Klaviyo filed their initial S1 statement today. This is the first S-1 we’ve seen in almost 2 years from a software company! A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

Klaviyo Overview

From the S1 - “Klaviyo enables businesses to drive revenue growth by making it easy to bring their first-party data together and use it to create and deliver highly personalized consumer experiences across digital channels.

Our modern and intuitive SaaS platform combines our proprietary data and application layers into one vertically-integrated solution with advanced machine learning and artificial intelligence capabilities. This enables business users of any skill level to harness their data in order to send the right message at the right time across email, SMS, and push notifications, more accurately measure and predict performance, and deploy the specific actions and campaigns that drive the highest impact. Our reviews add-on allows our customers to collect product reviews within our platform to provide a seamless experience across the customer lifecycle, and our CDP offering gives customers user-friendly ways to track new types of data, transform and cleanse data, run more advanced reporting and predictive analysis to drive revenue growth, and sync data in to and out of Klaviyo at scale. By combining easy implementation, rapid time-to-value, and clearly attributable outcomes, which we measure and refer to as KAV, we drive substantial return-on-investment, or ROI, for our customers. We focused on marketing automation within eCommerce as our first application use case, and we believe our software is highly extensible across a broad range of functions and verticals.”

Product Overview

At their core, Klaviyo is a marketing automation solution that covers email, SMS, mobile push, and reviews, tying it all together in a customer data platform. Customers can segment their customers, create specific campaigns that cover multiple channels, and overall engage more efficiently with their audience through the Klayvio platform

The Klaviyo platform is a “vertically-integrated, highly-scalable, and flexible platform unifies the data and application layers with our messaging infrastructure into one modern tech stack.”

“Data Layer. Our highly-scalable platform is optimized for large volumes of data, delivers sub-second-level accessibility, and provides extremely high levels of personalization and attribution. We built our data store from the ground up to be agile, unbound by specific schema or data structures, and, as of June 30, 2023, we are able to process data from over 300 native integrations and open APIs without friction. Our integrations span from retail and eCommerce platforms – such as Shopify, Salesforce Commerce Cloud, and WooCommerce – to loyalty, social media, customer service, and shipping solutions. Additionally, we have begun to launch integrations for new verticals, including Mindbody, Zenoti, and Olo. Our data store synchronizes unaggregated, historical profile data with real-time event data in a single system-of-record. Profile data enables our customers to generate unified consumer profiles with extremely granular segmentation, grouping consumer profiles into precise audiences that update in real-time as consumers interact with our customers. Event data allows customers to send behavior-triggered messages that keep consumers engaged with the right message at the right time. This industry-agnostic, data-first approach represents a new foundational capability in our market and can be applied to several use cases and new verticals in the future that all require the combination of fast performance with real time, predictive intelligence.

Application Layer. We built an application layer on top of our data layer, which provides a comprehensive set of tools and features that enable our customers to easily turn consumer learnings into insights and actions to drive revenue growth without the need to hire sophisticated and expensive in-house engineers. We started with our marketing application, enabling our customers to create and manage targeted marketing campaigns and flows, track customer behavior, and analyze campaign performance to grow revenue. Our advanced data science and predictive analytics capabilities also utilize artificial intelligence and machine learning so businesses can estimate consumer lifetime value, predict a consumer’s next order date, and calculate potential churn risk. As a result, our application helps companies deliver contextually-relevant and personalized experiences throughout the entire consumer journey and across digital channels, such as email, SMS, and push notifications, through our messaging infrastructure. We focused on marketing automation for business-to-consumer, or B2C, companies within retail and eCommerce as our first application, and we believe our software is highly extensible across a broad range of functions for B2C and B2B businesses alike.”

Market Opportunity

From the S-1: “Today, the customers we serve primarily operate within the retail vertical, with retailers spanning both online and offline channels. Our estimated serviceable addressable market opportunity within this vertical is over $16 billion. We calculate this opportunity using business count data sourced from Analysys Mason, focusing on the number of businesses in the geographies we primarily operate in today, including North America, Western Europe, New Zealand, and Australia, and segmenting them into Micro, Small, Medium, and Enterprise segments based on the number of employees. We then multiply the total number of companies in each segment by our respective average ARR per customer per segment as of December 31, 2022. The average ARR is based on customers in each segment in all geographies that have been using our email and SMS offering for more than twelve months.

While our first use cases were focused on the retail and eCommerce vertical, we believe our platform is highly extensible across a broad range of verticals, including education, events and entertainment, restaurants, and travel, as well as B2B companies. As we continue to scale our platform, we expect that our total addressable market will expand to businesses in all verticals that engage with third parties, including customers and clients, through email, SMS or push. Accordingly, we estimate that the total addressable market opportunity for our platform across all of these verticals is $34 billion in the United States alone.”

How Klaviyo Makes Money

Klaviyo has about 130k customers, with an ACV of ~$5k

From the S-1: “We generate revenue through the sale of subscriptions to our customers for the use of our platform. Our subscription plans are tiered based on the number of active consumer profiles stored on our platform and the number of emails and SMS messages sent. We currently permit our customers to send unlimited push notifications, which are included as part of our email subscription plan. Active consumer profiles are identified profiles that can be reached via at least one enabled marketing channel in Klaviyo; this means the profile is not suppressed, either by revoking consent or being rendered undeliverable. The vast majority of our subscription plans today are monthly.

Our land-and-expand strategy is designed to align our success with that of our customers. As our customers’ businesses grow, they utilize more active consumer profiles and send more emails and SMS messages, which naturally increases their usage of our platform. Our revenue also expands when our customers add additional channels, such as SMS, and additional use cases, such as reviews and our CDP offering, or when their other brands, business units, and geographies start using the platform.”

Benchmark Data

The data shown below depicts how the Klaviyo data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

Klaviyo’s LTM revenue was $585M

LTM Revenue Growth

Klaviyo grew revenue 57% over the last 12 months

Quarterly YoY Revenue Growth Trends

Despite macro headwinds, Klaviyo has maintained impressive growth

LTM GAAP Gross Margin

Klaviyo’s gross margins are 75%

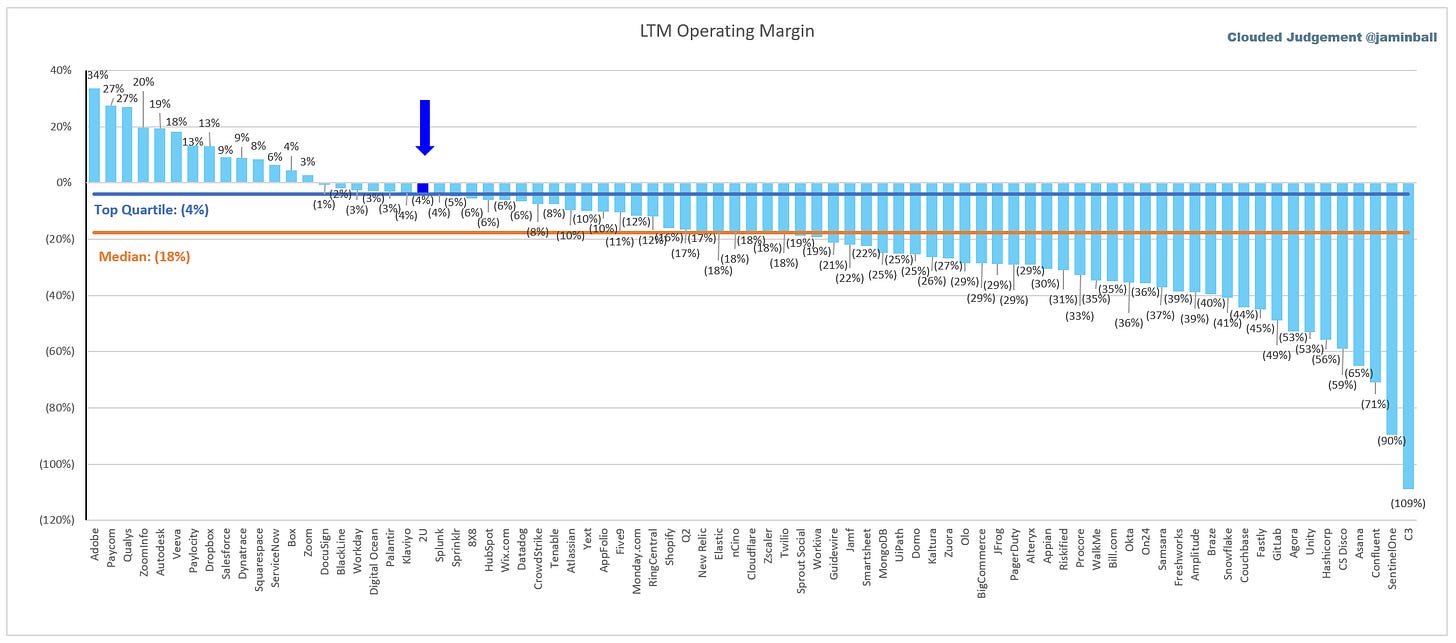

LTM GAAP Operating Margin

Klaviyo’s operating margins are (4%). In their last 2 quarters they did have a positive GAAP operating margin (1% and 4%)

LTM FCF Margin

Klaviyo’s LTM FCF margins are 8%

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

Klaviyo’s net retention is 119%

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them.

Klaviyo’s CAC payback period is 29 months

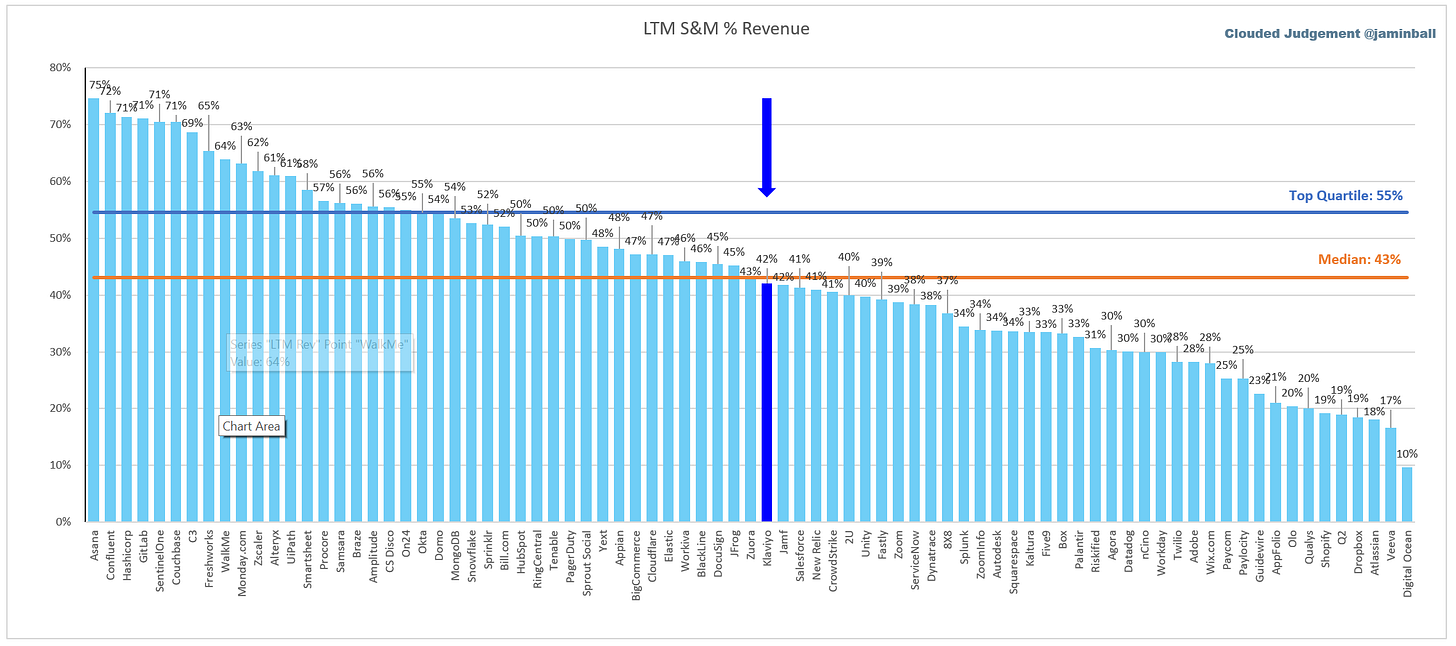

LTM S&M Expense as % of LTM Revenue

Klaviyo spent 42% of revenue on S&M over the last 12 months

Quarterly S&M trends below

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

Klaviyo’s rule of 40 is one of the best at 65%

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This fascinating article analyzes the breakdown of the first tech IPO in the last two years - the Kalviyo email platform.

First, I think we can name it as the vanilla metrics:

- The email marketing market in the US is worth $34B.

- Klaviyo has about 130k customers, with an ACV of ~$5k.

- Revenue for the last 12 months is $585M, which ranks 50th among public software companies and slightly below the median of $818M.

- Klaviyo's net retention is 119%, one of the most. Critical indicators for the land and expansion of SAAS are that current customers grow by more than twice a year. This is again the median.

And now, onto the more exciting parts:

- The CAC payback period is 29 months. This is a tough one! 29-month payback period for an acquired customer. However, nothing is said about the LTV. How long does the customer live, and how much does it bring? A big question.

- LTM GAAP Gross Margin is 75%, which is usually the median.

- But, the operating margin (LTM GAAP Operating Margin) is only 4%.

How to increase the margin with such a high customer acquisition cost is unclear. The email marketing market is super competitive, as evidenced by the CAC Payback. And it seems that they managed to pull out a four percent margin for the IPO, and that's at the limit.

Conclusion:

It is necessary to build an ecosystem of products, like Hubspot, Salesforce, and Intercom, to earn much more from a customer through a group of integrated products. CAC is growing, and an ACV of ~$5k is already the limit for a single product.

What do you think about their LTV and CAC ratios and future improvement opportunities?

loved the article