Sumo Logic filed their initial S1 statement today and will trade under the ticker “SUMO”. A S1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial press release (this is where we get a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before the Robinhood Traders can go crazy buying the stock.

Sumo Logic Overview

From the S1 - “Sumo Logic is the pioneer of Continuous Intelligence, a new category of software, which enables organizations of all sizes to address the challenges and opportunities presented by digital transformation, modern applications, and cloud computing. Our Continuous Intelligence Platform enables organizations to automate the collection, ingestion, and analysis of application, infrastructure, security, and IoT data to derive actionable insights within seconds. Continuous intelligence leverages artificial intelligence and machine learning capabilities, and is provided as a multi-tenant cloud service that allows organizations to more rapidly deliver reliable applications and digital services, protect against modern security threats, and consistently optimize their business processes in real time. This empowers employees across all lines of business, development, IT, and security teams with the data and insights needed to address the technology and collaboration challenges required for modern business. With our Continuous Intelligence Platform, executives and employees have the intelligence they require to take prescriptive action in real time—a modern business imperative.”

“We believe that as companies of all sizes and across all industries increase the amount of business they conduct digitally, they will continue to invest in solutions that help address the intelligence gap. Our platform is employed across a broad range of use cases to address this gap. Based on data from International Data Corporation, or IDC, Sumo Logic estimates its total addressable market opportunity to be approximately $55.1 billion. We calculated this estimate by aggregating 2020 projected revenue by organizations in the following IDC software categories: advanced and predictive analytics software; AI software platforms; content analytics and search software; end-user query, reporting, and analysis software; software change and configuration management; security analytics, intelligence, response, and orchestration; and IT operations management (ITOM) software, across on-premise and cloud environments.4 We believe that our platform currently addresses a significant portion of this market, and we intend to further expand our offerings to capture more of this market in the future.”

How Sumo Logic Makes Money

From the S-1 “We generate revenue through the sale of subscriptions to customers that enable them to access our cloud-native platform. We recognize subscription revenue ratably over the term of the subscription, which is generally one year, but can be three years or longer. We offer multi-tiered paid subscription packages for access to our platform, the pricing for which differs based on a variety of factors, including volume of data to be ingested, duration of data retention, and breadth of access to platform features and functionalities.”

Sumo Logic currently has 329 customers with an ACV >$100k, and 27 customers with an ACV > $1M (data is as of April 30th, 2020. July quarter end data not available yet). They currently have 2,131 customers in total, with an overall ACV of $89k

Benchmark Data

The data shown below depicts how the Sumo Logic data compares against the operating metrics of current public SaaS businesses. I’ve highlighted Elastic and Splunk, who I think have very comparable products / markets. One big caveot - Sumo Logic has not shown July quarter end numbers in this filing, so all data is as of the April 30th.

Last Twelve Months (LTM) Revenue

LTM Revenue Growth

LTM GAAP Gross Margin

LTM GAAP Operating Margin

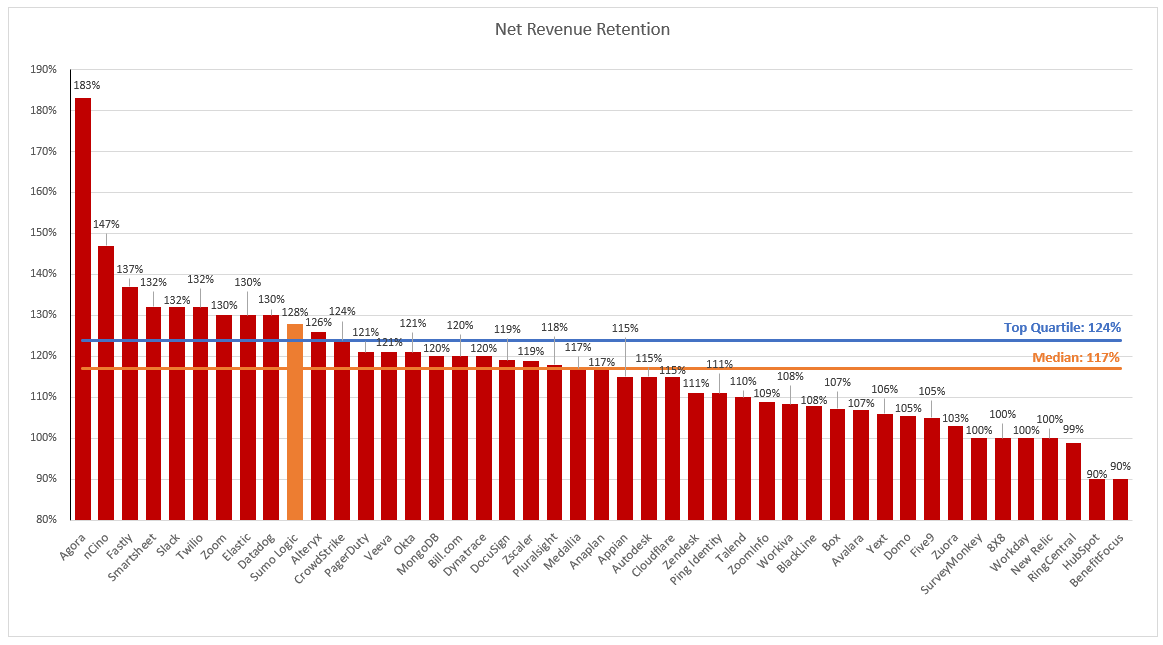

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10). I couldn’t find the exact metric in the Sumo Logic S-1, but they did mention their dollar-based net retention has fluctuated between 120% - 135% over the last 9 quarters, so I’m showing the midpoint.

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m taking the average of the 4 quarters leading up to IPO to remove any seasonality out outliers.

Valuation

Predicting the valuation of pending IPOs is nearly impossible, but it adds to the fun to make predictions! In the SaaS / Cloud world companies are valued off a multiple of their revenue (a select few are valued off of FCF). Generally this is a projected revenue number, and for the purpose of this analysis I will be looking at NTM (next twelve months) projections. When I think about what a company will be worth I first like to look at how other public companies are valued. First, let’s look at what SaaS multiples are trading at today, bucketed by growth:

Sumo Logic fits into that high growth bucket, but there are a number of very comparable businesses that trade below that which are a better comparison (Datadog being the exception). Datadog (38x), Dynatrace (17x), Elastic (16x), Splunk (13x) and New Relic (4x) all play in the broader “observability” category. The median here is 16x. In a perfect world, Sumo Logic should in theory trade below Elastic and above Splunk. As you can see from the charts in the sections above, Elastic is ~2.5x bigger and growing faster, with better unit economics (net retention and payback) and better operating margins. Sumo Logic (with attractive growth and a great market) has the second worst operating margin of all SaaS businesses I track! If I was ignoring all of the macro sentiment around SaaS valuations and IPOs today I’d say Sumo Logic should trade at 14-16x. However… SaaS IPOs have been known to pop recently and I don’t think that trend is stopping with Sumo Logic. So - my prediction is that once Sumo Logic starts trading it will end up with a multiple closer to 30x forward revenue, giving it a valuation of ~$7B! My other prediction - the IPO will price at a slight discount to Elastic, giving it a pricing valuation of ~$3.5B. Below you can see the implied Sumo Logic valuation at different multiples. For context: Sumo Logic did $170M in LTM rev, and grew 48%

My IPO Price Prediction:

My Day 1 Trading Prediction

If you could please add the total shares outstanding at IPO and the IPO price range, that would be awesome. That would enable readers to translate multiples to stock price. Thanks!