Clouded Judgement - 6.26.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any noteworthy news. Follow along to stay up to date! Today is shaping out to be a tough day in the markets with most Cloud stocks down. The data presented below is as of Thursday’s market close

Highlight of the Week - Convertible Debt Offerings

Recently convertible notes have been the financing method of choice for public SaaS businesses. Since Q1 ended there’s been over $8B in capital raised via convertible notes! After going public there are 3 primary ways companies can raise money:

Through Equity offering via a Follow-On - In this type of offering companies issue new shares that are sold to the public (mutual funds / institutional investors). This type of offering increases the total shares outstanding, thus lowering the share price. The overall valuation (market cap) of the company stays the same, so if # shares goes up, price has to go down (this is dilutive financing). Companies can also choose to not raise money, and instead let existing investors sell their shares through a secondary Follow-On offering. In these scenarios no new shares are issued, and there is no dilution. The company also receives no proceeds. Typically this type of offering happens after an IPO in the “lock-up” period. This is generally a 180 day period post IPO where existing shareholders are not allowed to sell their shares on the open market, so the secondary follow-on gives them the opportunity to sell.

Through Debt via Senior Notes - In this type of offering companies sell bonds to investors with a coupon (interest rate). Through the term of the loan agreement the company makes interest payments until the maturity date when the principal is paid down(this is non-dilutive financing). Debt offerings are not common in cloud businesses because they are generally operating at a loss and not an attractive candidate to bond holders (funds who “buy” the debt)

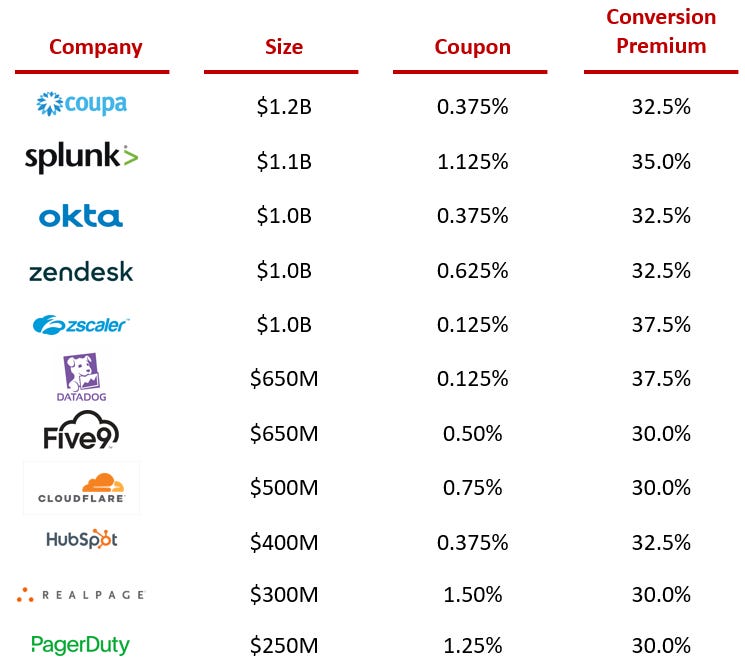

Through a combination of debt + equity via a Convertible Note. This type of offering has an interest rate associated with it (the debt piece, ie the “bond”), and also the option to convert these bonds to equity (shares) at a pre-determined price (conversion premium). Typically the maturity date for the bonds is 5 years from when they were issued, and the interest is paid semi-annually. The bond holders then have the option to convert the debt to equity at a pre-determined price - ie the conversion premium. Convertible notes are very nuanced, but an over simplified way to think about the conversion to equity is with an example (Datadog). If you read their press release you’ll see that the bond holders have the right to convert $1,000 of of principal (loan) into 10.8338 shares. If you divide these numbers you get an implied conversion price of $92.30, which was a 37.5% premium to the last reported sale price of Datadog stock before the offering. This 37.5% represents the conversion premium. If we look forward, the bond holders would convert their debt to equity if the share price at the time is greater than their conversion price ($92.30). It’s like an option. If the share price is below the conversion price, they’re better off just buying shares on the open market. Generally the company (Datadog) has the right to redeem (buy back) the debt for cash under certain circumstances. Convertible note offerings are attractive to tech companies because they are not dilutive up front (the dilution comes down the road, and in some cases never happens), and the interest rates are quite low (which is great for companies that are not profitable!). Here’s a summary of the convertible offerings + terms so far:

Bonus Highlight of the Week - A Self Promotional One :)

Earlier this week I published an article highlighting what it takes to become a public SaaS company. Here are the highlights that all founders should aspire to. This data is from a set of 36 SaaS IPOs over the last few years

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Gains

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 12.9x

Top 5 Median: 36.7x

3 Month Trailing Average: 10.3x

1 Year Trailing Average: 10.2x

Bucketed by Growth:

High Growth Median: 27.3x

Mid Growth Median: 15.6x

Low Growth Median: 9.0x

Operating Metrics

Median NTM growth rate: 18%

Median LTM growth rate: 33%

Median Gross Margin: 73%

Median Operating Margin (16%)

Median Net Retention: 117%

Median CAC Payback: 29 months

News

Splunk announced they were ranked #1 for 2019 market share and market revenue in IDCs Worldwide IT Operations Management Software Market Share, 2019.

Zoom hired Jason Lee as Chief Information Security Officer. He was most recently the Senior VP of Security Operations at Salesforce, and was previously Principal Director of Security Engineering at Microsoft

Amazon announced Amazon Honeycode, a no code mobile and web app development platform

Slack launched Slack Connect which is a solution that lets up to 20 organizations work seamlessly together with apps, chat and more

Okta, CrowdStrike, Netskope, and Proofpoint announced the companies are coordinating to help organizations implement an integrated, zero trust security strategy required to protect today’s dynamic and remote working environments

Zscaler announced an offering of $1Bn convertible notes (0.125% coupon, 37.5% conversion premium). They join Coupa ($1.2B), Splunk ($1.1B), Okta ($1B) and Zendesk ($1B) as recent convertible offerings $1B or greater from Cloud companies. Other recent convertible offerings include Datadog ($650M), Five9 ($650M), Cloudflare ($500M), Hubspot ($400M), RealPage ($300M)

PagerDuty announced an offering of $250M convertible notes (1.25% coupon, 30% conversion premium) joining the list of companies mentioned above

Comps Output