Asana: Benchmarking the S1 Data

Today Asana filed their initial S1 statement. A S1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial press release (this is where we get a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock. Asana, however, is not going public through a traditional IPO process. They are going public through a direct listing (and the timeline is different). I’m still researching the exact timeline

Asana Overview

From the S1 - “Asana is a work management platform that helps teams orchestrate work, from daily tasks to cross-functional strategic initiatives. Over 75,000 paying customers use Asana to manage everything from product launches to marketing campaigns to organization-wide goal setting. Our platform adds structure to unstructured work, creating clarity, transparency, and accountability to everyone within an organization—individuals, team leads, and executives—so they understand exactly who is doing what, by when.”

“The work management market that we address is large and rapidly growing. According to a June 2019 IDC report, the markets for collaborative applications and project and portfolio management, in aggregate, are expected to grow from $23 billion in 2020 to $32 billion in 2023. We believe we have the opportunity to address the 1.25 billion global information workers, estimated by a September 2019 report by Forrester Research, Inc., or Forrester. We believe we are less than 3% penetrated among addressable employees in our existing customer base, indicating a significant whitespace opportunity. Additionally, we believe we have significant greenfield opportunities among addressable customers worldwide.”

How Asana Makes Money

From the S1: “Our hybrid self-service and direct sales model allows us to efficiently reach teams everywhere and then rapidly expand the use of our platform within their organizations. A majority of our paying customers initially adopt our platform through self-service and free trials. Once adopted, customers can expand through self-service or with the assistance of our direct sales team, which is focused on promoting new use cases of Asana. As customers realize the productivity benefits we provide, our platform often becomes critical to managing their work and achieving their objectives, which drives further adoption and expansion opportunities.”

Benchmark Data

The data shown below depicts how the Asana data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

As you can see, Asana is on the smaller end

LTM Revenue Growth

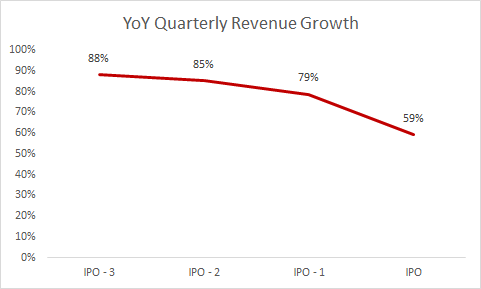

Quarterly YoY Revenue Growth Trends

LTM GAAP Gross Margin

LTM GAAP Operating Margin

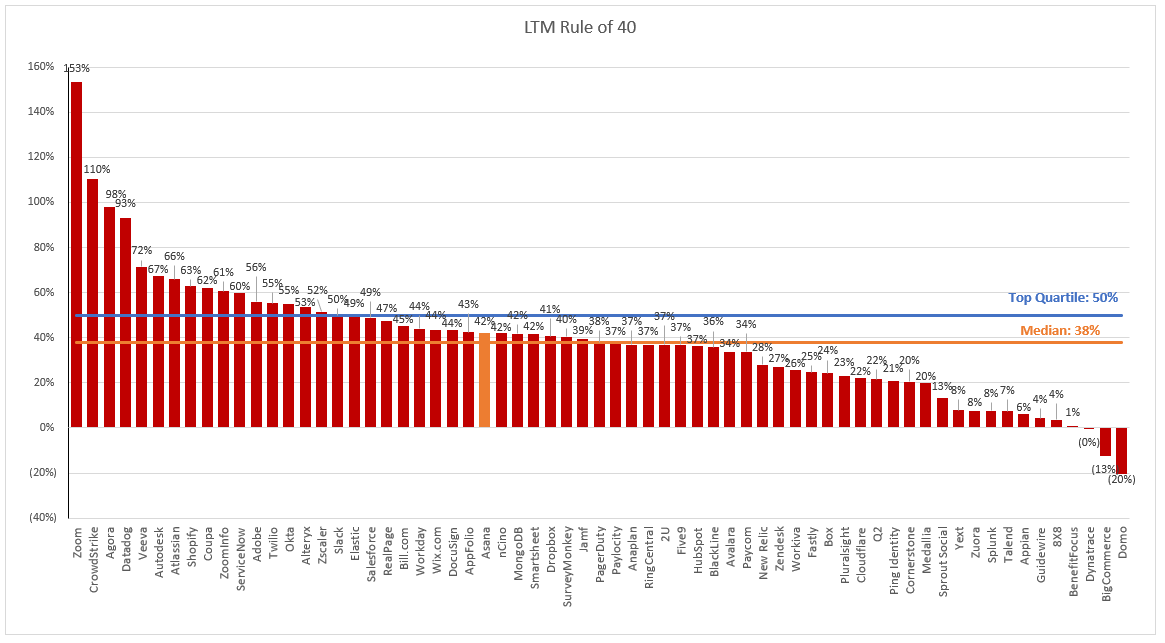

LTM Rule of 40 (LTM Growth + LTM FCF Margin)

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m taking the average of the 4 quarters leading up to IPO to remove any seasonality out outliers.

Valuation

Predicting the valuation of pending IPOs is nearly impossible, but it adds to the fun to make predictions! In the SaaS / Cloud world companies are valued off a multiple of their revenue. Generally this is a projected revenue number, and for the purpose of this analysis I will be looking at NTM (next twelve months) projections. When I think about what a company will be worth I first like to look at how other public companies are valued. First, let’s look at what SaaS multiples are trading at today, bucketed by growth:

Asana fits squarely into the high growth bucket with the 5th fastest growth rate of all current public SaaS businesses. However, they are wildly unprofitable with the second worst GAAP Operating Margin of all SaaS businesses. Despite this, their gross margin adjusted CAC payback is actually pretty good at 24 months which is above the median SaaS universe. I also think Asana is a very “well understood” product which typically helps. Investors understand it more, and are usually more comfortable investing in something they understand. JFrog, on the other hand, has far superior financials but is a much more technical product that I imagine won’t be as well understood. Wrapping all of this up into a prediction. I think they’ll get dinged for the (lack of) profitability despite the high growth as well as the decelerating revenue growth in the last quarter. However, the growth and unit economics are impressive. The market is also big, but very crowded and noisy. My gut tells me this should trade in the 20-25x range, but given all of the SaaS froth and consumer nature of this product I’m predicting (pending any material change in mutiples) - Asana will trade at 25-30x NTM revenue out of the gate, giving it a valuation of $7B on the first day of trading

Hi Jamin, thanks for this analysis and insights. Just one question: I read the whole S-1 but couldn't find out how the data to calculate the CAC payback time. How did you figure out the Net new ARR of previous year? Cheers!

Jamin - would be curious your thoughts to this. As someone newer to workflow management (I work in finance...) I tend to agree. What's the competitive advantage here other than rate of growth that stops someone else developing these features, just like they copied some of Trello's?