ServiceTitan: Benchmarking the S1 Data

Today ServiceTitan filed their initial S1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~2-3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~1-2 weeks before the stock starts trading. So we’re looking at roughly 3-5 weeks before any retail investor can buy the stock.

ServiceTitan Overview

From the S1 - “ServiceTitan is the operating system that powers the trades.

We are modernizing a massive and technologically underserved industry—an industry commonly referred to as the “trades.” The trades consist of the collection of field service activities required to install, maintain, and service the infrastructure and systems of residences and commercial buildings. Tradespeople—like your local plumber, roofer, landscaper, HVAC technician and others who are employed in the trades—are immensely skilled and extensively trained. They are the essential, unsung heroes who work tirelessly to ensure that our needs are met where we live or work, ready at a moment’s notice to leave their families in the middle of the night to go across town to help others. The trades constitute a large, expanding cornerstone of our economy. There are hundreds of thousands of trades businesses providing essential services in every corner of the country. Based on internal analysis of industry data, we estimate the customers of trades businesses, which we refer to as “end customers,” spend approximately $1.5 trillion annually on trades services for homes and businesses in the United States and Canada alone.”

Product Overview

From the S-1: “We designed our platform to address key workflows within a trades business. Contractors spend their days interfacing with the ServiceTitan platform across what we believe to be the five most business-critical functions, or the “core centers of gravity,” inside a trades business: CRM (customer relationship management, including sales enablement, marketing automation and customer service), FSM (field service management, including scheduling and dispatching), ERP (enterprise resource planning, including inventory), HCM (human capital management, including compensation and payroll integration) and FinTech (including payments and third-party consumer financing).

We go to market with our platform in three ways: Core, Pro and FinTech products. We land with our Core product, which offers a base-level functionality across all key workflows, including call tracking, scheduling, dispatching, end-customer communications, marketing automation, estimating, job costing, sales, inventory and payroll integration. To supplement our Core product and provide an even higher level of functionality, we offer our Pro products, which provide value-additive capabilities such as Marketing Pro, Pricebook Pro, Dispatch Pro and Scheduling Pro, as well as our FinTech products, which include payment processing and third-party financing solutions. Together, we refer to our Pro and FinTech products as “add-on products.”

Market Opportunity

From the S-1: “In the United States and Canada alone, end customers spend approximately $1.5 trillion on trades services annually. Today, we serve trades and markets that represent approximately $650 billion of the total $1.5 trillion annual industry spend, which we refer to as our serviceable industry spend. This serviceable industry spend includes work performed in the construction of homes and buildings as well as the servicing of existing residences and commercial buildings.

Today, we capture on average approximately 1% of our customers’ GTV as revenue from their subscription to and current usage of our products. We estimate that with our current product suite, we have the potential to capture on average approximately 2% of our customers’ GTV as revenue from their subscription to and usage of our full suite of add-on products.

Based on our approximately $650 billion serviceable industry spend and our estimate that we have the opportunity to capture on average approximately 2% of our customers’ GTV as revenue, we estimate ServiceTitan has a serviceable market opportunity of approximately $13 billion.”

How ServiceTitan Makes Money

From the S-1: “We have two general categories of revenue: (i) platform revenue and (ii) professional services and other revenue. The substantial majority of our revenue is platform revenue, which we generate through (a) subscription revenue generated from access to and use of our platform, including subscriptions to our Core and certain Pro products, and (b) usage-based revenue generated from transactions using our FinTech solutions, usage of certain Pro products and other usage-based services. We land with our Core product, which offers a base-level functionality across all key workflows, including call tracking, scheduling, dispatching, end-customer communications, marketing automation, estimating, job costing, sales, inventory and payroll integration. To supplement our Core product and provide an even higher level of functionality, we offer our Pro products, which provide value-additive capabilities, as well as our FinTech products, which include payment processing and third-party financing solutions. Together, we refer to our Pro and FinTech products as “add-on products.””

Benchmark Data

The data shown below depicts how the ServiceTitan data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

ServiceTitan generated $685m of LTM revenue

LTM Revenue Growth

ServiceTitan grew 26% over the last twelve months

Quarterly YoY Revenue Growth Trends

LTM GAAP Gross Margin

ServiceTitan had 64% gross margins over the last 12 months

LTM GAAP Operating Margin

ServiceTitan had (25%) operating margins over the last 12 months

LTM FCF Margin

ServiceTitan had (2%) FCF margins over the last 12 months

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10). ServiceTitan discloses that their net retention is “>110%”

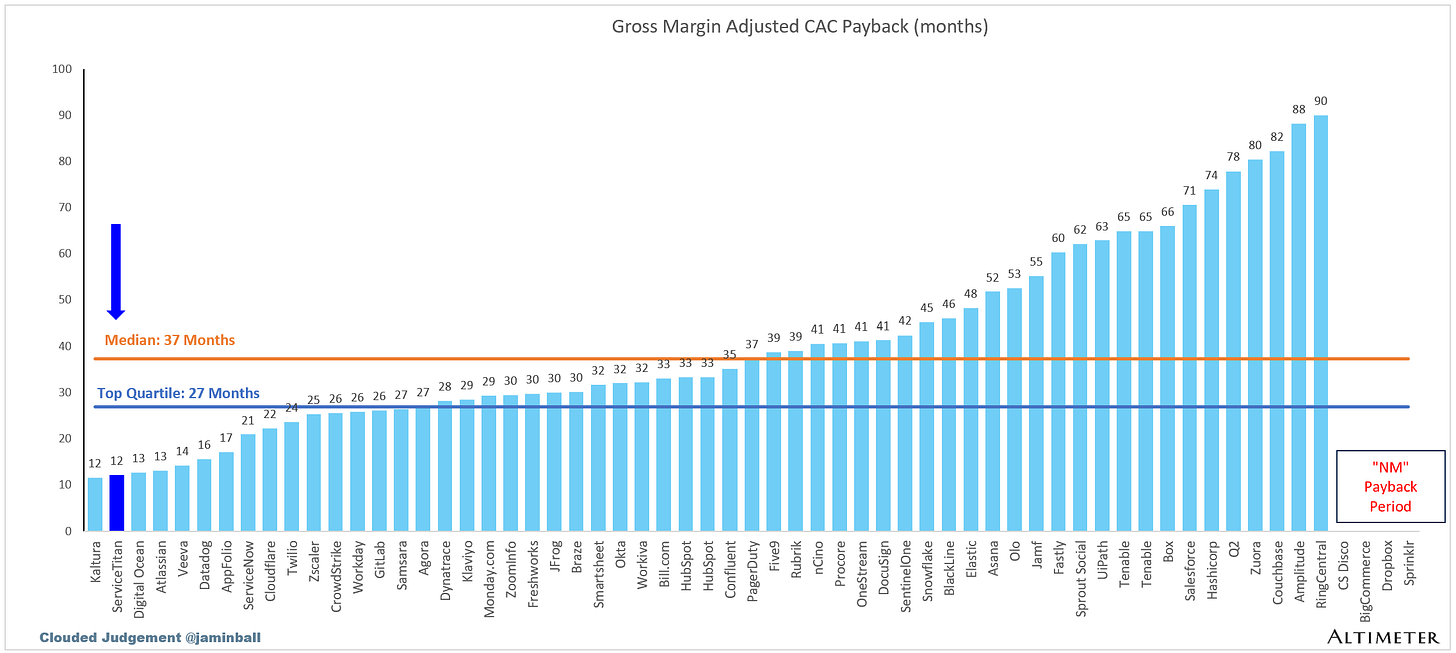

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them, and the data I’m showing is from the most recent quarter.

LTM S&M Expense as % of LTM Revenue

ServiceTitan spent 34% of revenue on S&M over the last 12 months

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.