WalkMe - Benchmarking the S-1 Data

Yesterday WalkMe filed their initial S1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a ton of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

WalkMe Overview

From the S1 - “WalkMe is the defining solution enabling organizations to better realize the value of their software investments. Using our cloud-based Digital Adoption Platform, users—employees and customers of organizations—can navigate websites, SaaS applications, and mobile apps through a digital, GPS-like experience to accomplish any task from simple, online transactions, to complex cross-application software processes, to fully autonomous experiences that require no manual clicks or entries. Our Digital Adoption Platform overlays upon any application with a simple no-code implementation. Once overlaid, our platform provides immediate insights that enable a data-first approach to understand the gaps between user interactions and behavior with technology and an organization’s business goals. With actionable insights, we then enable organizations to create and deliver elegant experiences that enable users to access the full functionality and value of the software, ensuring digital adoption, and ultimately fulfilling the promise of digital transformation. With a digital adoption strategy powered by WalkMe, employees and customers of organizations can benefit from intuitive and unified technology experiences. Chief information officers (“CIO”) and business leaders gain visibility and insights across the organization’s enterprise technology stack. This allows organizations to become more results driven, agile and innovative, to better compete in today’s ever-changing business environment and to ultimately achieve their objectives.”

Product Overview

From the S-1: “WalkMe’s Digital Adoption platform:

Provides Insights to Help CIOs and Business Leaders Drive Business Outcomes Horizontally Across the Organization. CIOs and business leaders use our Insights capabilities and integration center technology to gain visibility into the enterprise technology stack, including software usage and user experiences across business processes. This analytics suite delivers tactical and strategic metrics that can be leveraged by CIOs and business leaders.

Delivers Immediate Value. Our technology provides CIOs and business leaders with immediate visibility into their software stacks and business processes, consolidates user actions on applications and provides detailed guidance on how to use them effectively.

Optimizes Software Usage and Technology Spend. Our Digital Adoption Platform enables enterprises to make greater use of software more efficiently. With our Digital Adoption Platform, organizations can create easy-to-use business process workflows that facilitate and encourage employees to realize the full benefit of software applications.

Increases Employee Productivity and Reduces Support Costs. By engaging employees across software applications, employees are able to more easily use the software applications that the enterprise has deployed. This leads to improved productivity, increased data accuracy, reduced support costs and increased employee engagement.

Improves Customer Engagement. By simplifying the end user experience, our Digital Adoption Platform has been shown to drive an increase of approximately 35% in customer retention, 10% growth upsell opportunities from existing customers over three years, and 50% savings in customer support call costs, according to a 2020 Forrester Consulting study, The Total Economic Impact™ of WalkMe Digital Adoption Platform, a study we commissioned.

Market Opportunity

From the S-1: “We estimate our total addressable market opportunity to be approximately $34 billion. We calculated this figure by estimating the total number of organizations globally by referencing independent industry data from the S&P Global Market Intelligence database. We segmented these organizations globally into three cohorts based on the number of employees: organizations that have between 500 and 5,000 employees globally, between 5,000 and 25,000 employees globally and over 25,000 employees globally. We then applied an average annual contract value to each cohort using internally generated data of actual customer spend for the respective cohort. The ARR applied to the estimated number of organizations in each cohort based on the number of global employees is calculated using our internal data for actual customer spend by size, based on global employee count. We calculated the median ARR of the top 100 customers of each cohort, multiplied the calculated ARR for each cohort by the number of organizations in each cohort and then aggregated these values across all cohorts to arrive at our estimated total addressable market opportunity in 2021.”

How WalkMe Makes Money

From the S-1: “We generate revenue by selling subscriptions to our cloud-based Digital Adoption Platform, as well as associated professional services. Our contracts are typically for a period of one to three years. We have seen a trend towards multi-year contracts as our customers deepen their investment in WalkMe as a strategic platform underlying their digital transformation strategies. We primarily bill our customers annually in advance. Subscription revenue comprised approximately 90% and 88% of our total revenue for 2019 and 2020, respectively, and approximately 87% and 90% of our total revenue for the three months ended March 31, 2020 and 2021. We price our subscriptions based on the number of applications on which WalkMe is deployed, the number of users, and the breadth of the capabilities of our Digital Adoption Platform to which our customers choose to subscribe. Our customers often expand their subscriptions as they grow the number of users that engage with our Digital Adoption Platform, the number of applications on which WalkMe is deployed and the breadth of the capabilities to which they subscribe.”

Benchmark Data

The data shown below depicts how the WalkMe data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

WalkMe’s LTM revenue was $157M, making it one of the smallest public cloud companies

LTM Revenue Growth

WalkMe’s LTM revenue growth was 34%

Quarterly YoY Revenue Growth Trends

Tracking the YoY revenue growth in the coming quarters will be important. To see this kind of deceleration at such a small scale isn’t a great sign

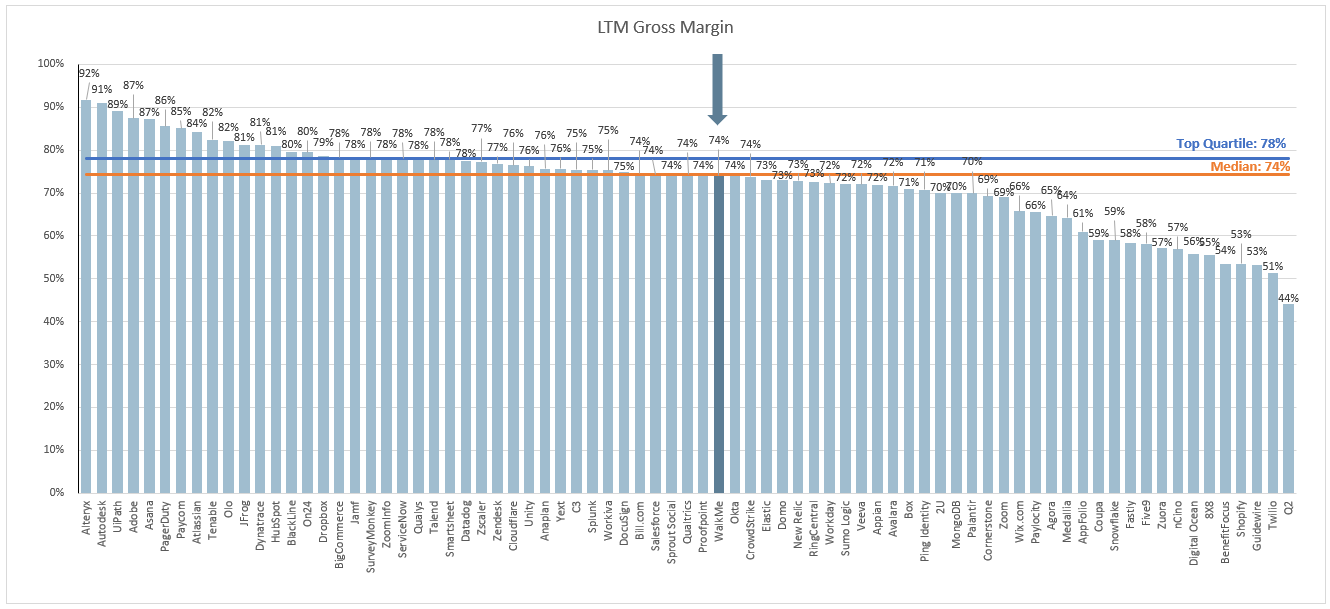

LTM GAAP Gross Margin

WalkMe’s LTM gross margin was 74%

LTM GAAP Operating Margin

WalkMe’s LTM operating margin was (29%)

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m taking the average of the 4 quarters leading up to IPO to normalize the business.

LTM S&M Expense as % of LTM Revenue

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thanks for these posts. They provide context and put some comparative numbers on the media hype of these upcoming IPO’s. they are very worthwhile reading. Much appreciated.