Navan: Benchmarking the S-1 Data

Recently Navan their initial S-1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses.

Navan Overview

From the S1 - “Navan is an end-to-end, AI-powered software platform built to simplify the global business T&E experience, benefiting users, customers, and suppliers. From day one, we leveraged technology to reimagine business travel. We built a comprehensive platform that serves as the foundation for further disruption. We deliver delightful, personalized experiences for users, efficiency and control for customers, and direct market access for suppliers—all powered by our proprietary AI framework, Navan Cognition.”

Product Overview

From the S-1: “Our end-to-end, AI-powered software platform is purpose-built to deliver a personalized global travel booking experience for our users, combined with next-generation expense management and payments solutions that provide real-time visibility and control over T&E spend.

Navan Cloud—The Infrastructure of Our Travel Experience: We built our proprietary technology and partner infrastructure from the ground up to provide a global, real-time inventory that maximizes choice for our users. Our platform is truly global, with broad inventory including smaller suppliers, and our human and virtual agents have access to all of the bookings on our platform, globally. Acting as a proprietary, in-house aggregator platform, our highly scalable Navan Cloud aggregates and dynamically accesses our broad inventory through direct relationships, API integrations, and partnerships to provide high levels of choice. Our direct connections and integrations give us access to sell over 600 airlines via GDSs, NDC, and LCCs, and over two million individual lodging properties through our platform globally. We have connections to the major credit card networks and over 200 banks and partnerships with multiple issuing partners in Navan Cloud.

Navan Cognition—Our New Paradigm in AI-Powered Travel Management: Navan Cognition is our third-generation innovative proprietary AI framework that combines the precision and predictive power of ML with the reasoning capabilities of large language models, or LLMs. Navan Cognition is designed to leverage third-party LLMs in combination with our own proprietary, internally developed software to operate a modular framework of virtual agents using a graph-based workflow. On our platform, Navan Cognition enables us to create, train, deploy, and supervise our specialized virtual agents that can handle many complex tasks previously requiring human intervention. Designed with built-in safeguards and real-time oversight, Navan Cognition works to ensure that AI-driven actions are reliable, secure, and aligned with enterprise needs.

Navan Native Apps and Enterprise Integrations: We have developed simple and intuitive front- end experiences for travel, payments, and expense management. Users can interface with our platform through web and mobile applications, omnichannel support, and white label travel solutions. We also offer deep enterprise integrations with leading human resource information systems, enterprise resource planning systems, and financial systems, which enable real-time syncing of employee directories, expense categories, and policy controls. This seamless connection also allows customers to streamline onboarding, enforce compliance automatically, and accelerate month-end reconciliation. By embedding Navan into existing enterprise infrastructure, finance and HR teams can maintain a single source of truth across systems and significantly reduce the operational burden of manual data entry and cross-platform coordination

Market Opportunity

From the S-1: “Navan addresses a large, growing, and global total addressable market, or TAM, by providing an all-in-one software platform for customers of all sizes. Even in the face of macroeconomic uncertainty, our data suggests that companies continue to prioritize business travel. The Navan Business Travel Index, or Navan BTI, is our own proprietary indicator of the strength of the business travel economy, based on volume- and spend-based data derived from our platform. The Navan BTI indicates that business travel activity during the period from April 1, 2025 through June 30, 2025 grew at an annualized rate of 15% relative to the same period in 2024. Our TAM spans travel management, both managed and traditionally unmanaged, as well as expense management and payments. We estimate the TAM for the services we offer today to be approximately $185 billion globally. To estimate our total TAM, we identified four categories of market opportunities: (1) managed and unmanaged business travel management, referred to as the managed and unmanaged categories, (2) bleisure, (3) expense management, and (4) payments”

Business Travel Management: $86B TAM

Bleisure: $24B TAM

Expense Management: $39B TAM

Payments: $37B TAM

How Navan Makes Money

From the S-1: “Our revenue is driven by our ability to attract new customers and retain and expand existing customers by providing an end-to-end platform that facilitates the full spectrum of their travel, payments, and expense management needs, ultimately helping our customers succeed. We serve customers of all sizes, verticals, and regions, and our vast network of suppliers and payment partners helps us capture this opportunity. The breadth of our offerings aligns the interests of our users, customers, suppliers, and payment partners. As of January 31, 2025, we had more than 10,000 active customers, millions of supply partners and lodging properties, and multiple payment partners.

We generate revenue on a usage or subscription basis from the following:

Customers: Our customers include companies and organizations that contract with us to provide their employees (our users) with access to our Travel Management offerings or Expense Management offering. We typically enter into annual or multi-year contracts whereby customers pay a per-trip or per-transaction fee for access to our Travel offering or on-demand travel management offerings (our VIP, Meetings and Events, and Bleisure offerings) and pay an annual subscription fee for access to our Expense Management offering.

Suppliers: Our suppliers include airlines, hotels, rental car companies, rail carriers, and providers of GDS. We earn revenue from our suppliers in the form of commissions based on the dollar volume of bookings made by users on our platform and a commission rate for each supplier.

Payment partners: Our payment partners primarily include corporate card payment processors and card issuing partners. We earn revenue from our payment partners from fees based on the

Benchmark Data

The data shown below depicts how Navan data compares to the operating metrics of current public SaaS businesses.

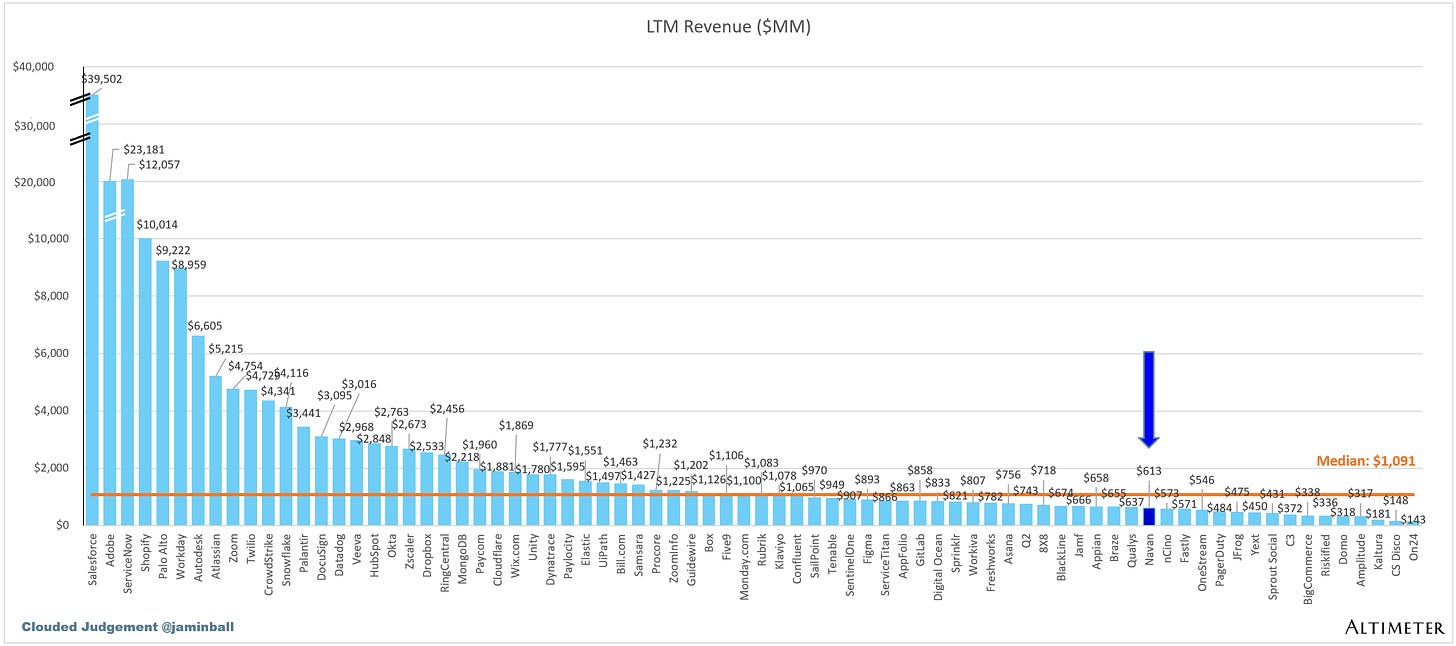

Last Twelve Months (LTM) Revenue

Navan had $613m of LTM revenue

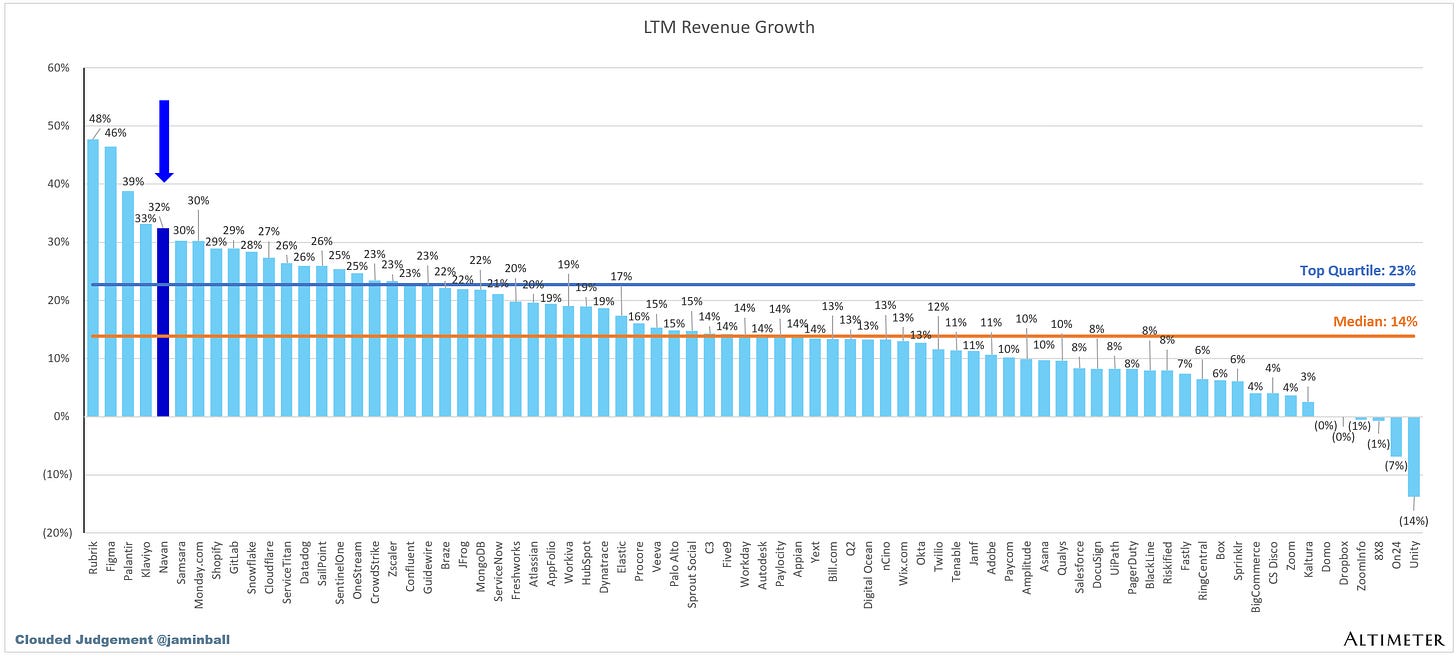

LTM Revenue Growth

Navan grew 32% over the last 12 months

Quarterly YoY Revenue Growth Trends

LTM GAAP Gross Margin

Navan’s gross margins are 71%

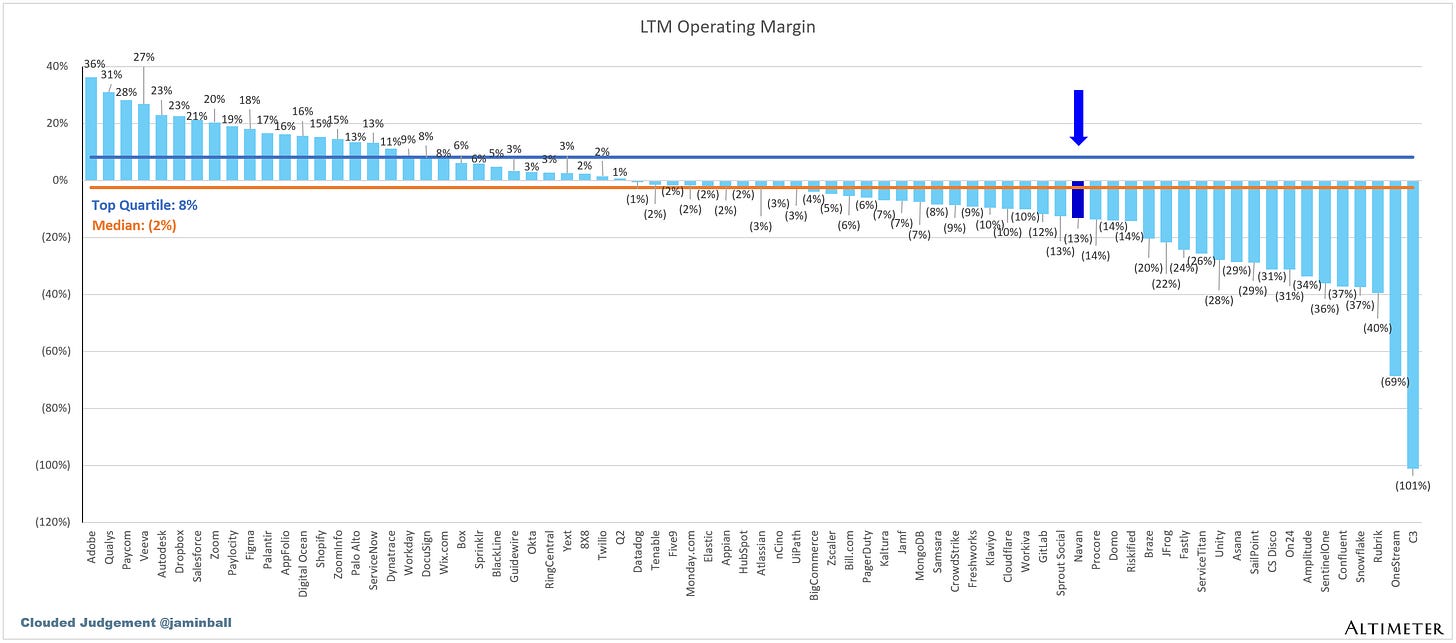

LTM GAAP Operating Margin

Navan’s GAAP operating margin over the last 12 months was (13%)

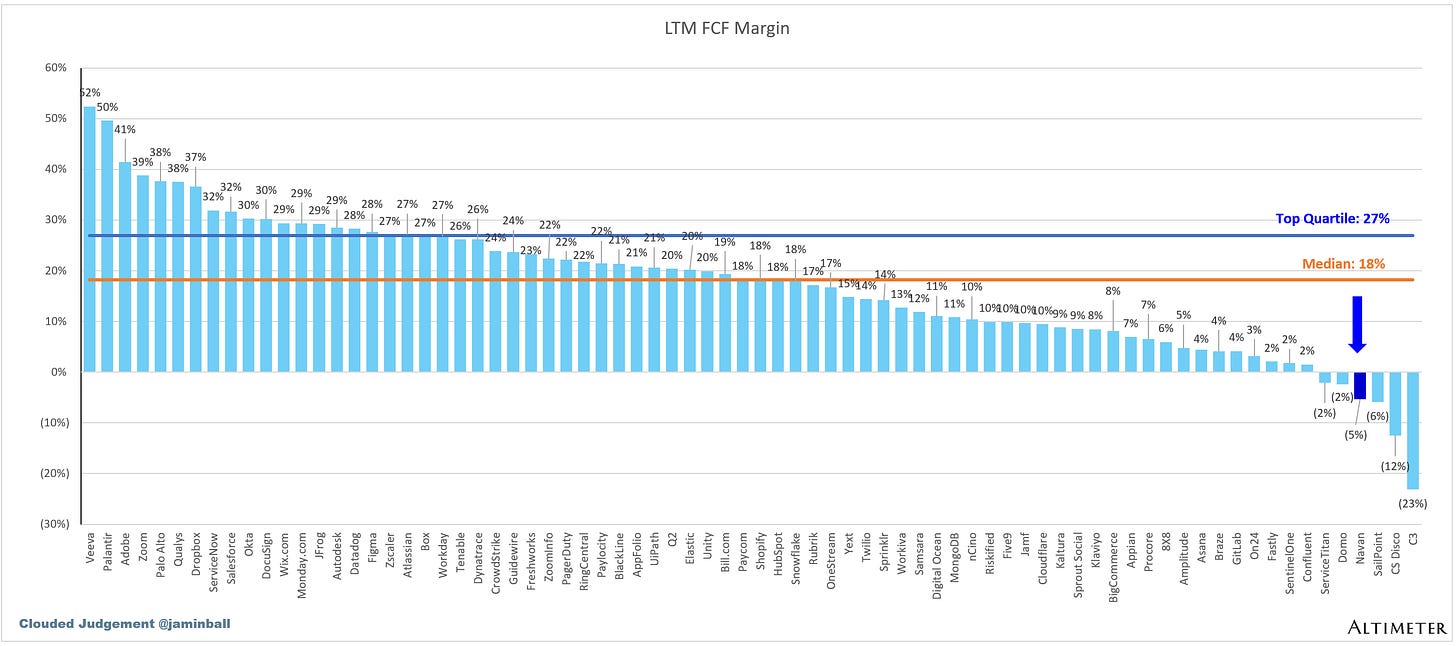

LTM FCF Margin

Navan’s FCF margin over the last 12 months was (5%)

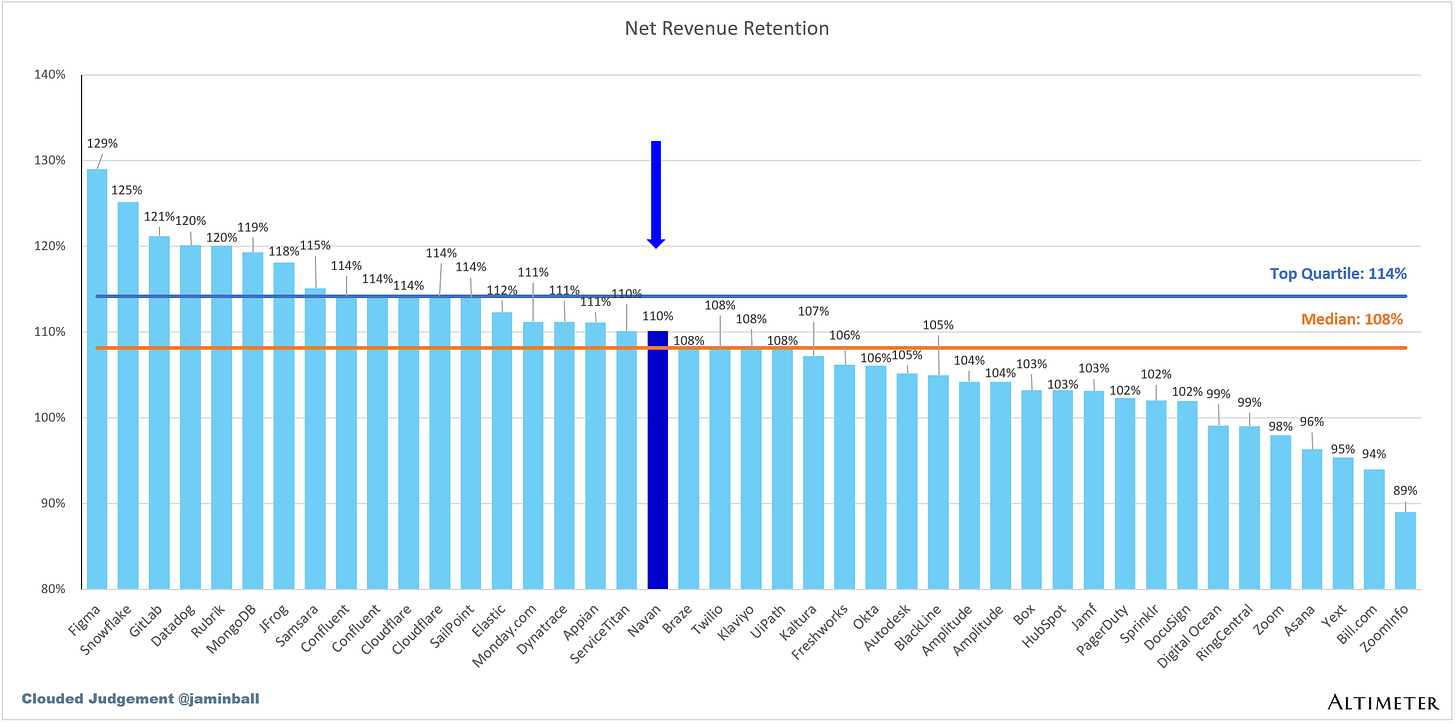

Net Revenue Retention

Here’s how Navan calculates NRR: “We determine NRR on an annual basis to account for seasonality in our business. To calculate NRR as of a given fiscal year end, which fiscal year is referred to as the Current Period, we first identify a cohort of customers, referred to as the Customer Cohort, for the fiscal year prior to the Current Period, which fiscal year is referred to as the Base Period. To be included in the Customer Cohort, a customer must have been an active customer as of the beginning and the end of the Base Period. We then divide total annual revenue from the Customer Cohort in the Current Period, referred to as Current Period Revenue, by total annual revenue from the Customer Cohort in the Base Period, referred to as Base Period Revenue, to derive our annual NRR as of the end of the Current Period.”

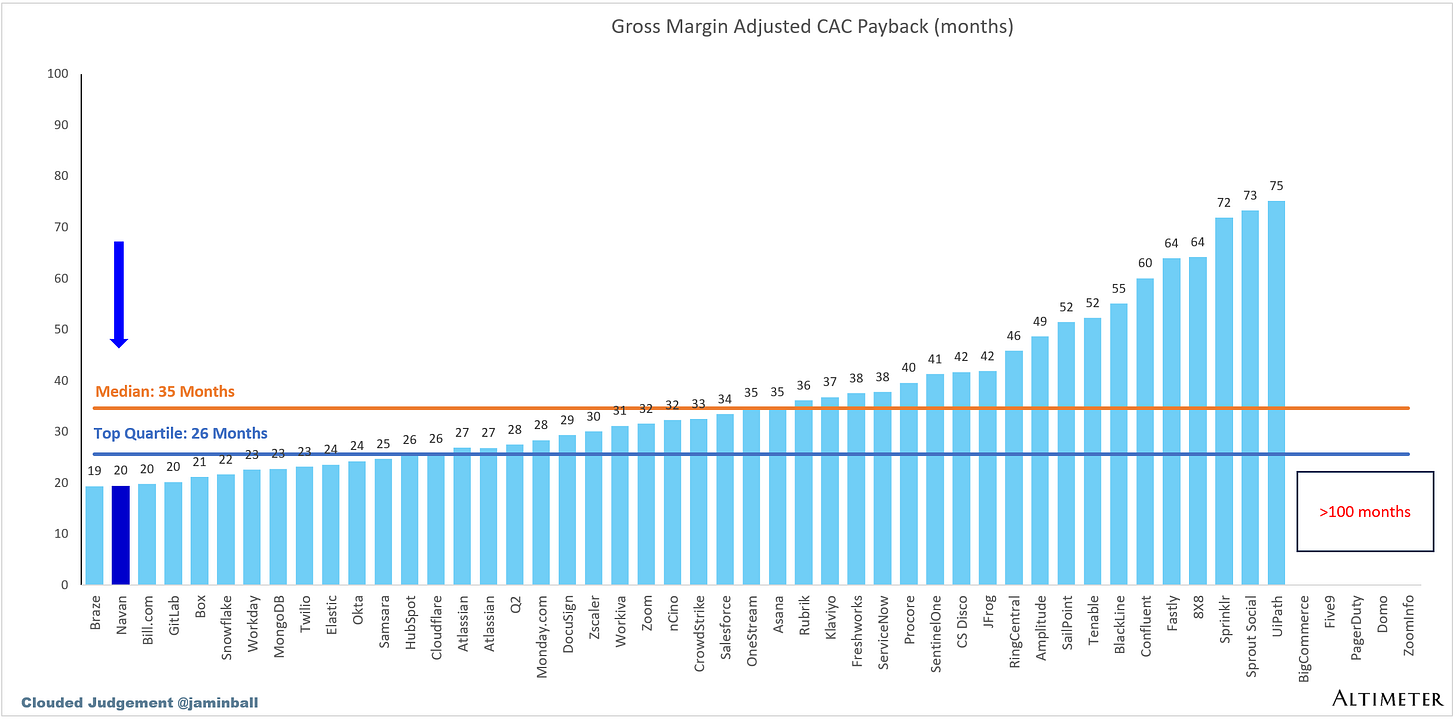

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. For Navan I’m just using quarterly rev x 4 to estimate ARR. It’s not perfect at all, especially with Navan’s revenue stream which is more usage / transactional based.

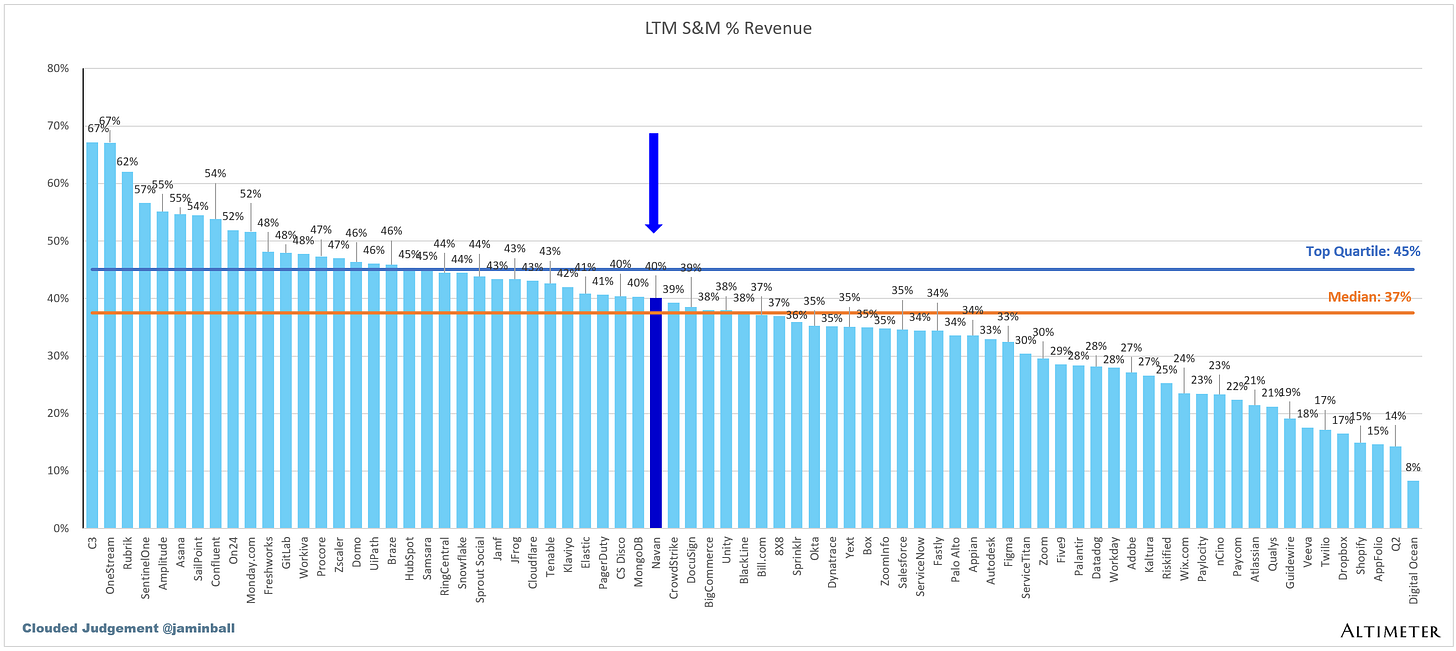

LTM S&M Expense as % of LTM Revenue

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as an investment recommendation or legal advice. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service or legal advice. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

The charts are super helpful in placing NAVAN in context. While not exhibiting the hyper growth we are now used to with companies like PLTR, NAVAN looks like a pioneer on generating effective enterprise productivity gains from merging LLMs with the last generation of ML. Without an effective vehicle for merging these deterministic and probabilistic ML results, LLMs may face an uphill climb in enterprise adoption beyond personal productivity (coding agents being an example). NAVAN looks like they are where the rubber meets the road in using LLMs to solve a big and knotty enterprise productivity problem in a new way.