Q2 earnings season for cloud businesses is now behind us. The 57 companies that I’ll discuss here (which is not an exhaustive list, but is still comprehensive) all reported quarterly earnings sometime between July 29 - September 9. New additions to the analysis from Q1 include Agora, nCino, ZoomInfo and BigCommerce. Looking ahead to the Q3 earnings recap we’ll have a few more new names to add who IPO’d recently. In this post, I’ll take a data-driven approach in evaluating the overall group’s performance, and highlight individual standouts along the way. As a venture capitalist at Redpoint Ventures, I naturally cater my analysis through the lens of a private investor. Over my time at Redpoint, I’ve had the opportunity to meet with hundreds of entrepreneurs who are all building special companies. Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their businesses around SaaS metrics (e.g., net retention and CAC payback). Let’s dive in.

Digital Transformations — Did They Happen?

First things first: Over the last six months, the acceleration of digital transformation has been the talk of the SaaS world in the time of Covid. Just about every SaaS exec was touting the fact that in our “new normal,” businesses would be forced to abandon legacy on-prem solutions for cloud-based software. The idea is that cloud software is inherently more collaborative and easier to run in a remote environment (and sometimes necessary!), and therefore everyone should be buying more cloud software! Indeed, this phenomenon was one of the reasons we saw a huge boost to SaaS stocks in the months leading up to Q2 earnings — everyone expected huge quarters from SaaS businesses due to accelerating digital transformations. There was some anecdotal data to support this. Looking at a CIO survey from Credit Suisse, it’s clear companies are planning on increasing their SaaS spend, and we can likely attribute this change to Covid (looking at the comparison between January plans and July plans)

However, when we look at the actual revenue numbers reported for Q2 we see a different story. To find “proof” of digital transformations accelerating, I would have liked to see revenue growth accelerating. If businesses across the world were in fact spending more on cloud software, wouldn’t it make sense for revenue growth to accelerate?

Here’s the data. The graph below shows the absolute change in YoY revenue growth between Q2 and Q1 (normalized for acquisitions / inorganic rev growth as much as I could). As an example, Fastly grew 62% in Q2 (Q2 ’20 / Q2 ’19), and 38% in Q1 (Q1 ’20 / Q1 ’19). The number shown below is the difference between the two (62% - 38%)

As you can see, the vast majority of SaaS businesses actually decelerated!

Now, for certain businesses, growing >40% YoY in Q1 and maintaining that growth rate should be considered a win. After all, in a normal setting (absent Covid) they would probably see deceleration from those levels anyway. So maintaining >40% is a sign they benefited from Covid. The companies I’m placing in this maintenance / “win” bucket include Cloudflare (48% to 48%), Slack (50% to 49%), Crowdstrike (85% to 84%), ZoomInfo (42% to 40%), Twilio (48% to 46%), and Okta (46% to 43%). These all decelerated slightly, but maintaining those growth levels is impressive.

But looking at the data, I only see three clear Covid beneficiaries: Zoom, Shopify and Fastly. So what happened? How could we see such a small number of true Covid beneficiaries, when everyone (myself included!) seemed to be talking about digital transformations accelerating? After reading through a number of earnings call (outside of Zoom, Shopify and Fastly) transcripts I think there are two primary explanations:

1. Buyers tightened up spend. Across the board businesses looked to control costs and “hunker down” while they assessed the short-term implications of Covid. No one really knew how long this pandemic would last or what its effects would be, so the prudent move was to reduce spend to only the absolutely critical needs. This dynamic was felt particularly strongly in larger enterprises.

On Datadog’s earnings call, for example, CEO Olivier Pomel stated, “Customers with large cloud deals from AWS, Azure or GCP look for short-term savings. Note that this is not a new motion as we see many enterprises go through these optimization exercises on a regular basis. What was unusual this quarter was to see a large number of companies going through it at the same time.”

On Slack’s earnings call, CEO Stewart Butterfield said, “On the enterprise side, there was also more budget scrutiny, especially from new categories, with longer adoption curves. Even when leaders understand the deep impact that Slack can have for them, the urgency, at the moment, favors short-term solutions to solve immediate problems. CIOs have a lot on their plates right now.”

My takeaway? Companies are definitely planning to accelerate their digital transformations, but this quarter was more about survival mode and waiting to formulate a long-term plan.

2. Pushed Pipeline. A significant number of deals that were planned to close in Q2 were pushed to Q3. This is related to the first point. Buyers put vendors through longer procurement cycles and ultimately ended up pushing buying decisions out. The good news is these deals were not canceled (for the most part). They were simply pushed out to a later date. The below graph from Credit Suisse really lays this out nicely.

Net-net, Q2 was about survival. My take is that by Q3 we’ll start to see normal buying behavior pick back up, and the true set of Covid beneficiaries will emerge.

Update on Public SaaS Valuations

Before getting into the Q1 data, it’s important to frame the conversation around valuations. Just about all cloud companies are valued off of a multiple of their revenue. That is, their Enterprise Value / NTM (Next Twelve Months) Revenue. We use forward revenue estimates as a company’s future outlook determines its worth. As you’ll see from some of the charts below, revenue multiples across the board are still quite elevated (even though we’re slightly off all-time highs).

What’s driving this? One factor is that the Fed is basically telling us to buy stocks, and sell the U.S. dollar :) And you should never fight the Fed! Just the other day, Chairman Jerome Powell basically confirmed that interest rates would stay at near zero percent through 2023. Without going into too much detail on this, the Fed will cut the federal funds rate during times of economic difficulty to stimulate financial activity. This also has the effect of making equities more attractive. In very oversimplified terms, any individual or firm has three places to park their money: in cash, in bonds, or equity. When rates fall, bonds with interest payments become a lot less attractive. Why invest in bonds with nominal coupon rates (say, 2%) if you think you can get a better annual yield in equities? Any rational investor will look to invest their money where they think they’ll achieve the highest yield, and it’s hard for anyone to assume their best yield will come from anything other than equities in near-zero interest rate environments.

So once capital flows leave bonds and enter equities, the question remains where to invest? Currently, it seems there’s no safer place than SaaS. Recurring revenue streams, attractive unit economics, and cloud penetration accelerating through digital transformations have made SaaS a safe haven. The massive inflow of investor capital into SaaS markets have effectively lifted multiples across the board. And the sentiment doesn’t seem to be changing any time soon as investors across the board are realizing just how early we are in the journey to the cloud. (Another recently unearthed explanation for the rise in SaaS multiples? The Softbank Whale! I’m not sure how much I buy into this theory so we’ll save that conversation for another time :) )

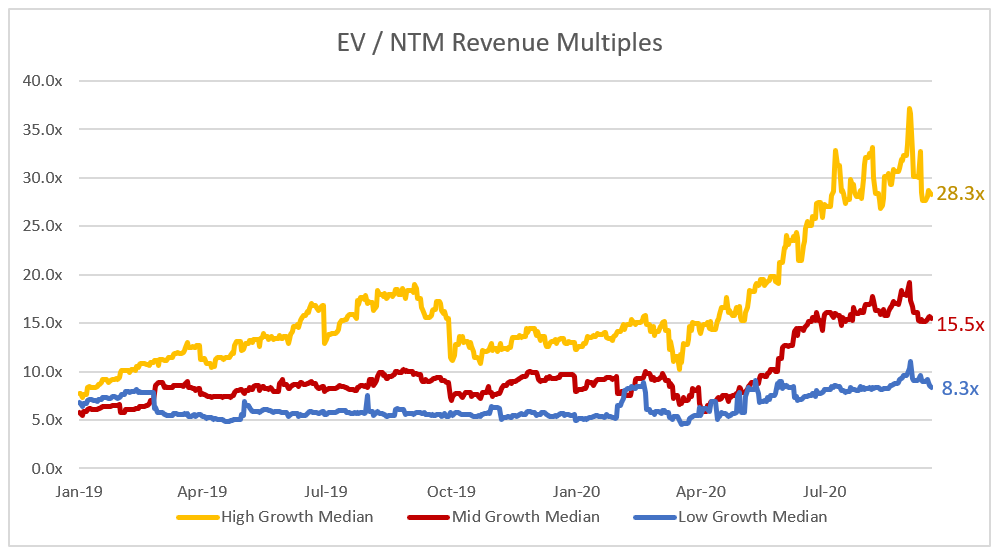

Now, onto the multiples. As you can see in the below chart we’re near all-time highs, with a slight pullback over the last few weeks.

Double-clicking one layer further, we can separate the median multiples into different growth buckets. In the below chart I define High Growth as >30% projected NTM growth, Mid Growth as 15%-30% and Low Growth as anything <15%. In this chart you can see the recent pullback more clearly. I hope it’s also clear that despite this pullback, valuations are still very high.

Q2 Big Winners

After Q1, I called out the businesses that really stood out, so I thought it would be fun to do the same coming out of Q2. The companies below are my “Big Winners” for Q2.

Interestingly, Zoom, Shopify, Fastly, Crowdstrike, Twilio and Zscaler were also Big Winners in Q1. The companies excluded from the Q2 list that were on the Q1 list include Datadog and Bill.com. The two new entrants are nCino and Agora (both Q2 IPOs). In the below sections I’ll go over the results from Q2 earnings across the SaaS universe looking at what I believe to be the key metrics.

Q2 Revenue Relative to Consensus Estimates

Beating consensus revenue estimates is the first aspect of a successful quarter. So what are these consensus estimates and who creates them? Every public company has a number of equity research analysts covering them who build their own forecasted models, which combine guidance from the company and their own research / sentiment analysis. The consensus estimates are the average of all the individual analysts’ projections. Generally when you hear “consensus estimates” it refers to revenue and earnings (EPS), but for the purpose of this analysis we’ll just be looking at revenue consensus estimates (as this is the metric these companies are valued off). For every public company the expectation is that they’ll beat consensus estimates, because companies often guide research analysts to the lower end of their internal projections. They do this to set themselves up to consistently beat estimates, demonstrating momentum. Cisco, for example, famously beat earnings expectations for 43 straight quarters in the 1990s.

It’s also important to note that when a company is providing guidance for the “next quarter,” it is (in some cases) already halfway through that quarter due to the timing of earnings calls. By then, the company generally has a good sense for how the quarter is going and can guide ever so slightly under their internal projections. As the data shows below, the median “beat” of quarterly consensus estimates was 4.1% in Q2 (it was 3.9% in Q1).

As you can see from the data below the vast majority of cloud businesses beat the consensus estimates for Q1.

Next Quarter’s Guidance Relative to Consensus Estimates

Guiding above next quarter’s consensus revenue estimates is the second factor for a successful quarter. Generally, companies will give a guidance range (e.g., $95M -$100M), and the numbers I’m showing are the midpoint. Providing guidance that is greater than consensus estimates is a sign of improving business momentum, or confidence that the business will perform better than previously expected. The concept of guiding higher than expectations is considered a “raise.” When you hear the term “beat and raise” the beat refers to beating current quarter’s expectations (what we discussed in the previous section), and the raise is raising guidance for future quarters (generally it’s annual guidance, but for this analysis we’re just looking at the next quarter’s guidance).

As you can see from the data below, there was no real difference between companies with June / July quarter ends (implying the overall sentiment stayed the same). This was different from Q1 with March / April quarters. Here’s the data:

Growth

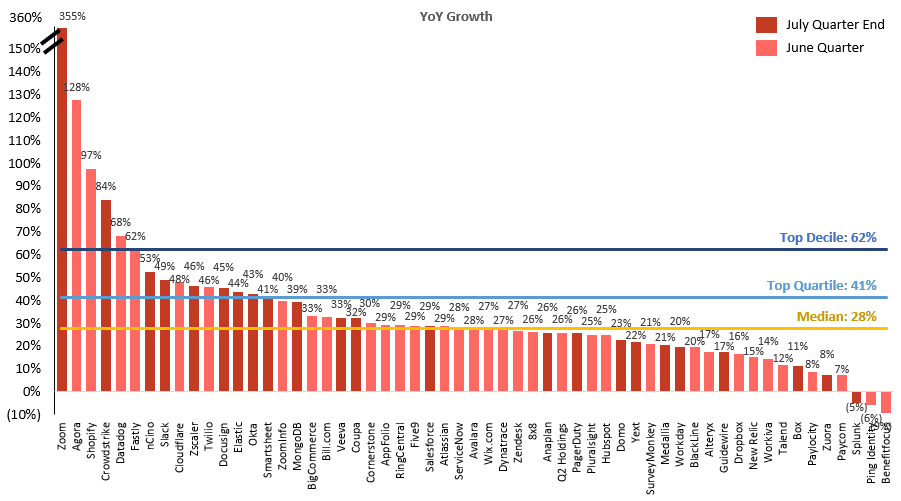

Demonstrating high growth is the third aspect of a successful quarter. This metric is more self-explanatory, so I won’t go into detail. The growth shown below is a year-over-year growth for reported quarters. The formula to calculate this is: (Q1 ’20 revenue) / (Q1 ’19 revenue) - 1.

As you can see from the data above, the median growth rate was 28%, a top quartile growth rate was anything >41%, and a top decile growth rate was anything >62%. It’s interesting to compare this to Q1. While the median and top quartile growth rates were slightly lower in Q2 than Q1, the top decile growth was quite a bit higher than in Q1. The driving factor? The Covid beneficiaries had exceptional growth in Q2.

Net Revenue Retention

High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn). In simpler terms — if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. The reason I love this metric is because it really demonstrates how much customers love your product. A high net revenue retention implies that your customers are expanding the usage of your product (adding more seats / users / volume - upsells) or buying other products that you offer (cross-sells), at a higher rate than they are reducing spend (churn).

Here’s why this metric is so significant: It shows how fast you can grow your business annually without adding any new customers. As a public company with significant scale, it’s hard to grow quickly if you have to rely solely on new customers for that growth. At $200M+ ARR, the amount of new-logo ARR you need to add to grow 30%+ is significant. On the other hand, if your net revenue retention is 120%, you only need to grow new logo revenue 10% to be a “high growth” business.

I’ve looked at thousands of private companies, and over time have come up with benchmarks for best-in-class, good, and subpar net revenue retention. Not surprisingly, these benchmarks match up relatively well with the numbers public companies reported. I generally classify anything >130% as best in class, 115% — 130% as good, and anything less than 115% as subpar. For businesses selling predominantly to SMB customers, these benchmarks are all slightly lower given the higher-churn nature of SMBs. I consider >120% best in class for companies selling to SMBs (like Bill.com). Here’s the data from Q1 earnings:

As you can see from the data above, the median net revenue retention rate was 117%, a top quartile net revenue retention rate was anything >125%, and a top decile net revenue retention rate was anything >132%. These benchmarks are actually slightly higher than Q1. The one point to note: Not all companies report this number. It’s likely fair to assume that the majority of companies who don’t report this metric probably fall into the subpar category. Because of this, the median, top quartile, and top decile numbers mentioned above probably are better than reality.

Sales Efficiency: Gross Margin Adjusted CAC Payback

Demonstrating the ability to efficiently acquire customers is the fifth aspect of a successful quarter. The metric used to measure this is my second-favorite SaaS metric (behind net revenue retention) : Gross Margin Adjusted CAC Payback. It’s a mouthful, but this metric is so important because it demonstrates how sustainable a company’s growth is. In theory, any growth rate is possible with an unlimited budget to hire AEs. However, if these AEs aren’t hitting quota and the OTE (base + commission) you’re paying them doesn’t justify the revenue they bring in, your business will burn through money. This is unsustainable. Because of the recurring nature of SaaS revenue, you can afford to have paybacks longer than 1 year. In fact, this is quite normal.

All that said, Gross Margin Adjusted CAC Payback is relatively simple to calculate. You divide the previous quarter’s S&M expense (fully burdened CAC) by the net new ARR added in the current quarter (new logo ARR + Expansion - Churn - Contraction) multiplied by the gross margin. You then multiply this by 12 to get the number of months it takes to pay back CAC.

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12

A simpler way to calculate net new ARR is by taking the current quarter’s ARR and subtracting the ending ARR from one quarter prior. Similar to net revenue retention, I’ve built up benchmarks to evaluate private companies’ performance. I generally classify any payback <12 months as best in class, 12–24 months as good, and anything >24 months as subpar. The public company data for payback doesn’t match up as nicely with my benchmarks for net revenue retention. The primary reason for this is that public companies can afford to have longer paybacks. At $200M+ ARR, businesses have built up a substantial base of recurring revenue streams that have already paid back their initial CAC. Their ongoing revenue can “fund” new logo acquisition and allow the business to operate profitably at paybacks much larger than what private companies (with smaller ARR bases) can afford.

Most public companies don’t disclose ARR (and when they do, it’s often not the same definition of ARR as we use for private companies). Because of this we have to use an implied ARR metric. To calculate implied ARR I take the subscription revenue in a quarter and multiply it by 4. So for public companies the formula to calculate gross margin adjusted payback is:

[(Previous Q S&M) / ((Current Q Subscription Rev x 4) -(Previous Q Subscription Rev x 4)) x Gross Margin] x 12

Here’s the payback data from Q1. Not every company reports subscription revenue, so they’ve been left out of the analysis.

As you can see from the data above, the median gross margin adjusted payback was 30 months, a top quartile gross margin adjusted payback was anything <19 months, and a top decile gross margin adjusted payback was anything <15 months. These benchmarks are also very in-line with Q1.

Change in 2021 Consensus Revenue Estimates

Tying all of these metrics together is another one of my favorites: the change in revenue consensus estimates for the 2021 calendar year. Heading into Q2 earnings, analysts had expectations for how each business would perform in 2021. After earnings, that perception either changed positively or negatively. It’s important to look at the magnitude of that change to see which companies appear to be on better paths. Analysts take in quite a bit of information into their future predictions — exec commentary on earnings calls, current quarter results, macro tailwinds / headwinds, etc., and how they adjust their 2021 estimates says a lot about whether the outlook for any given business improved or declined. If I had to blindly invest in a basket of stocks and only had one graph in this article to look at (with no other outside information), it would probably be this graph. Here’s the data:

The interesting thing for me is that for the most part estimates stayed the same. The median change was only +1%, and a top decile change was only +6%. My expectation is that by the end of 2021 Covid will have a much more positive impact on SaaS businesses, and consensus estimates today are quite conservative.

Change in Share Price

At the end of the day what investors care about is what happened to the stock after earnings were reported. The stock reaction alone doesn’t represent the strength of a company’s quarter, so the below data has to be viewed in tandem with everything discussed above. Oftentimes the buy-side expects a company to perform well (or poorly), and the company’s stock going into earnings already has these expectations baked in. In these situations the stock’s earnings reaction could be flat. However, it’s still a fun data point to track.

What I’ve shown below is the market-adjusted stock price reaction. This means I’ve removed any impact of broader market shifts to isolate the company’s earnings impact on the stock. As an example, a day after SurveyMonkey reported earnings their stock was up 9%. However the market (using the Nasdaq as a proxy) was up 2% that same day. This implies that even without earnings SurveyMonkey would likely have been up 2%. To calculate the specific impact of earnings on the stock we need to strip out the broader market’s movement. To do this we simply subtract the market’s movement from the stock’s movement: (% Change in Stock) - (% Change in Nasdaq)

However, some of this data can be quite misleading. Many of the companies with July quarter ends saw a huge run-up in their stock prices leading up to earnings (there was lots of positive anticipation after Salesforce’s earnings). When results didn’t blow past expectations, the stock fell back to where it was just a few days prior (which in some cases, this was a big drop!). Fastly is the perfect example of this. The day after earnings its stock fell 19%. However, if you compare its stock price to where it was 2 weeks prior to earnings, it was up 12%! For this quarter, it’s better to look at how the stock compared to 2 weeks prior to earnings. The data is below:

You can see this data paints a very different picture. The median SaaS business stock price was 4.5% higher than it was 2 weeks prior to earnings! This is quite different from the median single-day post-earnings change of -2.5%.

Wrapping Up

This quarter has been a wild ride for SaaS businesses. As a group they’ve performed quite well during these volatile times in the broader market, and in that sense the future looks bright.

Here’s a summary of the key stats for each category we talked about, and how the “Big Winners” performed. Excluding the share price reaction, Zoom and Shopify are the only two companies to perform at Top Decile levels across every metric they report and are my Elite Performers of Q1! nCino and Agora are also 2 recent IPOs that have performed very well. Hopefully this provides a blueprint for every entrepreneur out there reading this post.

The Data

The data for this post was sourced from public company filings, Wall Street Research and Pitchbook. If you’d like to explore the raw data I’ve included it below. Looking forward to providing more earnings summaries for future quarters! If you have any feedback on this post, or would like me to add additional companies / analysis to future earnings summaries, please let me know!

Excellent research - thanks for sharing! I love the application of private market views (something I'm personally also more familiar with) to the public markets. It would be interesting to go deeper into the verticals within SAAS - maybe that's something your analyst can do next quarter :)

Great analysis! Really interesting. Next time, I think you can use our WCLD instead of Nasdaq for a better benchmark of over/underperformance