Clouded Judgement 12.30.22 - Year End Review + Dispersion

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

And that’s a wrap for 2022! If you want to look back at the final post from 2021 to compare where we are today, the link is here

Dispersion

When I think about the upcoming year, the word that keeps coming to mind is dispersion. 2023 will be the year we truly learn who the best businesses are. Who’s defensible, who has real moats, who’s operating in a market with true tailwinds, who’s built a good business that generates free cash flow, etc. And with that, I think we see a lot more dispersion in software multiples. When I look at the data, we already do see a good amount of dispersion (relative to historical standards). I think this continues in 2023. The below chart shows the difference in the top quartile multiple vs bottom quartile multiple going back to 2015 (ie how much bigger the top quartile multiple is than bottom quartile).

2022 Top Performers

Below is a table that shows the top 10 share price performers of 2022. Congrats to Box for being the only positive returning cloud software stock of the year! I’ve removed companies that were acquired during the year. (this is as of Thursday’s close)

For reference, here’s a the same chart from the final post of 2021:

Top 10 EV / NTM Revenue Multiples

And below is the same chart for the year end 2021 post. What a difference a year makes!. What’s most interesting is that despite all of the volatility in software over the last year, there have been 5 companies that showed up in the top 10 year end multiples for 2022, 2021 AND 2020. Those are Snowflake, Cloudflare, Datadog, Bill and Zscaler.

And just for fun, here’s the year end 2020 table:

Top 10 Weekly Share Price Movement

Update on Multiples

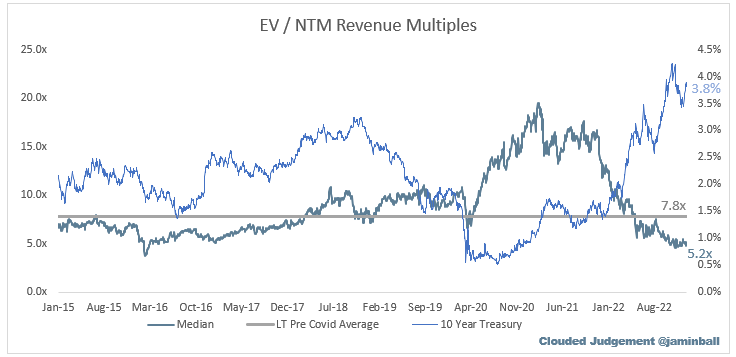

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 11.5x

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.5x

Mid Growth Median: 5.3x

Low Growth Median: 2.7x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

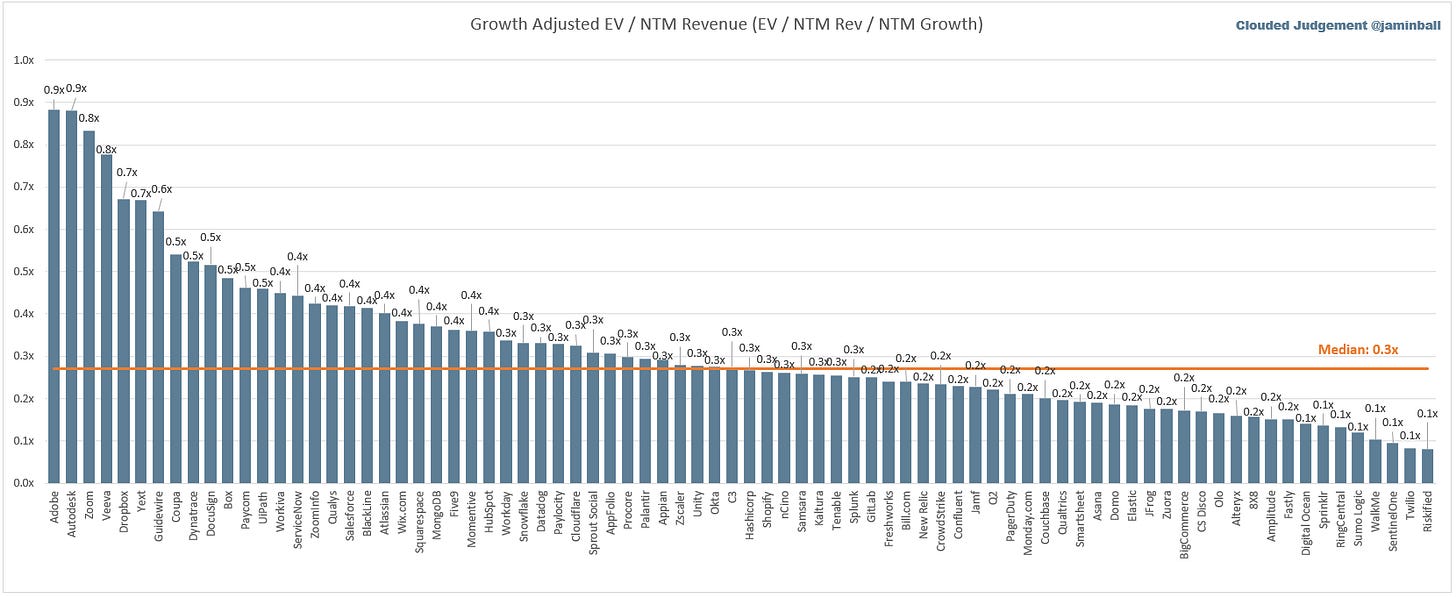

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

And here’s the same chart from the year end 2021 post

Operating Metrics

Median NTM growth rate: 17%

Median LTM growth rate: 29%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 0%

Median Net Retention: 119%

Median CAC Payback: 38 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Brilliant content as always.

Do you have a buymeacoffee.com or have you thought about a premium offering? I am sure many would like to give back for your great work.

Amazing!!