HashiCorp: Benchmarking the S-1 Data

Today Hashicorp their initial S1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

Hashicorp Overview

From the S1 - “At HashiCorp, we believe that infrastructure enables innovation. Our foundational technologies solve the core infrastructure challenges of cloud adoption by enabling an operating model that unlocks the full potential of modern public and private clouds. Our cloud operating model provides consistent workflows and a standardized approach to automating the critical processes involved in delivering applications in the cloud: infrastructure provisioning, security, networking, and application deployment. With our solutions, companies of all sizes and in all industries can accelerate their time to market, reduce their cost of operations, and improve their security and governance of complex infrastructure deployments.

Organizations today are undergoing a digital transformation across every business function, driven by competition and ever-increasing consumer expectations. Underlying this digital transformation is a re-platforming of static on-premises infrastructure to dynamic and distributed cloud infrastructure. In this dynamic world, existing procedures are too inefficient to scale with distributed, multi-cloud infrastructure. Inconsistent, fragmented technologies and processes are time consuming and resource intensive to manage, exacerbated by inefficient, linear ticket-driven workflows that cannot facilitate scaled, real-time operations. This digital transformation demands a new cloud operating model for enterprise information technology, or IT, requiring automation to provision, secure, connect, and run infrastructure at scale and in real time. At HashiCorp, we build industry-leading products that enable this cloud operating model and accelerate cloud adoption. Our primary commercial products are Terraform, Vault, Consul, and Nomad:”

Product Overview

Hashicorp has 4 main products:

From the S-1:

Terraform is our infrastructure provisioning product that allows users to easily set up and manage IT infrastructure. Terraform enables IT operations teams to apply an Infrastructure-as-Code approach, where processes and configuration required to support applications are codified and automated instead of being manual and ticket-based. Terraform is cloud-neutral, supporting all major public and private clouds, and has a broad ecosystem of more than a thousand integrations with multiple cloud, software, and hardware platforms.

Vault is our secrets management and data protection product. Using Vault, security teams can apply policies based on application and user identity, integrating with both on-premises and cloud-native identity providers, to govern access to credentials and secure sensitive data. Vault makes it simple for practitioners to deploy zero-trust security and automate complex workflows.

Consul is our application-centric networking automation product. It enables practitioners to manage application traffic, security teams to secure and restrict access between applications, and operations teams to automate the underlying network infrastructure.

Nomad is our scheduler and workload orchestrator that enables organizations to deploy and manage applications. It provides practitioners with a self-service interface to manage the application lifecycle.”

Market Opportunity

From the S-1: “Each of our primary products corresponds to one of these markets:

Terraform addresses the emerging cloud infrastructure market, which was estimated to be $2.1 billion by the end of 2021 and $12.0 billion by the end of 2026.

Vault addresses the legacy and emerging security market, which was estimated to be $16.3 billion by the end of 2021 and $20.8 billion by the end of 2026.

Consul addresses the legacy and emerging networking market, which was estimated to be $22.6 billion by the end of 2021 and $30.9 billion by the end of 2026.

Nomad addresses the emerging applications and workload orchestration market, which was estimated to be $0.7 billion by the end of 2021 and $8.8 billion by the end of 2026.”

How Hashicorp Makes Money

From the S-1: “Our primary products are based on a combination of our open-source and proprietary software. We are committed to an open-source model in which we maintain free open-source offerings while developing proprietary features for paid tiers of our software. These proprietary features include collaboration modules, governance and policy modules, enterprise use cases, and premium support and services. We provide our software under a licensing model that protects our intellectual property, grows our adoption, and supports our business.

We generate revenue primarily from sales of subscriptions to our software. We offer an enterprise-ready, self-managed software offering that can be deployed in our customers’ public cloud, private cloud, and on-premises environments. HCP is our fully-managed cloud platform, available on all of the leading cloud providers. These two core offerings can be leveraged independently or together, spanning the various public cloud, private cloud, and on-premises environments in which our customers operate."

For our self-managed offerings, we offer various tiers that provide different levels of access to our proprietary products, modules, and support. Our licenses for self-managed deployments typically have terms of one to three years. We bill for one-year licenses upfront, and we primarily bill for multi-year term licenses annually in advance, with a multi-year payment schedule. The substantial majority of our revenue is recognized ratably over the subscription term. Each product is sold as a base module, with additional optional modules available that address needs like governance and policy, and a tiered pricing system that scales pricing with increased product usage. The unit of value for product usage varies by product, and generally scales with customer cloud adoption as workloads managed by our products move to cloud-based infrastructure.”

Benchmark Data

The data shown below depicts how the Hashicorp data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

Hashicorp’s LTM revenue was $259M

LTM Revenue Growth

Hashicorp’s LTM revenue growth was 55%

Quarterly YoY Revenue Growth Trends

LTM GAAP Gross Margin

Hashicorp’s LTM gross margins were 82%

Hashicorp’s gross margins have been relatively stable the last few quarters

LTM GAAP Operating Margin

Hashicorp’s LTM operating margin was (22%)

Hashicorp’s quarterly operating margin have been trending down

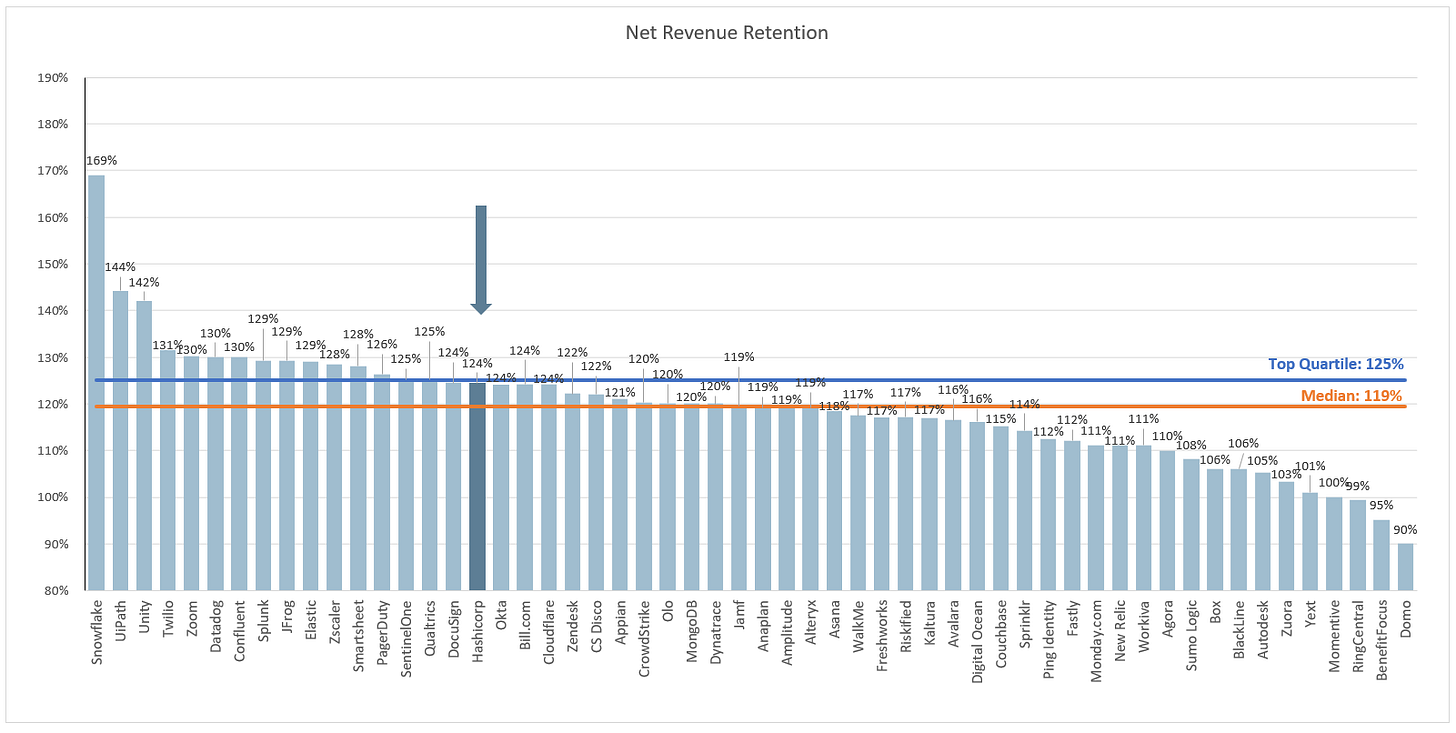

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

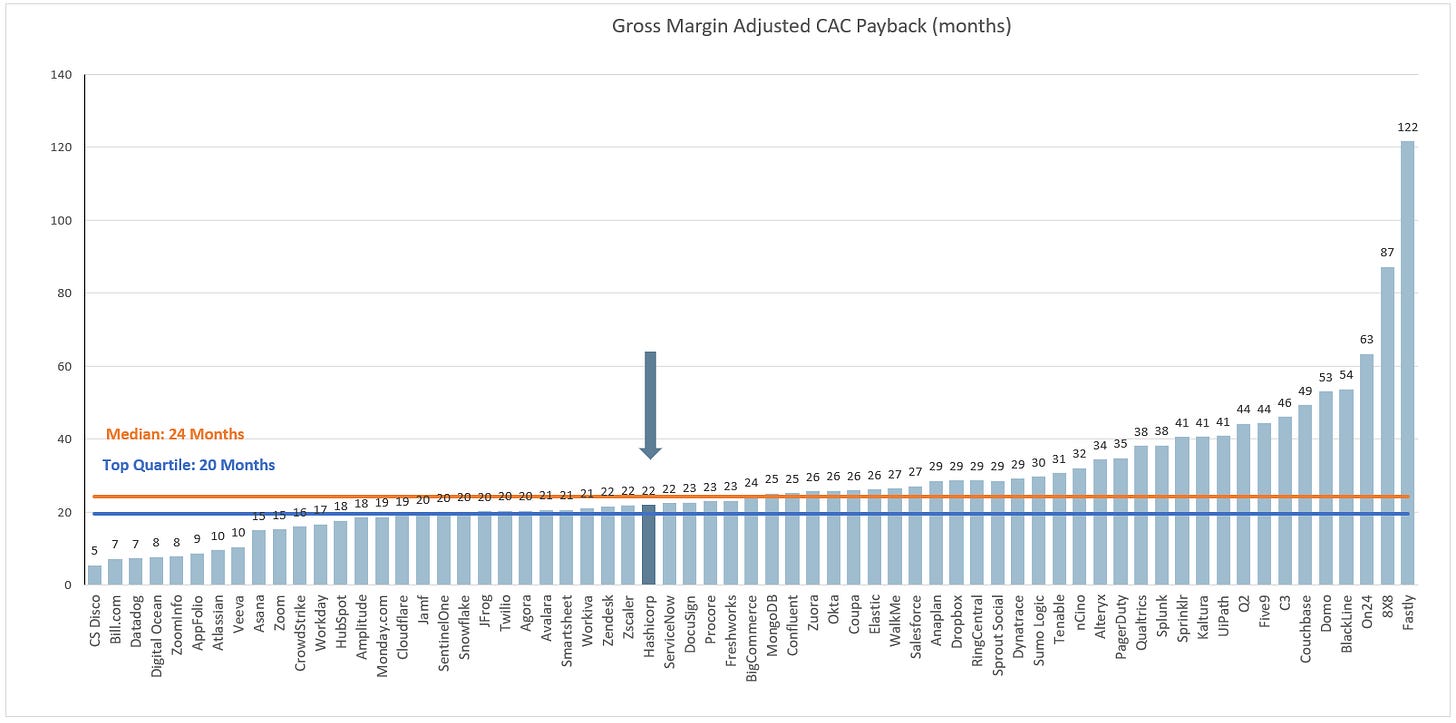

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them.

LTM S&M Expense as % of LTM Revenue

Hashicorp spent 59% of revenue on S&M over the LTM

Hashicorp has been spending more on S&M in the last few quarters

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.