Q3 earnings season for cloud businesses is now behind us. The 61 companies that I’ll discuss here (which is not an exhaustive list, but is still comprehensive) all reported quarterly earnings sometime between October 26 - December 9. New additions to the analysis from Q2 include Snowflake, Asana, JFrog and Sumo Logic. In this post, I’ll take a data-driven approach in evaluating the overall group’s performance, and highlight individual standouts along the way. As a venture capitalist, I naturally cater my analysis through the lens of a private investor. Over my ~4.5 years at Redpoint Ventures, I’ve had the opportunity to meet with hundreds of entrepreneurs who are all building special companies. Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their businesses around SaaS metrics (e.g., net retention and CAC payback). Let’s dive in.

Digital Transformations Accelerating

Was Q3 finally the quarter we saw data to back up the claim that digital transformations accelerated? Over the last 9 months all we heard SaaS practitioners (myself included!) talk about was how the industry was seeing a rapid acceleration of digital transformations. Companies leaving their legacy on-prem (or paper based) solutions and workflows for more modern, digital, cloud-based solutions and workflows. And it made anecdotal sense – in remote environments legacy solutions break down. In many ways businesses must adapt digital technologies to survive. However, despite all the surveys of CIOs and exec’s touting digital transformations as their top priority, we never really saw revenue growth accelerate for SaaS businesses. One explanation – revenue growth is actually a lagging indicator for SaaS given the way contracts are structured – monthly recurring by nature. When booking a 1 year deal (especially when that deal is booked towards the end of the quarter), the revenue impact is minimal given only a small percentage of that annual deal is recognized as revenue for the quarter. A far better metric would be ARR growth, but most public companies don’t report this metric. I believe this phenomenon played out to an extent, but the far bigger reason we hadn’t yet seen digital transformations accelerate revenue growth of SaaS businesses was caused by something else. I call it the “Covid Timeline.”

In phase 1 of the Covid Timeline just about every business across the board bunkered down and looked to cut costs wherever they could. In this phase just about all procurement was put on hold. Only the absolutely necessary SaaS businesses benefited (think remote productivity tools like Zoom or digital storefronts like Shopify). In phase 2 as the macro environment started to settle a bit, and some of the future uncertainty was removed from the equation, companies started to pick their heads up and think critically about what the “future of work” looked like for them. Covid opened their eyes to the benefits of cloud solutions. They knew they needed to digitally transform, and now started the exploratory phase / project mapping of how to do this. Buying cycles started to reopen, but it took time for deals to close. In this phase, some of the companies to benefit were lower ACV / transactional sales type products and some consumption based products (think Twilio). Then comes Phase 3. In Phase 3, cloud procurement was in full swing, and we had enough time to get through complete sales cycles and deals that were explored in phase 2 closed in phase 3. When I think about how 2020 has played out so far, in Q1 and Q2 we were in Phase 1 and Phase 2. However, in Q3 I think we turned the corner and hit Phase 3. We now have data to support digital transformations that I’ll get into next.

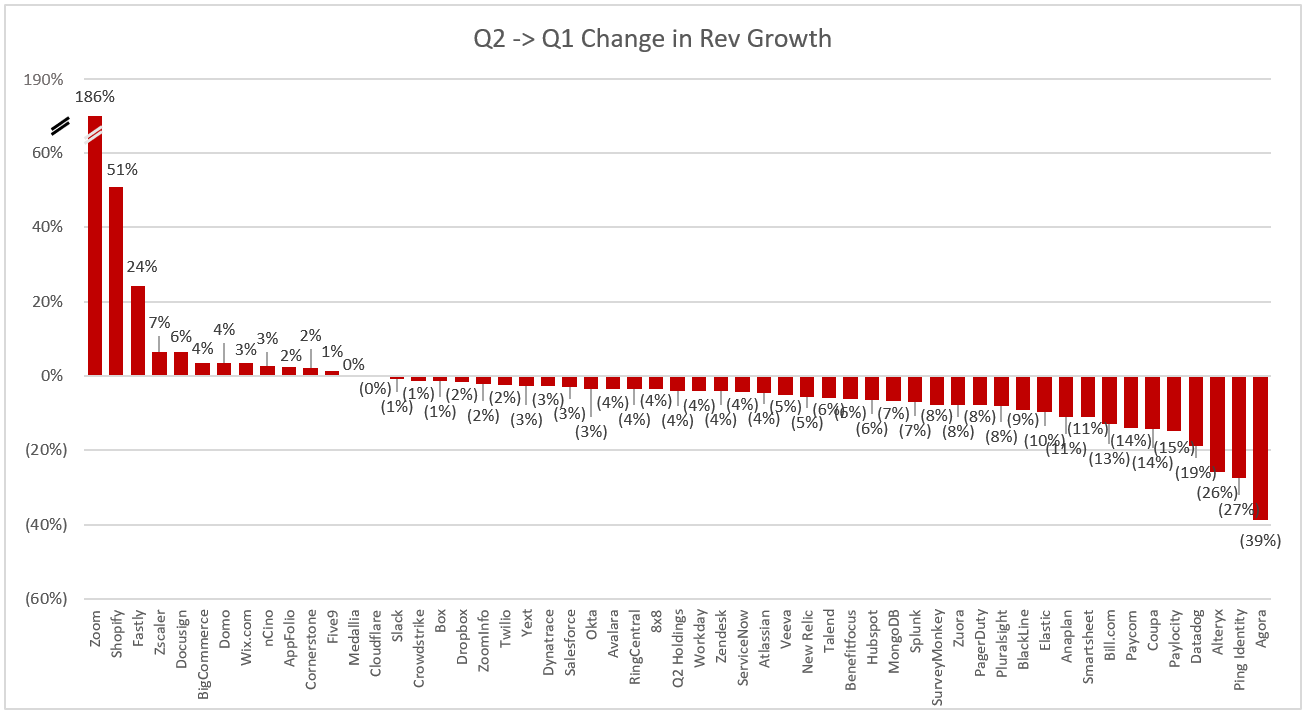

If we look at the difference between YoY growth rates in Q3 vs Q2 for cloud businesses we’ll see that number of them accelerated. I define accelerated as any business that grew faster in Q3 than it did in Q2. We can easily visualize this with the graph below that shows the difference between Q3 YoY growth and Q2 YoY growth (what is graphed is Q3 – Q2).

As you can see, 26 companies accelerated rev growth. This is in start contrast to Q2, where only 7 businesses accelerated (but really only 2 accelerated in a meaningful way). The chart below shows who accelerated in Q2 (this is Q2 YoY growth – Q1 YoY growth)

You can clearly see the difference between the Q3 acceleration graph, and the Q2 acceleration graph. The big question to ask is why? One answer fits my narrative very soundly. Covid opened peoples eyes to the inevitability and necessity of digital transformation acceleration, but buying and procurement were pushed out as businesses waited to see if the world completely fell apart or returned to some semblance of “normal.” Then in Q3 when there was more confidence around macro economics, buying started again. However, there is another explanation people should ponder. What if there wasn’t any acceleration, but what we simply saw was a redistribution of deals closing from Q2 to Q3. An example – let’s say in a normal world a business books $4M in Q2 and $6M in Q3 (so $10M across the two quarters). A completely possible Covid situation could play out where buyers were simply more cautious in Q2 (what I laid out above) and only bought $3M in Q2, and pushed out the remainder of buying decisions to Q3. Maybe then $7M closes in Q3 as a disproportionate number of Q2 deals moved into Q3. In this instance it would appear as if growth accelerated, but it was really just a redistribution of the same deals closing in Q3 vs Q2. We only have one quarter of acceleration so we don’t really know! I will be eagerly awaiting the results for Q4. If we see another strong quarter of growth accelerating I think we can confidently say digital transformations are in fact pulling revenue growth forward. Also – any businesses that can stack multiple quarters of acceleration will be in a great spot. January / February next year should be fun!

Another commentary on the growth acceleration chart. It doesn’t do a good job showing the relative acceleration of each business. For example, a company accelerating to 25% growth from 20% is far different than one accelerating to 55% from 50%. The below scatter plot shows the absolute acceleration (Q3 growth – Q2 growth) on the Y axis, and Q3 YoY growth on the X axis (for a sense of scale). I’ve drawn a diagonal line to highlight which businesses I found most impressive (those above the line)

Update on Public SaaS Valuations

Before getting into the Q3 data, it’s important to frame the conversation around valuations. Just about all cloud companies are valued off a multiple of their revenue. That is, their Enterprise Value / NTM (Next Twelve Months) Revenue. We use forward revenue estimates as a company’s future outlook determines its worth. As you’ll see from some of the charts below, revenue multiples across the board are sitting at all time highs. The chart below shows the median, as well as 3 month and 1 year rolling average for the entire cloud universe.

Double-clicking one layer further, we can separate the median multiples into different growth buckets. In the below chart I define High Growth as >30% projected NTM growth, Mid Growth as 15%-30% and Low Growth as anything <15%.

So what’s driving this significant multiple expansion? I think there are 3 main factors.

1. Digital Transformation Expectations. There is an expectation that digital transformations will accelerate, pulling forward growth (meaning SaaS businesses will grow faster in the short term, and potentially maintain that growth mid to long term). While I think this has played out, I think the effect on multiples is actually nominal. I think people want to hear a narrative of “SaaS is now a more attractive sector as digital transformations are accelerating and multiples have reset higher!” Again, this sentiment alone couldn’t by itself drive multiples up to where they are. The two key factors for multiple expansion are a bit more boring:

2. The Money Supply. The money flowing into equities (and certain sectors within equities) has exploded. Interest rates are near zero meaning the attractiveness of equities vs bonds has skyrocketed. There’s simply very little yield in anything other than equities! So money has flown out of bonds, and into equities. Simultaneously the government is printing stimulus money, and that has to go somewhere (and I just mentioned why equities are the most attractive option!)

3. Relative attractiveness of SaaS / Cloud businesses. There is a lot more money flowing into equities, but is this new money spread out proportionally across sectors? No. A disproportionate amount of this money is going into Cloud stocks. Why? It’s the most attractive (and safe) market! There clearly hasn’t been a negative business impact from Covid, and as we’ve discussed above there is reason to believe the sector has actually positively benefited from Covid. Not only has money flown out of bonds, but it has also flown out of “closed economy” sectors like travel, retail, casinos, etc. My conjecture is a lot of this money has been parked in cloud stocks. So not only has the money supply increased flowing predominantly into Cloud stocks, but existing capital has been reallocated to cloud stocks.

Are these Valuation Levels Sustainable?

That depends on your time horizon. Many people won’t want to hear this, but the emphatic answer to the question of “are these valuations sustainable” is an emphatic NO. Now, it’s important to separate revenue multiple from stock price when we talk about valuations. Here I am saying these multiples are not sustainable. Stock price is a separate topic I’ll get into later. In my opinion, it is INEVITABLE that multiples will compress. For 20 years median SaaS multiples never could sustain levels >10x forward revenue. Whenever they popped above this, they quickly came back down. Right now we’re at a ~18x median forward revenue multiple. I don’t think the industry has changed enough to justify a 2x jump in multiples. What has changed? As we discussed above, it is predominantly fiscal policy (interest rates) and Covid (which a vaccine is now available for).

So what will happen to multiples (and stock prices) in the short and medium term? That depends on what you think will happen with fiscal policy and the timeline for the vaccine rollout (ie for the economy to “reopen”). I do think cloud multiples have re-rated to a higher baseline / median. However, I don’t think this re-rating is significant. Maybe 15% higher. I do fundamentally believe the outlook for the best businesses has changed (positively) as growth is pulled forward with digital transformations. In my opinion, the largest factor driving multiple expansion in cloud stocks has been near zero interest rates. High growth cloud stocks are an attractive investment in this environment. The Fed has given us guidance that rates will stay near zero for quite some time, so in many ways I don’t think we’ll see any significant reversion to mean multiples for at least a few years. The final factor effecting multiples is the re-opening of the economy. When the economy re-opens my guess is we’ll see multiples compress some. How much is hard to say. This won’t happen because business fundamentals or outlook have changed. It’ll happen because money will rotate back into the “economy reopening” stocks, and it has to come from somewhere. As discussed above, cloud stocks have been one of the biggest beneficiaries of money leaving industries like retail, airlines, etc, so they may also be the biggest looser when the world normalizes and money rotates back into these forgotten sectors.

To summarize – in the short term as the economy reopens I think we’ll see downward pressure to cloud multiples. In the long run when rates rise I think we’ll see multiples fall back to where they were pre-pandemic, maybe slightly higher. Now the big question remains - what does this imply about stock prices? I believe that there will be a select group of businesses that will grow fast enough to weather the multiple compression and still provide good long term returns. These businesses are the ones I’ve called the “secular growth stars.” Companies that I think can sustain high growth rates at scale for many years to come given their market position today. The easiest way to visualize this concept of growing into a multiple (ie providing returns while multiple compresses) is with an example. The below chart shows Shopify’s stock price and NTM revenue multiple.

As you can see, Shopify’s forward revenue multiple peaked at 51x in early July. Since then their multiple has come down 27% while their stock price has grown by 13%. How is this possible? Their revenue growth has grown much faster than their multiple has compressed. Obviously Shopify is an extreme example – they’ve significantly benefited from Covid more than any cloud business other than Zoom. But I believe that there will be plenty of SaaS businesses who will grow fast enough over the next 5 years to provide steady returns on aggregate over that time period. Let’s look at another one of my favorite Cloud businesses: Datadog. Pre-pandemic they were trading in the 20-25x NTM revenue range. Currently they are trading at 43x NTM revenue, have an enterprise value of ~$32B, and are growing 75% (LTM annually) off of $540M in LTM rev. Let’s assume they grow over the next 5 years at a 35% CAGR. This seems high for such a long period of time, but remember since they’re growing ~75% currently, to average 35% a year for the next 5 years they can grow significantly less than 35% in the outer years and still have a CAGR of 35%. A 35% CAGR over 5 years implies that their NTM revenue estimate at the end of 2025 would be ~$3.3B. Let’s assume their multiple compresses back to pre-pandemic levels of 20x. This would imply an enterprise value in 5 years of ~$65B, or roughly double what it is today. This results in roughly a 15% annual return. As you can see – the biggest assumption here is that they can average 35% growth over the next 5 years. Seems high? Their net retention is >130%. This means they will grow 30% per year alone ONLY off the growth of existing customers. In other words, with their net retention where it is today, they don’t have to add a single customer to grow >30% annually. The other assumption is the exit multiple which can clearly fluctuate. My broader (more subtle) point is that I think for businesses like Datadog, a 35% CAGR over 5 years is conservative. My astute readers will recognize one other key variable that I didn’t mention when it comes to share price returns: share creep. Many of these businesses issue quite a bit of new shares every year in the form of stock based compensation. This increases the number of shares in circulation which will dampen returns. I will go into an analysis of this in a post down the road.

Finally – I want to point out that it’s really hard to predict what will happen to multiples in the short term. In the analysis above I dropped Datadog’s multiple from 43x to 20x. Over 5 years they can weather that storm and provide shareholder returns. But what happens if that multiple compression happens in a 1 year time horizon? Investors could be looking at some real losses. This is where I like to take a step back and remind everyone of my personal trading philosophy. Any company I invest in I want to hold for 5+ years. Set it and forget it. I believe that the best SaaS businesses will be able to sustain growth rates far greater than what people currently expect, which over the long run (5+ years) will provide shareholders with great returns. What the returns will look like in the short term is a big question mark. Now I’m sure you all are asking “how do I find the best in class SaaS businesses?” In the analysis in the rest of this article I’ll dissect the Q3 results for every SaaS business to hopefully arm you with the data you need to answer that question.

Q3 Big Winners

If you don’t have time to read the rest of this article, here are the companies who I believe really stood out (from a financial perspective). They represent my “Q3 Big Winners.” The 3 companies in the box are the elite performers.

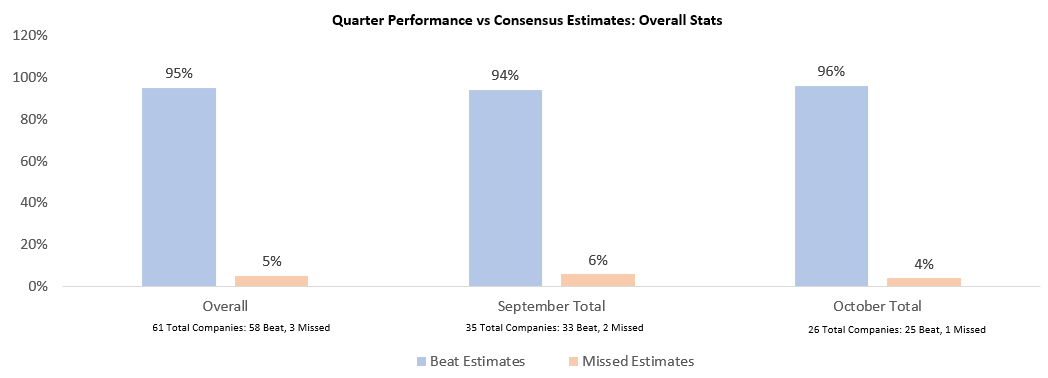

Q3 Revenue Relative to Consensus Estimates

Now let’s dive in to the financial results of Q3 starting with revenue. Beating consensus revenue estimates is the first aspect of a successful quarter. So what are these consensus estimates and who creates them? Every public company has a number of equity research analysts covering them who build their own forecasted models, which combine guidance from the company and their own research / sentiment analysis. The consensus estimates are the average of all the individual analysts’ projections. Generally when you hear “consensus estimates” it refers to revenue and earnings (EPS), but for the purpose of this analysis we’ll just be looking at revenue consensus estimates (as this is the metric these companies are valued off). For every public company the expectation is that they’ll beat consensus estimates, because companies often guide research analysts to the lower end of their internal projections. They do this to set themselves up to consistently beat estimates, demonstrating momentum. Cisco, for example, famously beat earnings expectations for 43 straight quarters in the 1990s.

It’s also important to note that when a company is providing guidance for the “next quarter,” it is (in some cases) already halfway through that quarter due to the timing of earnings calls. By then, the company generally has a good sense for how the quarter is going and can guide ever so slightly under their internal projections. As the data shows below, the median “beat” of quarterly consensus estimates was 4.16% in Q3 (it was 4.1% in Q2).

As you can see from the data below the vast majority of cloud businesses beat the consensus estimates for Q3.

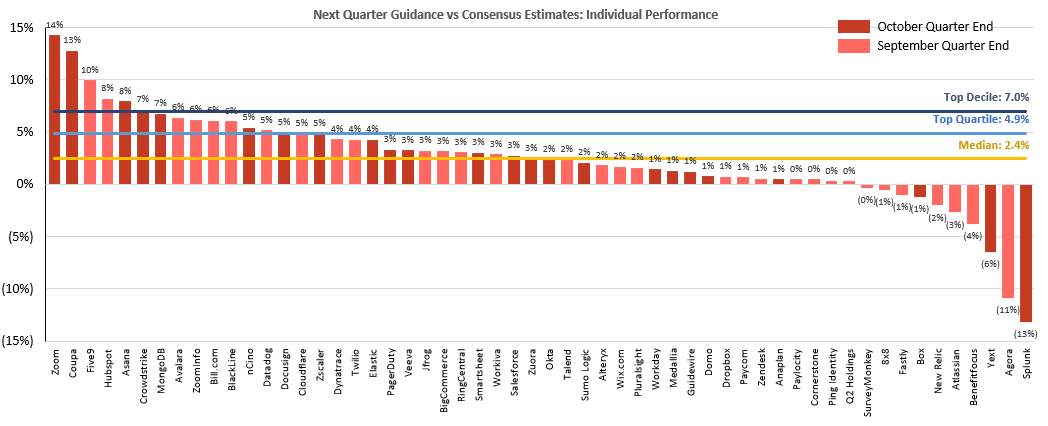

Next Quarter’s Guidance Relative to Consensus Estimates

Guiding above next quarter’s consensus revenue estimates is the second factor for a successful quarter. Generally, companies will give a guidance range (e.g., $95M -$100M), and the numbers I’m showing are the midpoint. Providing guidance that is greater than consensus estimates is a sign of improving business momentum, or confidence that the business will perform better than previously expected. The concept of guiding higher than expectations is considered a “raise.” When you hear the term “beat and raise” the beat refers to beating current quarter’s expectations (what we discussed in the previous section), and the raise is raising guidance for future quarters (generally it’s annual guidance, but for this analysis we’re just looking at the next quarter’s guidance).

As you can see from the data below, there was no real difference between companies with September / October quarter ends (implying the overall sentiment stayed the same).

Growth

Demonstrating high growth is the third aspect of a successful quarter. This metric is more self-explanatory, so I won’t go into detail. The growth shown below is a year-over-year growth for reported quarters. The formula to calculate this is: (Q3 ’20 revenue) / (Q3 ’19 revenue) - 1.

As you can see from the data above, the median growth rate was 30%, a top quartile growth rate was anything >42%, and a top decile growth rate was anything >56%. It’s interesting to compare this to Q1, Q2 and Q3 (which you can see in the chart below).

FCF Margin

FCF is an important metric to evaluate in SaaS businesses. Profitability is often the big knock against them, however many generate more cash than you might imagine. I’m calculating FCF by taking the Operating Cash Flow and subtracting CapEx and Capitalized Software Costs. The big caveat in FCF – it adds back the non-cash expense of SBC. This is controversial, and something I’ll get into in a later post.

As you can see, the median FCF margin was POSITIVE 8%! Top decile companies delivered 25% FCF margins. Zoom had an absolutely unreal quarter with a 50% FCF margin.

Net Revenue Retention

High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn). In simpler terms — if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. The reason I love this metric is because it really demonstrates how much customers love your product. A high net revenue retention implies that your customers are expanding the usage of your product (adding more seats / users / volume - upsells) or buying other products that you offer (cross-sells), at a higher rate than they are reducing spend (churn).

Here’s why this metric is so significant: It shows how fast you can grow your business annually without adding any new customers. As a public company with significant scale, it’s hard to grow quickly if you have to rely solely on new customers for that growth. At $200M+ ARR, the amount of new-logo ARR you need to add to grow 30%+ is significant. On the other hand, if your net revenue retention is 120%, you only need to grow new logo revenue 10% to be a “high growth” business.

I’ve looked at thousands of private companies, and over time have come up with benchmarks for best-in-class, good, and subpar net revenue retention. Not surprisingly, these benchmarks match up relatively well with the numbers public companies reported. I generally classify anything >130% as best in class, 115% — 130% as good, and anything less than 115% as subpar. For businesses selling predominantly to SMB customers, these benchmarks are all slightly lower given the higher-churn nature of SMBs. I consider >120% best in class for companies selling to SMBs (like Bill.com). Here’s the data from Q3 earnings:

As you can see from the data above, the median net revenue retention rate was 116%, a top quartile net revenue retention rate was anything >123%, and a top decile net revenue retention rate was anything >131%. These benchmarks are actually slightly higher than Q2. The one point to note: Not all companies report this number. It’s likely fair to assume that the majority of companies who don’t report this metric probably fall into the subpar category. Because of this, the median, top quartile, and top decile numbers mentioned above probably are better than reality.

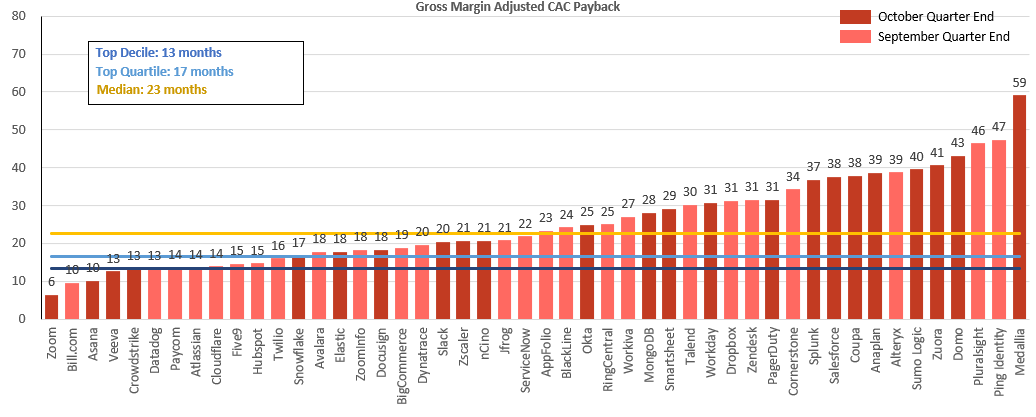

Sales Efficiency: Gross Margin Adjusted CAC Payback

Demonstrating the ability to efficiently acquire customers is the fifth aspect of a successful quarter. The metric used to measure this is my second-favorite SaaS metric (behind net revenue retention) : Gross Margin Adjusted CAC Payback. It’s a mouthful, but this metric is so important because it demonstrates how sustainable a company’s growth is. In theory, any growth rate is possible with an unlimited budget to hire AEs. However, if these AEs aren’t hitting quota and the OTE (base + commission) you’re paying them doesn’t justify the revenue they bring in, your business will burn through money. This is unsustainable. Because of the recurring nature of SaaS revenue, you can afford to have paybacks longer than 1 year. In fact, this is quite normal.

All that said, Gross Margin Adjusted CAC Payback is relatively simple to calculate. You divide the previous quarter’s S&M expense (fully burdened CAC) by the net new ARR added in the current quarter (new logo ARR + Expansion - Churn - Contraction) multiplied by the gross margin. You then multiply this by 12 to get the number of months it takes to pay back CAC.

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12

A simpler way to calculate net new ARR is by taking the current quarter’s ARR and subtracting the ending ARR from one quarter prior. Similar to net revenue retention, I’ve built up benchmarks to evaluate private companies’ performance. I generally classify any payback <12 months as best in class, 12–24 months as good, and anything >24 months as subpar. The public company data for payback doesn’t match up as nicely with my benchmarks for net revenue retention. The primary reason for this is that public companies can afford to have longer paybacks. At $200M+ ARR, businesses have built up a substantial base of recurring revenue streams that have already paid back their initial CAC. Their ongoing revenue can “fund” new logo acquisition and allow the business to operate profitably at paybacks much larger than what private companies (with smaller ARR bases) can afford.

Most public companies don’t disclose ARR (and when they do, it’s often not the same definition of ARR as we use for private companies). Because of this we have to use an implied ARR metric. To calculate implied ARR I take the subscription revenue in a quarter and multiply it by 4. So for public companies the formula to calculate gross margin adjusted payback is:

[(Previous Q S&M) / ((Current Q Subscription Rev x 4) -(Previous Q Subscription Rev x 4)) x Gross Margin] x 12

Here’s the payback data from Q3. Not every company reports subscription revenue, so they’ve been left out of the analysis.

As you can see from the data above, the median gross margin adjusted payback was 27 months, a top quartile gross margin adjusted payback was anything <17 months, and a top decile gross margin adjusted payback was anything <13 months. These benchmarks are also very in-line with Q2.

Change in 2021 Consensus Revenue Estimates

Tying all of these metrics together is another one of my favorites: the change in revenue consensus estimates for the 2021 calendar year. Heading into Q3 earnings, analysts had expectations for how each business would perform in 2021. After earnings, that perception either changed positively or negatively. It’s important to look at the magnitude of that change to see which companies appear to be on better paths. Analysts take in quite a bit of information into their future predictions — exec commentary on earnings calls, current quarter results, macro tailwinds / headwinds, etc., and how they adjust their 2021 estimates says a lot about whether the outlook for any given business improved or declined. If I had to blindly invest in a basket of stocks and only had one graph in this article to look at (with no other outside information), it would probably be this graph. Here’s the data:

As you can see, the outlook (according to analysts) for a number of these businesses really improved after this quarter. I believe what we’re seeing play out is analysts factoring in the “Covid timeline” I discussed earlier. Buying cycles are getting back to normal which means growth is picking up! The chart below shows how estimates for 2021 changed after Q2 earnings (not this quarter, but one prior). As you can see, there weren’t nearly as many positive changes to 2021 estimates then.

Change in Share Price

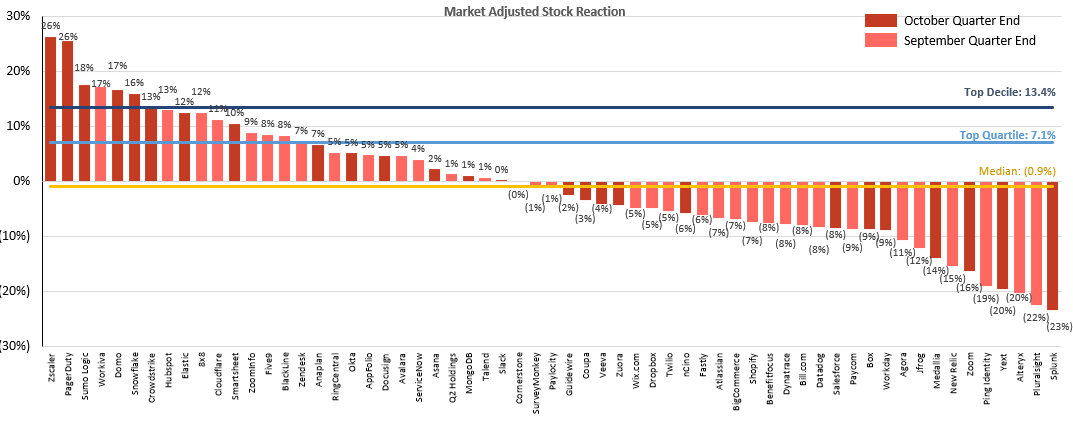

At the end of the day what investors care about is what happened to the stock after earnings were reported. The stock reaction alone doesn’t represent the strength of a company’s quarter, so the below data has to be viewed in tandem with everything discussed above. Oftentimes the buy-side expects a company to perform well (or poorly), and the company’s stock going into earnings already has these expectations baked in. In these situations the stock’s earnings reaction could be flat. However, it’s still a fun data point to track.

What I’ve shown below is the market-adjusted stock price reaction. This means I’ve removed any impact of broader market shifts to isolate the company’s earnings impact on the stock. As an example, a day after Workiva reported earnings their stock was up 20%. However the market (using the Nasdaq as a proxy) was up 3% that same day. This implies that even without earnings Workiva would likely have been up 3%. To calculate the specific impact of earnings on the stock we need to strip out the broader market’s movement. To do this we simply subtract the market’s movement from the stock’s movement: (% Change in Stock) - (% Change in Nasdaq)

However, some of this data can be quite misleading. Many of the companies saw a run-up in their stock prices leading up to earnings. When results didn’t blow past expectations, the stock fell back to where it was just a few days prior (which in some cases, this was a big drop!). For this quarter, it’s better to look at how the stock compared to 2 weeks prior to earnings. The data is below:

You can see this data paints a very different picture. The median SaaS business stock price was 2% higher than it was 2 weeks prior to earnings! This is quite different from the median single-day post-earnings change of -1%.

Wrapping Up

This quarter has been a wild ride for SaaS businesses. As a group they’ve performed quite well during these volatile times in the broader market, and in that sense the future looks bright.

Here’s a summary of the key stats for each category we talked about, and how the “Big Winners” performed. Zoom, Crowdstrike and Shopify are my Elite Performers of Q3! . Hopefully this provides a blueprint for every entrepreneur out there reading this post.

The Data

The data for this post was sourced from public company filings, Wall Street Research and Pitchbook. If you’d like to explore the raw data I’ve included it below. Looking forward to providing more earnings summaries for future quarters! If you have any feedback on this post, or would like me to add additional companies / analysis to future earnings summaries, please let me know!

I love your point about the quarterly lag for enterprise Saas buying cycles amidst Covid. Would take it a step further, and say that many companies have identified budget and need for digital transformation in 2021 coming out of this. Would expect 2021 to be a massive year as deals that started in 2020 come in, and companies spending Q1 laser focused on digital transformation start to purchase in the summer and fall

great Point of view Jamin. and very heartening to know i am vested in all three elite performers you pointed out Shopify, Zoom and CRWD. all three target the very basic needs and they get amplified with digitization. I would think- in terms of larger purpose - Shopify is above and beyond . thanks