Clouded Judgement 11.22.24 - Is Software Back?

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Is Software Back?

One reason I really like writing this blog is it gives me the opportunity to go back in time and revisit how I was thinking about the world at certain points in time. In many ways it acts as a personal journal. Revisionist history, recency bias, and price driving narrative are three challenges that are prevalent in the investing business, and certainly ones I have to keep myself in check on. Keeping a weekly journal laying out what was top of mind for me on a weekly basis helps keep me honest! This was particularly relevant this week, as I enjoyed looking back on some posts from summer that I thought were relevant for this week (more on that coming up).

This week saw the rapid acceleration of an interesting trend that started not too long ago - Mag 7 underperformance and software outperformance. Might this be the start of a rotation into software and growth (ie more risky assets)? Meta was down 3% over the last week. Amazon was down 7%. Microsoft down 3%. Google down 6%. Nvidia flat. Apple / Tesla were slightly up. QQQ was down 1.5%. Meanwhile, the WCLD index was up 6% over the last week! In addition to that, there were some really big moves in individual names. Snowflake was up >30% on Thursday after reporting earnings on Wednesday, which lifted the rest of the software market. Also just on Thursday Mongo was up 14%, Confluent / Datadog / Cloudflare were each up 7%. Many others were up 3-5%. Elastic then reported earnings on Thursday and saw their stock rise >20% after hours.

The Mag 7 - The stalwarts, the Kings, the “can’t go wrong” - showed cracks. While software exploded up. So I ask again, is this the start of a broader trend that will continue into 2025 or just a false start?

Here’s why I led with the intro about recency bias and looking back at old posts - I wrote seemingly the exact same article on July 19th of this year. You can find it here, and it’s titled “The Big Tech Rotation.” In that July 19th post I highlighted the same trend I highlighted today - Big Tech / Mag 7 underperformance with simultaneous software over performance. And I asked the question, is this the end of the Mag 7’s run and the start of software’s run??

Well, let’s look at what happened since that post. Nvidia is up ~24%. Meta is up ~18%. Amazon is up ~8%. Tesla is up ~42%. Apple is up ~2%. Microsoft is down ~6%. Google is down ~6%. Overall, QQQ was up 6%. So in general, the Mag 7 performed quite well! However, when we look at how the WCLD index performed since July 19th, it’s up ~23%! However, WCLD was basically flat from late July to late October. In the last month alone WCLD is up ~19%. So while WCLD was up a lot more relative to big tech from that July 19th post, the majority of the gains happened in the last month. I think it’s fair to say the Big Tech Rotation of July 19, 2024 really wasn’t a rotation at all. It was just an anomaly, a blip in an otherwise impeccable two year run for the Mag 7.

So let’s ask the question again! Is the last month the real start of a rotation out of big tech and into software? Are markets moving further out on the risk curve? Is growth starting to rebound? All good questions. I think one thing is clear - the market is dying for a new trade. A new source of alpha. A constant set of winners over a 2 year stretch (Mag 7) can’t keep going on forever, right? At some point the run has to end (at least on a relative basis), and when that happens no one wants to be caught offsides.

So let’s look at some data to try and answer the question of whether this rotation is the start of something real, or another blip like July 19th. What’s one reason markets would move further out the risk curve? Rates. Everyone surely must remember the ZIRP period…Interestingly the 10Y has risen significantly from 3.6% to 4.4% over the last ~2 months. This is despite the Fed starting a rate cutting cycle. The economy appears to be strong, the market believes some of Trumps policies will further market strength, and there are some signs that inflation could be getting sticky (which would imply less cuts). Time will tell if any of these are true, but probability of them being true has gone up as we’ve seen rates go up. So I don’t think this rotation into software has to do with macro / rates. There’s maybe a longer term view that rates will be a gradual tailwind over the next 12-24 months, but we won’t know what the neutral rate will be or where the Fed will settle out.

If rates aren’t the driving force behind the software outperformance, maybe it was earnings / business fundamentals? Are software companies starting to turn it around? Let’s look at the data for Q3 so far. Of the companies who’ve reported, their aggregate quarterly net new ARR added is the highest it’s been in the last ~3 years (chart below). Of the ~60 companies I compile a quarterly earnings recap of 100% beat Q3 consensus estimates (last few years average was ~90%). The median beat of consensus estimates was 2.2% (highest since Q2 ‘22). The median guidance raise for Q4 was 0.3% (highest since Q1 ‘22)

Overall there are definitely some signs / breadcrumbs of performance and business fundamentals rebounding. The trendline is certainly positive. I think that, plus some element of macro (we’re certainly in a rate cutting cycle, so hard to see rates being a headwind and at some point they should be a tailwind) has given the market the reason it craved to take some profit in Mag 7 and search for the next area of alpha.

So what do I think? It’s always fun to make predictions… In the July 19th post I said:

“If I had to guess, I think a bit of this “rotation” was a bit overdone? I’m not sure we’re quite at peak earnings yet for Big Tech (earnings start next week!), and I’m not sure we’ll really see the rest of the market inflect up yet (if I had to guess I think we’re false starting that a bit). However, markets will move ahead of either of these shifts, so maybe we see these things play out in next 6 months and the market is simply moving ahead of that 6 month forward look.”

This time I think the rotation may have more legs, but I’m not so it’s a longer term trend yet. I think Q4s will be strong for software with a bigger-than-normal budget flush similar to Q4 ‘23. I also think AI is starting to drive performance for certain businesses (I think there will be real dispersion here though as it relates to who’s really benefiting, who’s getting disrupted, and who’s not moving fast enough). And as I wrote about last week, companies are starting to lean more into growth, and the market is showing signs of rewarding that growth. Snowflake was one of the first companies to report who’s quarter ended in October (rest of software companies to report had quarters ending in September). So there’s hope that the macro stayed “strong” into the month of October. On their earnings call Snowflake said re macro / economy: “it’s not euphoric, it’s good. It’s not bad.” Not necessarily an “all systems go” type quote, but a positive nonetheless.

I think 2025 will really separate the AI beneficiaries. The market will probably reward too many people at the beginning, and throughout the year the dust will settle and illuminate the the true winners. More workloads will move from prototype to production. Investments from the last 12-24 months will start to pay off. I’m ready for an exciting year in software!

Quarterly Reports Summary

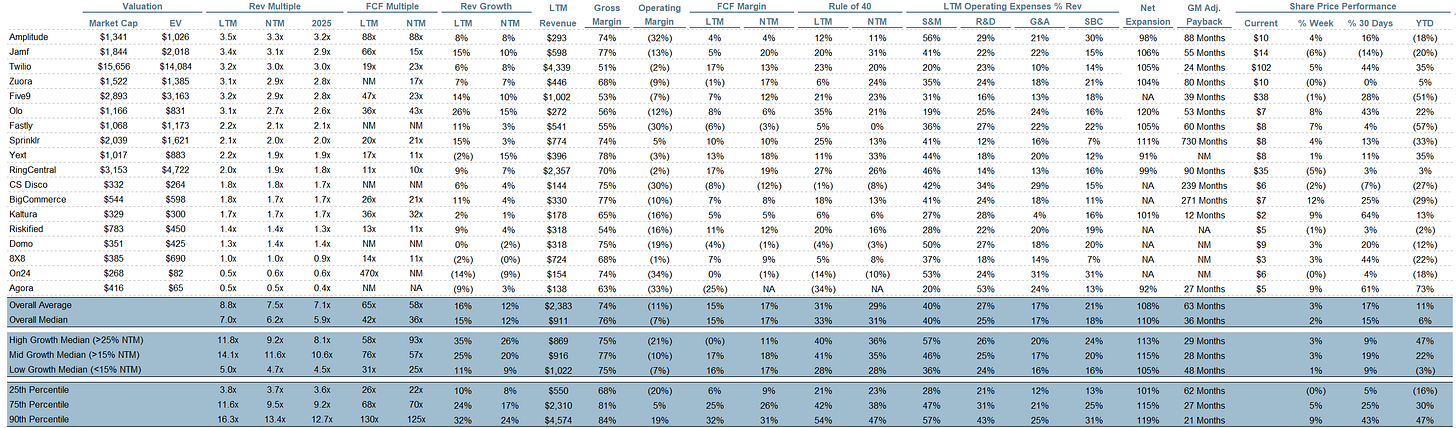

Top 10 EV / NTM Revenue Multiples

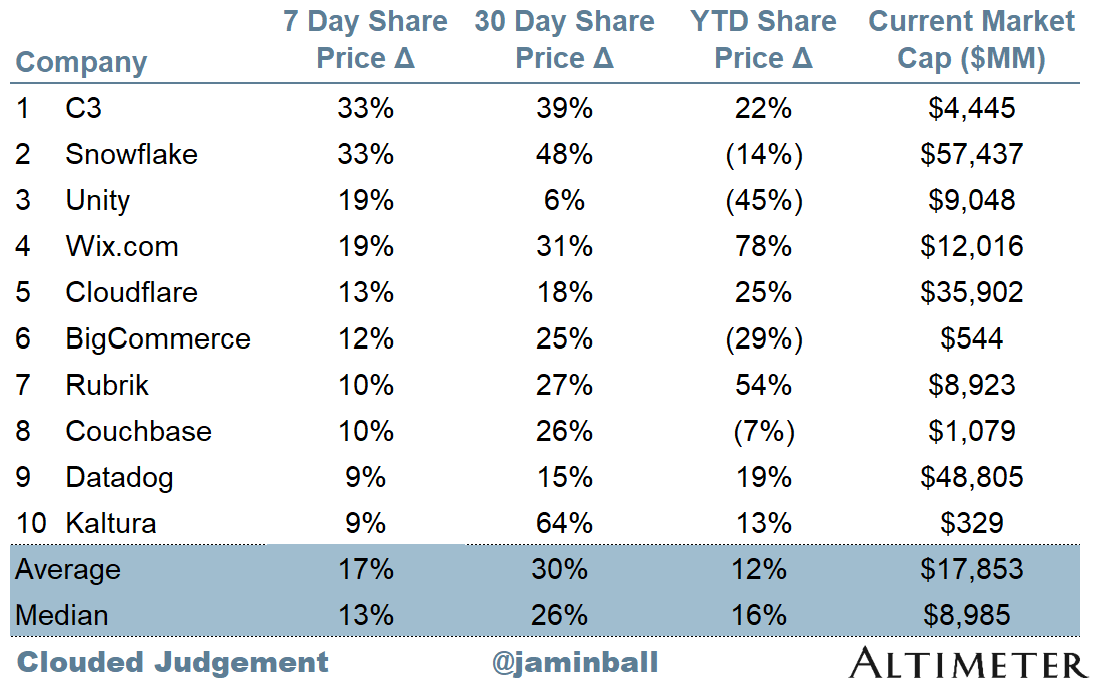

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.2x

Top 5 Median: 19.8x

10Y: 4.4%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.2x

Mid Growth Median: 11.7x

Low Growth Median: 4.7x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 15%

Median Gross Margin: 76%

Median Operating Margin (7%)

Median FCF Margin: 15%

Median Net Retention: 110%

Median CAC Payback: 36 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Why would mid growth command a higher revenue multiple than high growth?

I completely agree with you, Jamin. While there are some nascent signs of a recovery in software, investors need to be cautious about jumping in head first into ALL software stocks thinking that software is back. There are going to be some future winners and several other losers and so-so performers. Our challenge is to sift through these companies to find the former. Cheers!