Olo: Benchmarking the S-1 Data

Last Friday Olo filed their initial S-1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

Olo Overview

From the S-1 - “Olo provides a leading cloud-based, on-demand commerce platform for multi-location restaurant brands. Our platform powers restaurant brands’ on-demand commerce operations, enabling digital ordering and delivery, while further strengthening and enhancing the restaurants’ direct consumer relationships. Consumers today expect more on-demand convenience and personalization from restaurants, particularly through digital channels, but many restaurants lack the in-house infrastructure and expertise to satisfy this increasing demand in a cost-effective manner. Olo provides restaurants with a business-to-business-to consumer, enterprise-grade, open SaaS platform to manage their complex digital businesses and enable fast and more personalized experiences for their customers…Restaurant brands rely on Olo to increase their digital and in-store sales, maximize profitability, establish and maintain direct consumer relationships, and collect, protect, and leverage valuable consumer data.”

The Olo platform includes 3 core modules:

Ordering: A fully-integrated, white-label, on-demand commerce solution, enabling consumers to order directly from and pay restaurants via mobile, web, kiosk, voice, and other digital channels.

Dispatch: A fulfillment solution, enabling restaurants to offer, manage and expand direct delivery while optimizing price, timing, and service quality.

Rails: An aggregator and channel management solution, allowing restaurants to control and syndicate menu, pricing, location data, and availability, while directly integrating and optimizing orders from third-parties into the restaurants’ point-of-sale, or POS, systems.

Market Opportunity: “We believe our total addressable market opportunity is $7 billion based on our current product offerings and focus on enterprise restaurants primarily in the United States. To arrive at this figure, we determined the number of enterprise restaurant locations and number of orders that we could generate revenue from on a per location basis. According to a 2019 publication by the NPD Group, there are approximately 300,000 enterprise restaurant locations across the United States. We determined the number of orders per enterprise location, based on industry research, by dividing their total sales by the average order value in the United States. To determine our opportunity per location, we then multiplied the implied number of orders by the percentage of digital orders, and by our actual average fee per order, and then added our actual annual average subscription fee per location as of December 31, 2020 to get the estimated total annual average revenue per restaurant location. This figure was then multiplied by the number of enterprise locations to arrive at the U.S. estimate.”

How Olo Makes Money

From the S-1: “We refer to our business model as a transactional SaaS model as it includes both subscription and transaction-based revenue streams, and we designed it to align with our customers’ success. We generate subscription revenue from our Ordering module and transaction revenue from our Rails and Dispatch modules. We charge our customers a fixed monthly subscription fee per restaurant location for access to our Ordering module. In addition, a growing portion of our customers purchase an allotment of monthly orders for a fixed monthly fee and pay us an additional fee for each excess order, which we also consider to be subscription revenue. Our transaction revenue includes revenue generated from our Rails and Dispatch modules. Customers who subscribe to our Rails and Dispatch modules pay a fee on a per transaction basis. In most cases, we also charge aggregators, channel partners, and other service providers in our ecosystem on a per transaction basis for access to our Rails and Dispatch modules. We also derive transactional revenue from other products, including Network, which allows brands to take orders from non-marketplace digital channels (e.g., Google Food Ordering, which enables restaurants to fulfill orders directly through Google search results and Maps pages). These products generate fees predominantly through revenue sharing agreements with partners. For the years ended December 31, 2018, 2019, and 2020, 93.2%, 80.8%, and 56.7% of our platform revenue was subscription revenue, respectively, and 6.8%, 19.2%, and 43.3% was transaction revenue, respectively.”

Benchmark Data

The data shown below depicts how the Olo data compares to the operating metrics of current public SaaS businesses. TLDR - they’re on the smaller side, but growing exceptionally well with exceptional efficiency and margins.

Last Twelve Months (LTM) Revenue

As you can see, at <$100M LTM revenue, Olo will be the smallest public SaaS company

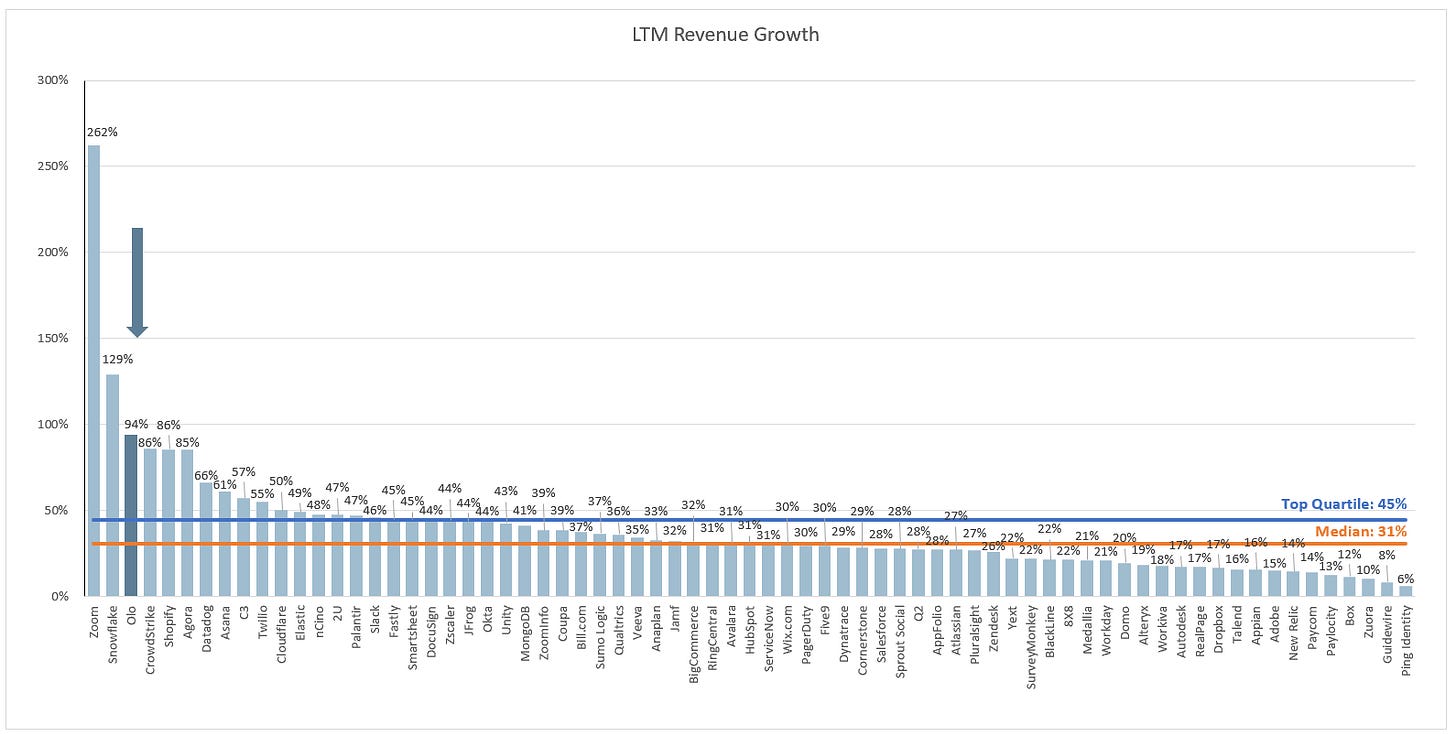

LTM Revenue Growth

Olo will be one of the fastest growing public SaaS businesses. Their scale is much smaller, however their growth is exceptional.

Quarterly YoY Revenue Growth Trends

Olo has shown nice revenue growth acceleration through Covid as more restaurants look to digitize their operations and offer online ordering.

LTM GAAP Gross Margin

Olo has excellent SaaS gross margins

LTM GAAP Operating Margin

Olo has a positive GAAP operating margin, which is something we rarely see for public SaaS companies this early in their public market journey. Congrats to the team for building a profitable businesses! Not all SaaS companies can say the same :)

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10). Olo doesn’t disclose their exact number, but instead discloses a number “>120%”

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m taking the average of the 4 quarters leading up to IPO to remove any seasonality out outliers. I’m also defining ARR as quarterly subscription revenue x 4.

Olo has an exceptional payback period. The calculated metric for Olo is a bit of a “swag.” They don’t disclose quarterly subscription revenue (they disclose platform revenue which includes subscription + transactional revenue), but they do disclose the annual subscription revenue (as a % of platform revenue). I’ve applied the annual % subscription revenue to their two most recent quarters.

Olo gets tremendous leverage from their S&M spend. Total S&M spend only represents 9% of LTM revenue, which is the lowest of all SaaS companies (by a long shot). RealPage is the next closest at 16%. The median is 44%.

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin. Olo benchmarks quite well given their profitability + high growth

The big story for OLO is its ability to build a transaction business on top of a subscription business. They have no real enterprise-class competitor. With excellent operating metrics, I see the stock trading at 50x (or $5b market cap). Its only challenge is TAM and for sustained long term growth, they will have to expand the product portfolio and geographical reach.

Thanks for this wonderful analysis!