Q2 earnings season for Cloud businesses is right around the corner! This Wednesday will kick off a ~2 week sprint of earnings announcements for Cloud businesses with June 30th quarter ends. The companies with July 31st quarter ends haven’t announced their earnings dates yet, but it’s fair to assume they’ll likely start reporting sometime around the end of August, and will similarly span a two week stretch. Tying it all together, we’ll have about a month and a half of earnings season! I’ll post regular updates, so follow along to stay up to date!

Earnings season always comes with a lot of excitement, but this quarter might be the most highly anticipated Cloud earnings season ever. Over the last few months as the country has spiraled into turmoil from the Covid-19 pandemic and most market indices have declined, tech stocks (and particularly cloud stocks) have soared to all-time highs. Everything seems to suggest this is the result of digital transformations accelerating, but the proof will be in the numbers! Might this be a time to “buy the rumor, sell the news” and cash out after a huge run-up?? In Q1, companies with March quarter ends were only affected in their last week or two of business, and companies with April quarter ends only had about a month of affected business. Q2 will be the first full quarter of covid-affected business, making it even more intriguing. Last quarter we saw some massive stock movements after earnings. Fastly (+44%), Twilio (+38%), Zscaler (+28%), and Datadog (+26%) rounded out the largest market-adjusted stock gains. 8x8 (-25%), Smartsheet (-22%) and Slack (-16%) rounded out the “biggest losers.” Might we see similar movements this quarter? We’ll find out shortly! Below you can see a calendar of upcoming earnings dates:

Update on Public SaaS Valuations

There’s never been a better time to be a public SaaS company. The demand for SaaS businesses is growing at a frenetic pace - Multiples are near all time highs, and the SaaS IPO market is robust as every. Every IPO that happened in Q2 saw a massive “pop” on day 1 of trading. nCino popped 195%, Agora popped 153%, and Jamf popped 51% (imo a lot of this was speculative SaaS buyers). For a stretch of about a month, every week median SaaS multiples were creating new all-time highs. While multiples are not currently at all time highs, they’re not far off. The median forward SaaS multiple is 13.3x, just slightly down from all time highs of 14.9x (which happened just 2 weeks ago). As you can see below, median SaaS multiples have more than doubled in the last 5 years.

This multiple expansion is even more dramatic when we look at the “cream of the crop” bucket of SaaS businesses (in this case companies projected to grow 30%+ over the next twelve months). This basket has expanded their median multiple nearly 3x in the last couple months!

And finally, to show where the most multiple expansion has occurred, look no further than the median multiple of the top 5 multiples. This basket has 5x’d their multiple in 5 years.

A few weeks back I wrote about why SaaS businesses were performing so well while the majority of the market struggled. In summary - 1) Covid forced businesses to accelerate their digital transformations (driving up demand, and growth, for SaaS products). 2) Their predictable recurring revenue streams and strong unit economics gave investors comfort. 3) Investors rotating out of greatly affected industries (like travel, hospitality, retail, etc) were parking money in SaaS businesses (because of point 1 and 2). I believe all of these factors to be true today!

Are These Valuations Sustainable?

When I look at the bucket of high growth businesses trading at ~25x (and remember this is just the median, many companies are trading at 35x+) I don’t think those multiples are sustainable. While I do think we’re in a “new normal,” and SaaS multiples will reset higher for the long term (historically median multiples stay in the 5-10x band), I don’t think numbers this high can last. It’s just too rich. HOWEVER, I absolutely, 100%, believe that the valuations are sustainable for the best SaaS businesses, and will continue to go up (and by valuation I’m decoupling market cap from revenue multiple, and only talking about market cap). I believe this because I think forward growth rates will surprise us (for reasons I’ll lay out), allowing businesses today trading in the 35x range to “grow into” their valuations much quicker than anticipated. Many people believe we’re in for a SaaS reckoning (or a SaaSpocalypse as I’ve cleverly heard it called), and the bubble will burst. I couldn't disagree more. While we may see pullbacks along the way, I’m as bullish as ever on the 1, 2, 3+ year outlook for SaaS. Here’s why:

First - When I look at current multiples today, I think they’re artificially inflated. Once Covid hit, many research analysts strongly revised down forward estimates across all sectors (and haven’t adjusted since). However, due to the increased attention on SaaS products with digital transformations accelerating, we may not see such an adverse affect from Covid. Because of this, I think forward estimates are quite conservative, and too low for a number of companies. If the true forward growth ends up being higher than projected, this means the forward multiple is actually not as high as it appears (if we increase the denominator of the multiple, it comes down). And because of this I think the multiples today are actually more sustainable than a 30x+ multiple may seem! Granted, a lot of this is already “priced in” to the stock. But is it priced in for 2-3 more years of sustained growth? Double clicking on why I think forward estimates are too low - We’ve heard data point after data point suggesting digital transformations are really benefiting SaaS businesses. Satya Nadella said on Microsoft’s Q1 earnings that:

“We’ve seen two years worth of digital transformation in two months.”

Twilio released the results of a survey saying:

“Over the last few months, we’ve seen years-long digital transformation roadmaps compressed into days and weeks in order to adapt to the new normal as a result of COVID-19.” They went on to say “COVID-19 was the digital accelerant of the decade. COVID-19 accelerated companies’ digital communications strategy by an average of 6 years.”

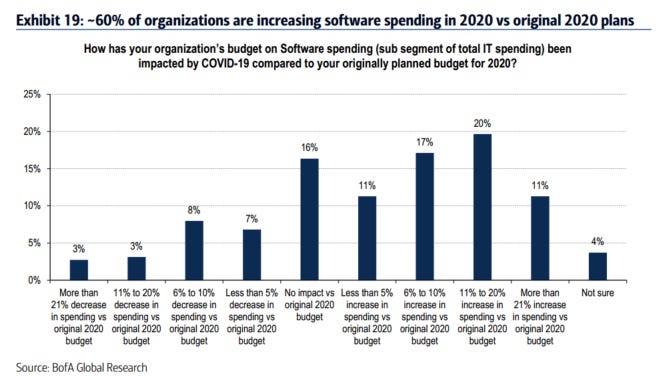

This to me doesn’t suggest growth will take as big of a hit they’re projected to. There’s even data to support this! The chart below comes from a survey of CIOs from BofA research. As you can see, the majority of respondents are actually planning on increasing their spend of software because of Covid.

But, when we look at the revenue deceleration consensus estimates are projecting across the board for SaaS businesses it doesn’t seem to align with accelerated digital transformations. Take Twilio for example. They grew 68% over the last 12 months, yet forward estimates peg their expected forward growth at 27%. Does this deceleration sound like the result of a market where companies are accelerating their need for the Twilio product by 6 years? Looking at the delta of historical growth to projected growth of the rest of the SaaS universe tells a similar story. In the chart below I’m showing the percent change in LTM revenue growth to projected NTM revenue growth. It’s calculated by: NTM Growth / LTM Growth - 1 (so it’s showing the % change in growth). Every number <0 is showing decelerating growth, and every number >0 is accelerating growth. Decelerating growth is normal (and expected), but the rate at which revenue growth is projected to decelerate seems high to me.

This is some pretty substantial revenue deceleration for a group “benefiting” from digital transformations. I’m not convinced the outlook is as bleak as forward estimates make it appear! Just to be clear, I’m not saying every SaaS company should accelerate revenue growth, I’m saying the magnitude of the deceleration shouldn’t be so high. And because of this (as I mentioned above), I think the true forward multiples are much lower, and are sitting at more sustainable levels (albeit still very high).

The second reason I’m confident valuations are sustainable and we’re not headed for a bubble - even if multiples do compress (which I think is likely), valuations can still appreciate as long as companies sustain high revenue growth. The best way to explain this point is with an example. Let’s take a hypothetical business at $200M of LTM revenue projected to grow 75%, 55% and 45% in the next 3 years. If their multiple today is 30x forward revenue, they’d be worth $10.5B ($200M growing 75% = $350M. $350M x 30 = $10.5B). Let’s play this forward 2 years, and watch what happens to the valuation as their multiple compresses from 30x to 20x:

As you can see, even as the company’s multiple significantly contracted, the valuation grew by 50%! This is commonly called “growing into a valuation.” The key point I want to make in this article: as long as companies can sustain high growth rates (a big if, but a point I’ll argue later on the best SaaS businesses can!), they will grow into these “high” valuations much earlier than anticipated, and continue to appreciate in value over the next 2-3 years. And my take - for a group of elite SaaS businesses I’ll term the “Secular Growth Stars” I’m as convinced as ever their growth rate will far outpace multiple contraction painting an incredibly positive outlook on the future. I’ll even take this one step further - research analysts generally asymptote revenue growth to ~20% (or less) in outer years for the best business. As you may expect, I believe this is too low! (Quick data point - Salesforce still grows 30% annually, at almost $20B in LTM revenue, after going public 16 years ago). In my opinion, there are many factors in play that suggest companies will be able to sustain growth rates far north of 20% for extended periods of time. Clearly the crux of my argument is that SaaS businesses will grow faster, and sustain this growth for longer periods than projected. So why am I so bullish that growth rates in SaaS (and in particular for the Secular Growth Stars) will continue to surprise us in the near term, and also asymptote to levels much higher into perpetuity than what was previously thought possible? Read on!

1.We’re in the Early Innings of SaaS - and Adoption is Accelerating

This is a point I can’t stress enough. Cloud / SaaS penetration is still incredibly low! Most of the workloads / storage today are still done on prem. No matter how you cut the data - looking at the storage of data in cloud data warehouses vs on-prem warehouses, looking at application workloads running in the cloud vs on-prem, or looking at the % of IT budget spent on Cloud vs op-prem technologies - everything points to only about 20% cloud penetration. Here’s a chart from a recent JP Morgan CIO survey:

As you can see, according to their data only 20% of IT spend is on cloud technologies. And here’s a chart from a recent Morgan Stanley CIO Survey:

Similarly, they are showing only 25% of application workloads are being run in the cloud (and spend would be lower than this).

Finally, a chart from BofA juxtaposing public cloud infrastructure spend with on-prem data center spend. As you can see Cloud is accelerating while on-prem is decelerating.

Despite this relatively low penetration, cloud businesses are still generating >$100B in revenue (I’m including AWS, GCP and Azure), and the aggregate market cap is in the trillions! Cloud still has so much room to grow, and with Covid the adoption of SaaS technologies is accelerating. The image earlier on from BofA showed how companies actually planned on increasing their software spend post-Covid. The changes Covid is instilling in businesses are permanent. As more and more companies look to digitally transform, the overall CAGR of the Cloud industry will increase supporting higher growth rates for SaaS businesses.

2.Cloud Markets are Often Larger than Anticipated

I can’t tell you how often I’ve been wrong (by underestimating) when assessing market sizes in the early days of a cloud product. At the earlier Series A / B stage I severely underestimated the size of the CDN market with Fastly, the infrastructure monitoring market with Datadog, and the bank OS market with nCino (just to name a few…). As crazy as it seems now, looking back 8 years when assessing Datadog the (silly) thinking was “how big of a market will there be for *just* monitoring cloud infrastructure, when cloud infrastructure spend isn’t that high to begin with?” Sounds so stupid now! Clearly two things happened - the cloud infra market exploded (thus greatly increasing the size of the monitoring market), and the team executed flawlessly expanding into adjacent areas like APM and logging.

So why are cloud market sizes often misunderstood? First, you can’t take the size of a legacy on-prem market for a certain product (the observed market size) and apply that to a cloud product in the same market and say “that’s their market size.” Cloud markets are almost always bigger! A cloud product makes the operation / management of that product so much easier - you don’t need a team on site to manage physical infrastructure / scaling. In so many ways cloud products democratize access to workflows many users previously couldn’t access with the on-prem version (because they couldn’t afford, or didn’t have access to the resources required to maintain it). So what effect does unlocking greenfield use cases have? It increases the market size! Compounding this, cloud software products often eat into the services revenue associated with their on-prem counterparts (people forget how gigantic the services markets are for on-prem products). These services revenue wouldn’t be included in a market size analysis, and “converting” services to software also greatly increases market size. And finally, the most obvious reason we underestimate cloud market sizes relates to the point I made above. We are just so early in the SaaS adoption cycle, and these products have so much more room to run than we think (ie markets grow faster than we anticipate). Let’s wrap up this point by looking at Datadog again. If cloud penetration as a whole is only at 20% today, does this mean the cloud monitoring market could grow by 5x? Yup!

And bringing this back to my initial claim that cloud products will grow faster, and sustain this growth for longer periods of time - if the markets are bigger than we think, there’s more room to grow!

3.Superior Unit Economics - Net Retention

Net retention is one of my favorite SaaS metrics. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10). In simpler terms — if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. Here’s why this matters so much - net retention shows what your growth rate would be over the next year if you added ZERO new customers. Let’s think about this in the context of Datadog. Their net retention is >130%. So in theory, they could grow into perpetuity at 30% without adding any new customers! Layer on growth from new customers, and 50% seems completely achievable (if not expected). However, research models peg Datadog’s growth at 5+ years out at ~20% (and declining to 15% closer to 10 years out). The counter point here is that overtime as you penetrate your existing customers, you’ll run out of room to grow within them. However, let’s not forget that for many of these Cloud products their “user” is often other software. So as Datadog’s customers continue to move workloads to cloud architectures, their product has more infrastructure and applications to monitor (and thus expand)! This will happen naturally! And as we talked about above, cloud is only 20% penetrated and still has tons of room to grow. When we think about what a baseline equilibrium growth rate is for SaaS businesses, I think we (and by we I mean research analysts, not me!) severely underestimate the impact of net retention. I really don’t think it’s crazy to assume that the best cloud businesses can sustain 35% or 40%+ growth rates at scale. When we tie this back to current valuation levels, this is a key point for why I’m so confident and bullish that cloud businesses can sustain their growth rates, thus growing into their valuations quicker, and ultimately expanding their valuations above the current expectations.

4.Leaders in Markets - the Secular Growth Stars

The last point I’ll make to demonstrate my thesis that high growth rates are sustainable for Cloud business - over the last 5-10 years we’ve seen a shift in market share dynamics. I don’t have data to support this, but I’d claim historically the #1 player in any given category typically captured ~50% of the equity value. Today I think that number is much greater than 50%, and probably something closer to 80%. The “winners” of a market are simply taking more share. Just looking at a couple examples. Shopify is the leader in their category, doing close to $2B in annual rev growing 50% with a market cap >$100B. BigCommerce is probably the number 2 player doing $120M in annual rev growing 24% annually. Ultimately they’ll end up with a market cap around $2.5B. A STARK difference. Twilio is worth $35B. The number 2 player, Bandwidth, is worth $3.5B. Crowdstrike is worth $21B. The number 2 and 3 competitors in the space, CarbonBlack and Cylance, were acquired for $2B and $1.4B respectively. Okta is worth $25B, while Ping Identity is worth $2.5B. DocuSign is worth $35B. I don’t know how big the AdobeSign business is, but I can’t imagine it’s anywhere close to DocuSign. Coupa is worth $20B and doesn’t have a strong modern competitor. They still primarily compete with SAP / Ariba and Oracle type products. I think you get the point I’m making, there are plenty of other examples (Salesforce in the CRM world being the most prominent!). There are obviously counterpoints - CloudFlare / Fastly have both built nice businesses in the CDN space. Datadog / Dynatrace / Elastic have built great businesses in the monitoring space. But these are exceptions.

Taking this 1 step further. The leaders in markets are not only taking more share, but they’re growing faster and almost always have better unit economics (net retention). The leaders in markets get the compounded benefits of the SaaS adoption curve accelerating, their markets growing faster and ending up larger than expected (of which they take more share!), with superior net retention. This is a killer compounding combo, and I’ve dubbed them the Secular Growth Stars. I could not be more bullish that this set of companies in particular will continue to grow faster than expected into perpetuity, and expand on their valuations. While I’m still bullish overall on the SaaS universe, some companies may not live up to the lofty expectations everyone is placing on SaaS businesses. Because of this, they may face a more turbulent short term outlook.

Wrapping Up / A Prediction

So who do I include in this exclusive group of Secular Growth Stars? It’s many of the names I listed above. Shopify, Datadog, Zoom, Okta, Docusign, Crowdstrike, Fastly, Twilio, Zscaler, probably round out my list. But others like Coupa and Bill.com have an interesting payments business model angle they’re riding, and Atlassian, Alteryx, and MongoDB have built amazing businesses. Everyone should put together their own elite list! In general this is the group of SaaS businesses with the highest EV / Rev multiples currently. Many people think we’re due for a Saas reckoning, and that the “bubble will burst.” I disagree. I think many of these businesses will continue to grow much faster than anticipated because 1) We’re in the early innings of Cloud adoption and it’s accelerating drastically because of Covid. 2) Cloud markets almost always surprise us with how big they get. 3) Strong unit economics like net retention set up companies for sustained growth. 4) The leaders in their respective markets benefit disproportionately from the first 3 points. Because of these 4 points I don’t think we’re headed towards a SaaS bubble. These Secular Growth Stars will grow into their valuations much faster than anticipated, reaching “sustainable” levels faster than anticipated.

The one point I’ve subtly made throughout this article but haven’t explicitly made yet - Not all cloud companies are set up for sustained success. Yes, many of the points I discussed suggest the rising Cloud tide lifts all ships. However, the last point I made (around the #1 player in each market) is super important. Not everyone will benefit equally. I’m also not saying every company is going to crush earnings and continue the hot streak. I’m saying two things. With a long term view the multiples today might not seem that expensive, and over the long term I see an incredible potential for these Secular Growth Stars. Cloud businesses are defying the law of large numbers that suggest companies can’t sustain high growth rates at scale in ways we’ve never seen before.

And now for my earnings prediction. In the short term valuations have been stretched. We won’t see massive boosts to stock prices like we did after Q1 earnings (10 of the 54 companies I track saw their share price go up by >10% the day after reporting earnings). Many of the points I discussed above have already been “priced in.” BUT, for the best businesses, the “Secular Growth Stars,” they’ll grow into their valuation much quicker than people expect. This group does NOT have a bubble coming. That’s not to say we won’t see 10-15% corrections along the way (or Q2 could be lighter than expected!), that’s normal, and will happen. But in 5 years from now, if we are to zoom out and look at the trajectory of these stock prices I think it’ll be a fantastic “up and to the right” story, with a TON of value creation still on the come.

Q2 Earnings Preview

Everything I’ve stated in this article is conjecture, it’s just my personal opinion I’ve formed based on the data points I’ve laid out above. The reality is I could be completely wrong! Maybe Covid hasn’t really accelerated digital transformations. Or maybe it has, but buyers were exercising extreme caution in Q2, and will only pick up buying in Q3 (or later!) Maybe net retention numbers will fall off a cliff this quarter. It’s all unknown at this point as we haven’t really seen data to show how Covid truly affected SaaS businesses. Once businesses start reporting Q2 numbers, we’ll see the results of quarters that took place from start to finish in a “covid effected” world. The proof will be in the numbers, and I can’t wait to see them! If you’re risk adverse, now might be time to “but the rumor sell the news.” The “rumor” being that Covid pulled in digital transformations benefiting SaaS stocks, and the “news” being earnings.

There’s two main numbers to track when looking at earnings. The company's revenue for the Q2 relative to consensus estimates, and the company's guidance for Q3 relative to consensus estimates. In Q1, the top decile companies beat their current quarters estimates by >10%, and guided (raised) the upcoming quarter >7% above consensus estimates. While consensus estimates are a moving target (they get updated), below you can see the consensus estimates (as they currently stand) for this quarter and the upcoming quarter for all Cloud businesses with June quarter ends. Once we get closer to reporting dates for companies with July quarter ends I’ll update this table.

Great post as usual. Spotted a small typo in the last table for LivOngo

Fantastic post and great insight on the cloud market in general. I tend to agree with how Secular Growth Stars will emerge as clear category winners. Keen to see how earnings shake out this month and next and if we see pullback in valuations.