Most importantly - Warriors are CHAMPIONS! Go Dubs

Two Competing Truths

It’s an interesting point in time. I’ve never been more excited about the future of cloud software (particularly cloud infrastructure software). We have so much room left to grow into these markets, with many markets still being quite early in their S Curves. At the same time, the slope of innovation, and progression to the cloud, is only getting steeper! Business fundamentals are as great as they’ve ever been, and we’re even seeing businesses hit mature FCF margins while remaining in their hyper-growth phase of maturity. 10 years ago most doubted SaaS companies would ever generate profits. Now we’re seeing companies >$1B ARR, growing 60%+ generating 20-30% FCF margins. It’s truly remarkable. Yet despite this, and despite the fact that most software businesses have already dropped 50-80% from highs, it still feels like there are more reasons to be short term pessimistic than optimistic. There is just so much outside of companies control governing what multiples will do in the short term. With a 1-2 year time horizon I think great opportunities are presenting themselves today. However, even if Point B (call that 2 years from now) is much higher than Point A (today), it doesn’t mean it will be a straight line up from A to B. It very well (and right now feels most likely) could slope down first before heading up.

Update to Event Path

This week I posted a chart that showed the median cloud software multiple, the 10Y, and the long-term average cloud software multiple (this excludes 2020-present). I also commented that the present multiple is 30% below the long term average. Below is the chart I’m referencing:

There were 2 key responses to this that I want to address here:

1. “How can a long-term average only be a 5 year period?”

It’s a valid critique. However, we barely had any cloud software businesses before the global financial crisis (‘08), so no matter what period we use for a long term average it will be in a bull market. And even when cloud software became more prevalent, it was very different post 2015 than pre 2015. Namely - the public cloud wasn’t very penetrated (ie vendors still managed their own data centers which had ramifications on how they could scale). Also, software business models were not understood very well at all pre 2015, and therefore traded at a discount to where I believe is a more sustainable place. Net net - I’ll defend the use of 2015-2020 as a “long term” sustainable average.

2. “Being 30% below the long term average means nothing. We’re in a new normal.”

I want to first point out that by mentioning we’re 30% below the long term average I did not intend the conclusion to be “things are cheap!” I was simply presenting the data, and giving a historical context. Given where the world is, we should ABSOLUTELY be below the long term average. The reason I included the 10Y on the cart was to show the concrete reason for why we’re below the long term average.

From 2015 - 2020 (the period for my long term multiple average), the average 10Y was 2.3%. It’s currently 3.3%. If all I knew was the current 10Y, I’d guess we should be ~20% below the long term average (as of this writing we’re currently about 35% below the long term average). Part of the reason we’re even further below the long term average is uncertainty around how high rates will need to go, and how resilient software is in a recession (I’ve talked about this in previous Clouded Judgement issues)

What I want to touch on today is an update to an event path I laid out last week after we had CPI data last Friday, and updated Fed guidance on Wednesday. One thing appears clear - I was too optimistic on when inflation would roll over. The magnitude of my over-optimism still isn’t totally clear. Core inflation still did decline in May. What has changed is the rate the Fed is now targeting for end of 2022, 2023 and 2024. These targets are now 3.4% for 2022, 3.8% for 2023, and 3.4% for 2024. What’s important here is that the Fed is basically sayin rates will stay elevated (relative to the average from 2015-2020) for the next 2.5 years. This is important for everyone expecting a quick bounce back to the long term multiples for software companies. It’s becoming increasingly clear we won’t ever get a “bounce” back (this was never my base case). Instead it will be a much slower grind. Now, that doesn’t mean stocks can’t preform well over the coming 2.5 years. We’re already at really depressed multiples. If multiples stay constant then fundamentals will drive performance. However, with a recession fundamentals could be impacted. And when fundamentals get impacted companies get lower multiples (growth comes down). Double whammy.

As I’ve said before, I expect more choppiness / pain until we get clarity on where rates will settle (what’s the upper bound), and how fundamentals are impacted in a recession. The incremental data points on rates are getting worse not better. And we have no data points on fundamentals in a recession (we aren’t even in a recession yet).

Quarterly Reports Summary

Q1 earnings season is in the books! I’ll publish a recap soon

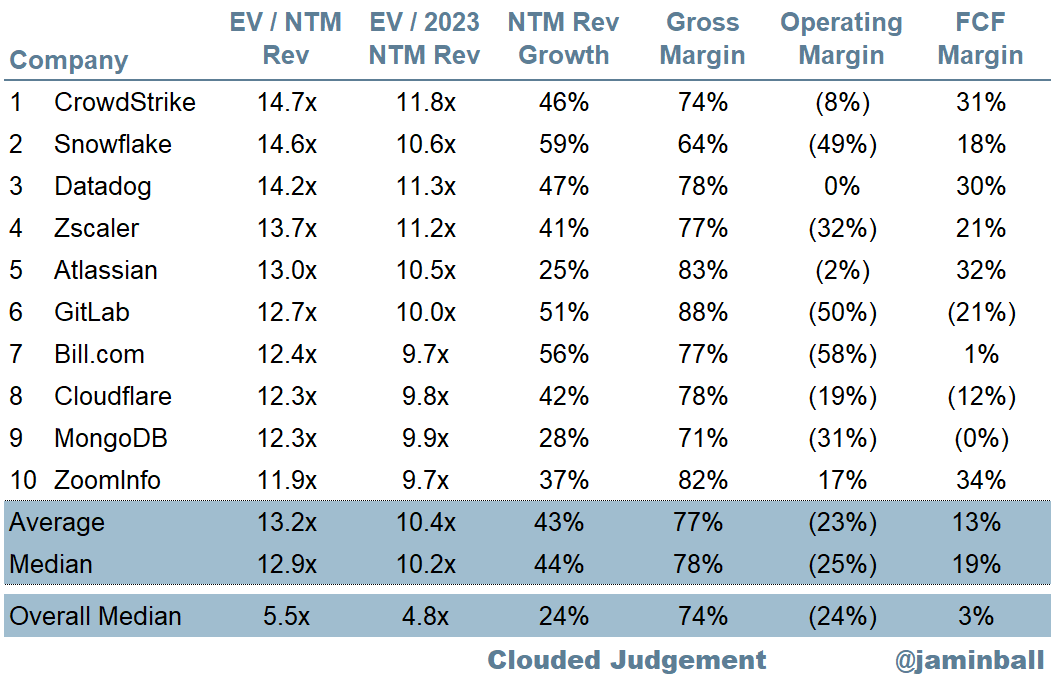

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

I’m changing up the chart I usually show here (removing the 3 month and 1 year trailing average which didn’t mean much anyway). Instead I’m adding the 10Y and the long term average (average from 2015 - 2020)

Overall Stats:

Overall Median: 5.5x

Top 5 Median: 14.2x

10Y: 3.3%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 7.1x

Mid Growth Median: 5.7x

Low Growth Median: 3.2x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 24%

Median LTM growth rate: 32%

Median Gross Margin: 74%

Median Operating Margin (24%)

Median FCF Margin: 3%

Median Net Retention: 120%

Median CAC Payback: 34 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Fantastic post. Appreciate you sharing all this info.

Shouldn’t GM adjusted CAC payback be done on new ARR instead of Net New ARR? I’m guessing you’re doing Net New since the ARR break ups are not typically called out in public financials?