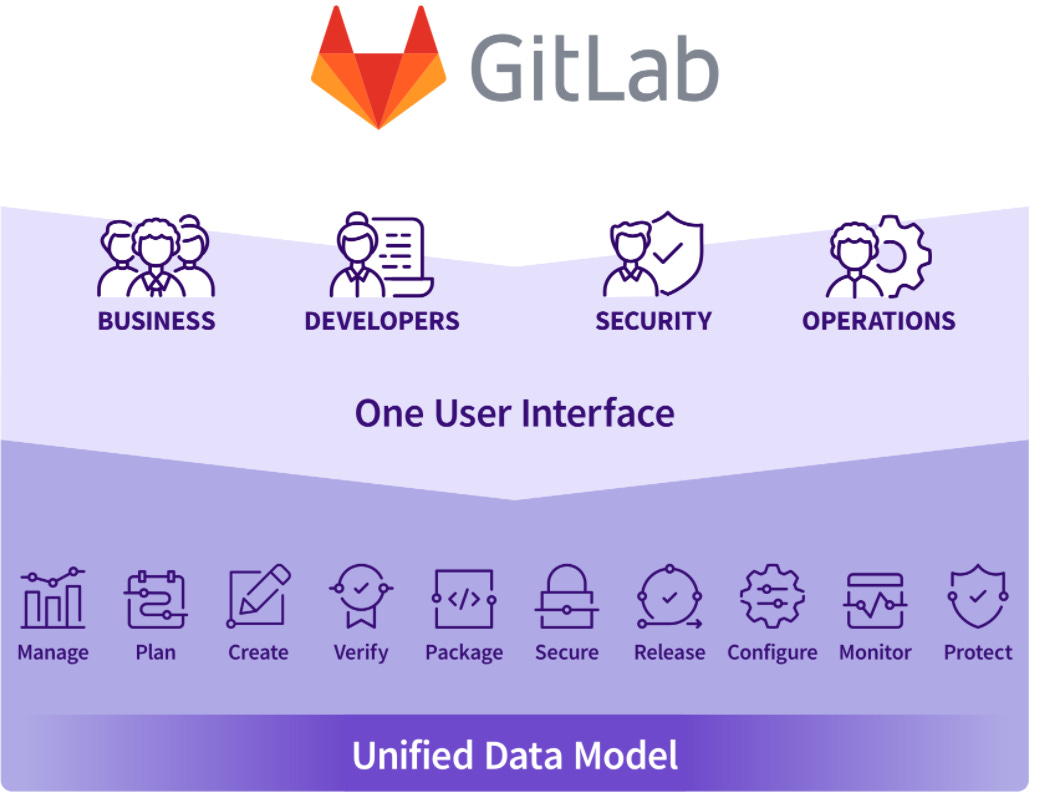

From the S1 - “GitLab is The DevOps Platform, a single application that brings together development, operations, IT, security, and business teams to deliver desired business outcomes. Having all teams on a single application with a single interface represents a step change in how organizations plan, build, secure, and deliver software…DevOps is the set of practices that combines software development (dev) and IT operations (ops). It aims to allow teams to collaborate and work together to shorten the development lifecycle and evolve from delivering software on a slow, periodic basis to rapid, continuous updates. When DevOps started, each team bought their own tools in isolation, leading to a “Bring Your Own DevOps” environment. The next evolution was standardizing company-wide on the same tool for each stage across the DevOps lifecycle. However, these tools were not connected, leading to a “Best in Class DevOps” environment. Companies tried to remedy this fragmentation and inefficiency by manually integrating these DevOps point solutions together defining the next phase: “DIY DevOps.” ”

Product Overview

From the S-1: “The DevOps Platform replaces the DIY DevOps approach. It enables organizations to realize the full potential of DevOps and become software-led businesses. It spans all stages of the DevOps lifecycle, from project planning, or Plan, to source code management, or Create, to continuous integration, or Verify, to static and dynamic application security testing, or Secure, to packaging artifacts, or Package, to continuous delivery and deployment, or Release, to configuring infrastructure for optimal deployment, or Configure, to monitoring it for incidents, or Monitor, to protecting the production deployment, or Protect, and managing the whole cycle with value stream analytics, or Manage. It also allows customers to manage and secure their applications across any cloud through a single platform…The majority of our customers begin by using Create and Verify. Developers use Create to collaborate together on the same code base without conflicting or accidentally overwriting each other's changes. Create also maintains a running history of software contributions from each developer to allow for version control. Teams use Verify to ensure changes to code go through defined quality standards with automatic testing and reporting. We believe serving as this system of record for code and our high engagement with developers is a competitive advantage in realizing our single application vision as it creates interdependence and adoption across more stages of the DevOps lifecycle, such as Package, Secure, and Release. As more stages are addressed within a single application, the benefits of The DevOps Platform are enhanced.”

Market Opportunity

From the S-1: “Today, we believe the addressable market opportunity for the DevOps Platform is approximately $40 billion. To estimate our current addressable market we have categorized companies of what we view as adequate scale into tiers based off of employee count as reported by S&P Global. We then multiply these cohorts by the average annual recurring revenue from the top 25% of customers in each of these categories as of January 31, 2021. Given the wide applicability of our platform, we believe we are well suited to grow our market opportunity over time…According to Gartner, the total addressable market for Global Infrastructure Software is estimated to be $328 billion by the end of 2021 and $458 billion by the end of 2024. We believe that we can serve $43 billion of this market by the end of 2021 and $55 billion by the end of 2024. We calculated these figures by determining the markets currently addressed by the most common use cases for our platform and summing their estimated sizes as reported by Gartner.”

How GitLab Makes Money

From the S-1: “We have a simple and easy to understand open core business model. We offer a free tier that includes a large number of our features to encourage initial use of The DevOps Platform, solicit wider community contributions, and create lead generation. We offer two paid subscription tiers, Premium and Ultimate, which are based on features available and priced on a per user basis. Our Premium tier includes features relevant for managers and directors, while our Ultimate tier includes additional features relevant for executives. Each of our plans provide feature access across every stage of the DevOps lifecycle, making it easier for customers to adopt additional stages on The DevOps Platform and add more users.We make our plans available through our self-managed and SaaS offerings. For our self-managed offering, the customer installs The DevOps Platform in its own private, or hybrid cloud environment. For our SaaS offering, the platform is managed by GitLab and hosted in the public cloud.”

Benchmark Data

The data shown below depicts how GitLab financial data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

GitLab did $196M of LTM revenue

LTM Revenue Growth

GitLab grew revenue 74% over the last 12 months

Quarterly YoY Revenue Growth Trends

GitLab has held revenue growth constant over the last couple quarters

LTM GAAP Gross Margin

GitLab’s LTM gross margins are 88%

GitLab’s quarterly gross margin has stayed constant over the last 4 quarters

LTM GAAP Operating Margin

GitLab’s LTM operating margin is (106%). However this figure is a bit misleading (see quarterly data below)

GitLab’s quarterly GAAP operating margin is closer to (50%). The big drop 3 quarters ago was related to a very high SBC charge in G&A. I haven’t looked into this, but I imagine it had to do with a secondary sale of shares (similar to what drove Confluent’s GAAP operating margin down)

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

GitLab’s dollar based net retention is 152%, which is best in class

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m taking the average of the 4 quarters leading up to IPO to normalize the business as there is generally more chopiness as companies prepare to go public. Every other company shown is their most recent quarters payback.

However, GitLab’s payback in their most recent quarter was 18 months

LTM S&M Expense as % of LTM Revenue

GitLab spent 88% of their LTM revenue on sales and marketing expenses

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thanks for this Jamin! - A quick clarifying Q: does your benchmark of S&M spend as a % of rev exclude stock based comp? Spot checking the Gitlab data it seems to, but not entirely sure. Appreciate all of your insights!

Amazing and useful work, Jamin. Thanks