Braze: Benchmarking the S-1 Data

Today Braze filed their initial S-1 statement. A S-1 is a document companies file with the SEC in preparation for listing their shares on an exchange like the NYSE or NASDAQ. The document contains a plethora of information on the company including a general overview, up to date financials, risk factors to the business, cap table highlights and much more. The purpose of the detailed information is to help investors (both institutional and retail) make informed investment decisions. There’s a lot of info to digest, so in the sections below I’ll try and pull out the relevant financial information and benchmark it against current cloud businesses. As far as an expected timeline - typically companies launch their roadshow ~3 weeks after filing their initial S-1 (the roadshow launches with an updated S-1 that contains a price range). After the roadshow launch there’s typically ~2 weeks before the stock starts trading. So we’re looking at roughly 5 weeks before any retail investor can buy the stock.

Braze Overview

From the S1 - “Braze is a leading comprehensive customer engagement platform that powers customer-centric interactions between consumers and brands. Our platform empowers brands to listen to their customers better, understand them more deeply and act on that understanding in a way that is human and personal. Using our platform, brands ingest and process customer data in real time, orchestrate and optimize contextually relevant, cross-channel marketing campaigns and continuously evolve their customer engagement strategies. As of July 2021, more than 1,000 customers around the world trust Braze with their most valuable assets: their customer relationships. Over the past three years, the scale of our platform has grown substantially. Our platform enabled interactions with 3.3 billion monthly active users via our customers’ apps, websites and other digital interfaces in July 2021, up from 2.3 billion in January 2020 and 1.6 billion in January 2019. In fiscal year 2021 alone, we processed over seven trillion consumer-generated data points on our platform, and our customers sent approximately one trillion messages to their consumers using our platform.”

Product Overview

From the S-1: “Our comprehensive customer engagement platform enables authentic, real-time relationships between consumers and the brands they love. We enable brands to perform three core functions: listen to their customers better, understand them more deeply and act on that understanding by communicating with them in a way that is human, relevant and personal.

Our platform facilitates these core functions through five functional layers that are unified by an interactive feedback loop of continuously flowing data. Brands can easily and securely supplement that data by plugging into any layer of the technology stack via APIs. Additionally, using Braze Currents, they can continuously and automatically export consumer event and campaign interaction data to their internal data storage systems and to Braze partners.

Data Ingestion: We enable brands to listen to their consumers. To implement our platform, brands integrate software directly into their digital consumer interfaces, such as their websites and mobile applications, enabling consumer data to flow automatically into our platform. Brands can then understand where, when and how consumers interact with them. This helps them to build comprehensive consumer profiles that evolve alongside each individual consumer’s personal journey.

Classification: Our customers can build granular audience segments based upon each consumer’s demographics, past behaviors, and current actions. Once created, audience segments in our platform are continuously updated in real time to reflect each consumer’s ongoing behaviors. This is designed to ensure that consumers receive only messages that are likely to be relevant to them at a particular point in time.

Orchestration: Brands use our orchestration capabilities to deliver contextually relevant messages, whether as part of a single campaign or as part of a broader effort to engage with consumers throughout their brand relationships.

Personalization: Brands use our platform to customize their messaging content based on the information they learn in real time and on what they know already about each individual consumer, resulting in messages that are human, relevant and personal.

Action: Having listened to and understood their consumers, brands are then able to use our platform to execute marketing strategies that are focused and relevant. Brands can send messages to their consumers via both in-product and out-of-product channels.”

Market Opportunity

From the S-1: “International Data Corporation, or IDC, estimates the market for marketing campaign management software to reach $15.0 billion in 2021 and $19.4 billion in 2024. We believe this understates our addressable market because in addition to marketing campaign management capabilities, we offer analytical tools that help companies better understand their consumers and improve the overall consumer experience.

We estimate that, based on our current average customer spending levels, the annual market opportunity for our solution is currently $16 billion in the United States alone, and we believe there is also significant opportunity outside the United States.”

How Braze Makes Money

From the S-1: “We employ a land-and-expand business model centered around offering products that are easy to adopt and have a rapid time to value. We expand our reach within existing customers when our customers add new channels, purchase additional subscription products such as Braze Currents, implement new engagement strategies or onboard new business units and geographies. We also grow as our customers grow because our pricing is based in large part on the number of consumers that our customers reach and the volume of messages our customers send”

Benchmark Data

The data shown below depicts how the Braze data compares to the operating metrics of current public SaaS businesses.

Last Twelve Months (LTM) Revenue

Braze LTM revenue was $186M

LTM Revenue Growth

Braze grew 52% over the last twelve months

Quarterly YoY Revenue Growth Trends

Braze has accelerated revenue growth the last couple quarters

LTM GAAP Gross Margin

Braze’s LTM gross margin was 65%

Over the last couple quarters Braze’s gross margins have slightly improved

LTM GAAP Operating Margin

Braze’s LTM operating margin was (24%)

Braze’s quarterly operating margin has stayed relatively constant

Net Revenue Retention

This metric is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10).

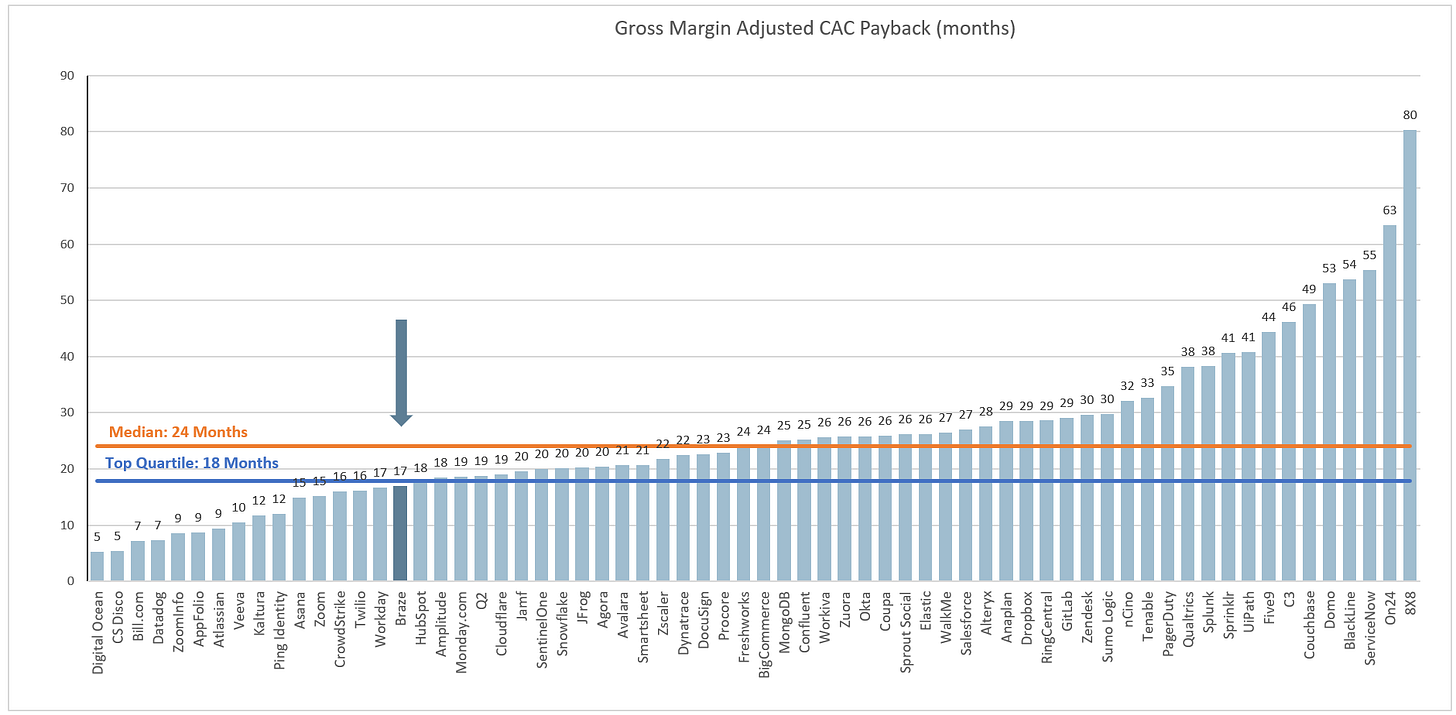

Gross Margin Adjusted CAC Payback

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12. This metric demonstrates how long it takes (in months) for a customer to pay back the cost at which it took to acquire them. In the chart below I’m showing the latest quarter’s payback

LTM S&M Expense as % of LTM Revenue

Braze’s quarterly S&M spend has stayed relatively constant

Rule of 40

In the below chart I’m showing LTM revenue growth + LTM FCF margin.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thanks for the brief on braze! Quick question to clarify the CAC payback calculation : say 3Q21 S&M is $10M, net new ARR in Sept is $5m and GPM is 80%, you get (10 / 5 *. 8) * 12 = 30 months? Thanks